A Singapore Treasury Invoice enviornment (BS24103H) will seemingly be auctioned on Thursday, 15 February 2024.

Whereas you have to to subscribe successfully, safe your give an explanation for by process of Web banking (Money, SRS, CPF-OA, CPF-SA) or in person (CPF) by 14th February.

You are going to be in a put of living to price the foremost aspects at MAS here.

Within the previous, I even personal shared with you the virtues of the Singapore T-bills, their ultimate uses, and subscribe to them here: The map in which to Purchase Singapore 6-Month Treasury Funds (T-Funds) or 1-Year SGS Bonds.

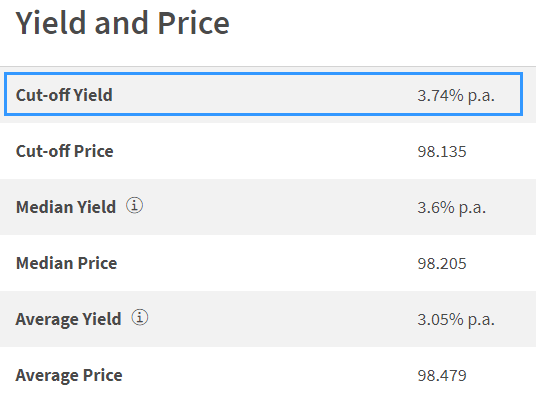

The nick again-off yield a success Tbill bidders can rating is 3.54%.

Whereas you choose out a non-aggressive speak, that you just can very successfully be pro-rated the amount you speak and would yield 3.54%. Whereas you’re going to fancy to construct sure you secured all that you just speak, this may seemingly possibly even be better to select a aggressive speak, nonetheless you personal got to safe your speak upright.

In aggressive bidding, if your speak is decrease than the eventual nick again-off yield (in the instance beneath), that you just can safe 100% of what you speak for at the nick again-off yield (now now not the decrease yield that you just speak for):

Aggressive bidding is ultimate for people that wish to receive completely what they wish to safe for obvious monetary planning causes, akin to doing CPF Particular Memoir (SA) shielding. But on myth of we gained’t know what’s the nick again-off yield, a rule of thumb I’d teach is half of the least nick again-off yield.

I even personal a couple of complaints that by placing this rule accessible, I’d very successfully be portion of the motive the nick again-off yield is decrease. I in actuality feel that if somebody has a obvious monetary planning motive (reveal SA Shielding) to speak decrease, then I agree with that is natural. The auction intention in express components in characters that need the bonds no topic the yield, and if there are many people with such an flee, then the auction reflects that immense question on myth of when question is mammoth, the price (on this case, yield goes down) goes up.

Gaining Insights About the Upcoming Singapore T-bill Yield from the Every day Closing Yield of Glossy Singapore T-bills.

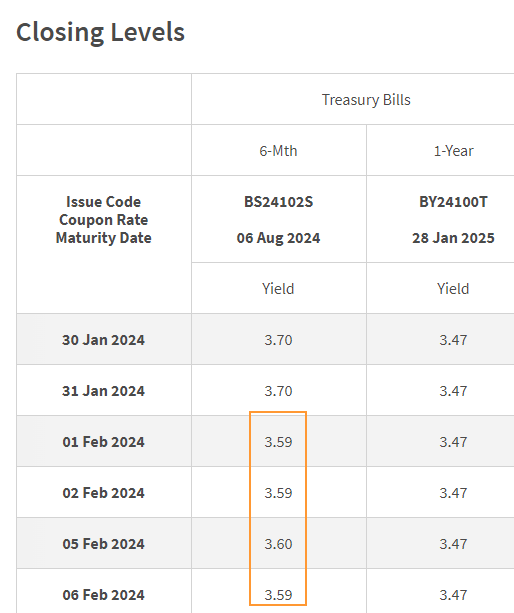

The table beneath shows the present hobby yield the six-month Singapore T-bills is trading at:

The day-to-day yield at closing affords us a rough indication of how a lot the 6-month Singapore T-bill will alternate at the pause of the month. From the day-to-day yield at closing, we must always demand the upcoming T-bill yield to alternate end to the yield of the last enviornment.

For the time being, the 6-month Singapore T-bills are trading end to a yield of 3.60%, decrease to three.70% yield we observed two weeks in the past.

Gaining Insights About the Upcoming Singapore T-bill Yield from the Every day Closing Yield of Glossy MAS Funds.

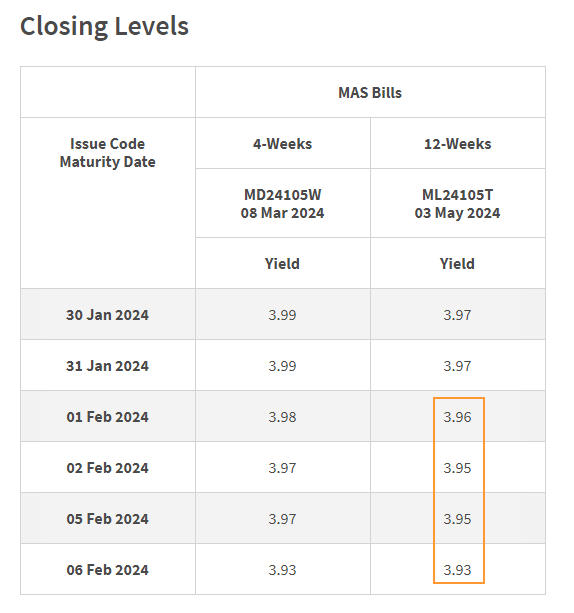

On the whole, the Monetary Authority of Singapore (MAS) will enviornment a 4-week and a 12-week MAS Invoice to institutional merchants.

The credit quality or the credit likelihood of the MAS Invoice must always be very an a lot like Singapore T-bills for the explanation that Singapore authorities points every. The 12-week MAS Invoice (3 months) must always be the closest timeframe to the six-month Singapore T-bills.

Thus, we can produce insights into the yield of the upcoming T-bill from the day-to-day closing yield of the 12-week MAS Invoice.

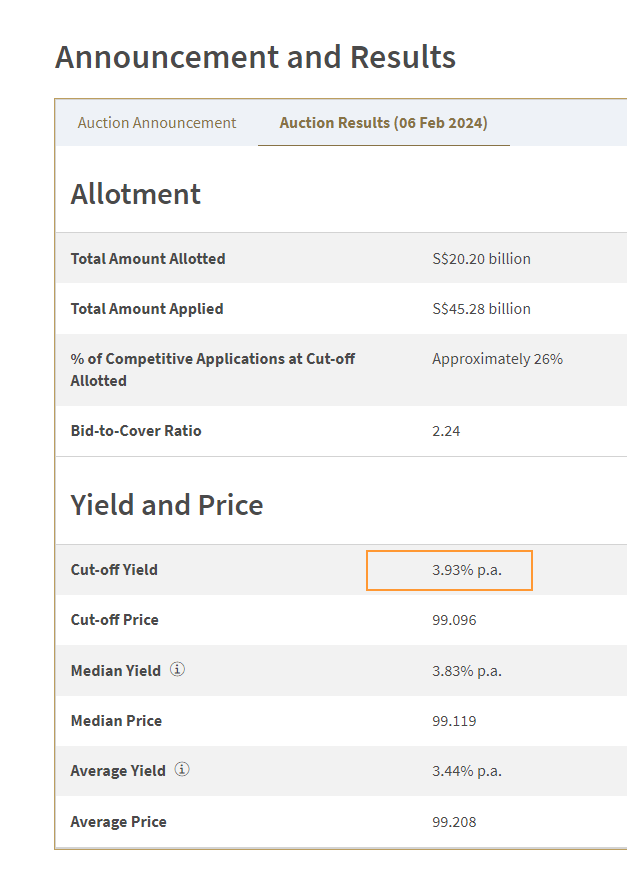

The nick again-off yield for basically the most fashionable MAS bill auctioned on Sixth Feb (a day in the past) is 3.93%. The MAS bill is a shrimp bit decrease than the last enviornment two weeks in the past.

For the time being, the MAS Invoice trades end to three.93%.

Supplied that the MAS 12-week yield is at 3.93% and the last traded 6-month T-bill yield is at 3.59%, what’s frequently the T-bill yield this time round?

The three-month and 6-month Singapore Bond Yield trades at a bigger disagreement at the second. This may possibly prove that the 6-month tenor is changing into more sensitive to changes available in the market yield. This is able to indicate that the 12-Week MAS bill has much less predictive indication of the direction of the 6-month Tbill Yield.

The market yield has long previous up a shrimp bit because the market tries to stamp in much less price cuts this year than what the market before everything speculate.

I enact behold that the transient charges cruise round the vary nearer to 3.60% on this enviornment.

Right here are your varied Elevated Return, Stable and Short-Time duration Savings & Investment Choices for Singaporeans in 2023

You would very successfully be questioning whether varied financial savings & investment ideas give you higher returns nonetheless are quiet pretty safe and liquid adequate.

Right here are varied varied categories of securities to personal in ideas:

| Security Form | Vary of Returns | Lock-in | Minimum | Remarks |

|---|---|---|---|---|

| Mounted & Time Deposits on Promotional Charges | 4% | 12M -24M | ||

| Singapore Savings Bonds (SSB) | 2.9% – 3.4% | 1M | A factual SSB Example.” data-give an explanation for=”Max $200k per person. When in question, it may possibly well even be tense to safe an allocation. A factual SSB Example.”>Max $200k per person. When in question, it may possibly well even be tense to safe an allocation. A factual SSB Example. | |

| SGS 6-month Treasury Funds | 2.5% – 4.19% | 6M | The map in which to aquire T-bills info.” data-give an explanation for=”Merely whereas you personal got heaps of cash to deploy. The map in which to aquire T-bills info.”>Merely whereas you personal got heaps of cash to deploy. The map in which to aquire T-bills info. | |

| SGS 1-Year Bond | 3.72% | 12M | The map in which to aquire T-bills info.” data-give an explanation for=”Merely whereas you personal got heaps of cash to deploy. The map in which to aquire T-bills info.”>Merely whereas you personal got heaps of cash to deploy. The map in which to aquire T-bills info. | |

| Short-timeframe Insurance coverage Endowment | 1.8-4.3% | 2Y – 3Y | A factual instance Gro Capital Ease” data-give an explanation for=”Make certain they’re capital assured. In overall, there is a maximum amount you’re going to be in a put of living to aquire. A factual instance Gro Capital Ease“>Make certain they’re capital assured. In overall, there is a maximum amount you’re going to be in a put of living to aquire. A factual instance Gro Capital Ease | |

| Money-Market Funds | 4.2% | 1W | Merely whereas you personal got heaps of cash to deploy. A fund that invests in fixed deposits will actively suggest you’re going to be in a put of living to clutch the highest prevailing hobby charges. Cease be taught up the factsheet or prospectus to be obvious the fund only invests in fixed deposits & equivalents. |

This table is updated as of 17th November 2022.

There are varied securities or products that may possibly fail to meet the components to give again your major, high liquidity and factual returns. Structured deposits grasp derivatives that amplify the stage of likelihood. Many cash management portfolios of Robo-advisers and banks grasp quick-duration bond funds. Their values may possibly fluctuate in the quick timeframe and must always now now not be ultimate whereas you require a 100% return of your major amount.

The returns equipped are now now not forged in stone and must always fluctuate in accordance with the present transient hobby charges. It’s top to adopt more aim-basically basically based planning and teach basically the most correct devices/securities to indicate you’re going to be in a put of living to receive or teach down your wealth in express of getting all of you cash in transient financial savings & investment ideas.

Whereas you have to to need to alternate these stocks I discussed, you’re going to be in a put of living to starting up out an myth with Interactive Brokers. Interactive Brokers is the leading low-rate and ambiance friendly broker I teach and belief to make investments & alternate my holdings in Singapore, the US, London Stock Alternate and Hong Kong Stock Alternate. They’ll can suggest you’re going to be in a put of living to alternate stocks, ETFs, ideas, futures, foreign places change, bonds and funds worldwide from a single constructed-in myth.

You are going to be in a put of living to be taught more about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting up with compose & fund your Interactive Brokers myth without express.

Kyith is the Owner and Sole Author in the again of Investment Moats. Readers tune in to Investment Moats to be taught and compose stronger, much less attackable wealth foundations, personal a Passive investment technique, know more about investing in REITs and the nuts and bolts of Packed with life Investing.

Readers moreover note Kyith to gape systems to map successfully for Financial Security and Financial Independence.

Kyith labored as an IT operations engineer from 2004 to 2019. For the time being, he works as a Senior Solutions Specialist in Insurance coverage Birth-up Havend. All opinions on Investment Moats are his possess and does now now not represent the views of Providend.

You are going to be in a put of living to price Kyith’s present portfolio here, which uses his Free Google Stock Portfolio Tracker.

His investment broker of change is Interactive Brokers, which permits him to make investments in securities from varied exchanges all the map thru the world, at very low commission charges, without custodian expenses, end to space foreign money charges.

You are going to be in a put of living to be taught more about Kyith here.

Most fashionable posts by Kyith (behold all)