A Singapore Treasury Bill project (BS24104T) would maybe be auctioned on Thursday, 29 February 2024.

If you happen to favor to subscribe efficiently, catch your advise by means of Web banking (Cash, SRS, CPF-OA, CPF-SA) or in particular person (CPF) by Twenty eighth February.

You should the option to discover the miniature print at MAS right here.

In the previous, I in actuality possess shared with you the virtues of the Singapore T-bills, their very perfect uses, and the appropriate method to subscribe to them right here: How to Purchase Singapore 6-Month Treasury Payments (T-Payments) or 1-three hundred and sixty five days SGS Bonds.

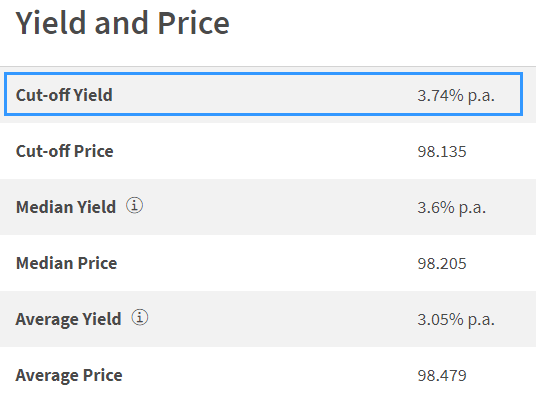

The nick-off yield a success Tbill bidders can damage is 3.66%.

If you happen to determine on a non-competitive uncover, you furthermore mght can very effectively be professional-rated the quantity you uncover and would yield 3.66%. If you happen to would favor to develop decided you secured all that you uncover, it would maybe be better to determine on a competitive uncover, but you have to catch your uncover staunch.

In competitive bidding, if your uncover is decrease than the eventual nick-off yield (within the instance under), it’s doubtless you’ll maybe maybe catch 100% of what you uncover for on the nick-off yield (not the decrease yield that you uncover for):

Competitive bidding is extremely perfect for folks that favor to score completely what they like to catch for decided monetary planning causes, corresponding to doing CPF Particular Legend (SA) shielding. Nonetheless on fable of we obtained’t know what’s the nick-off yield, a rule of thumb I would maybe maybe maybe use is half the least nick-off yield.

I in actuality possess just a few complaints that by striking this rule within the market, I also can very effectively be share of the motive the nick-off yield is decrease. I salvage that if any person has a decided monetary planning motive (mutter SA Shielding) to uncover decrease, then I mediate that is pure. The public sale system in mutter factors in characters that need the bonds no matter the yield, and if there are loads of of us with such an speed, then the general public sale reflects that substantial question on fable of when question is mighty, the cost (on this case, yield goes down) goes up.

Gaining Insights About the Upcoming Singapore T-bill Yield from the On a usual foundation Closing Yield of Fresh Singapore T-bills.

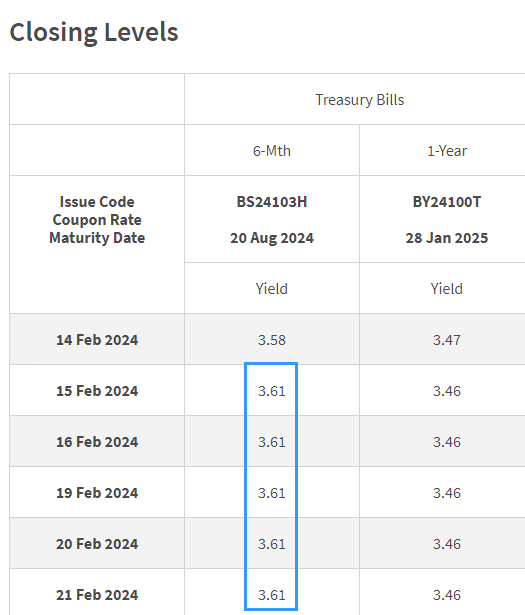

The table under reveals the present passion yield the six-month Singapore T-bills is trading at:

The on a usual foundation yield at closing provides us a rough indication of how essential the 6-month Singapore T-bill will trade on the tip of the month. From the on a usual foundation yield at closing, we must ask the upcoming T-bill yield to trade shut to the yield of the last project.

Currently, the 6-month Singapore T-bills are trading shut to a yield of 3.61%, a little bit better than the three.59% yield we observed two weeks within the past.

Gaining Insights About the Upcoming Singapore T-bill Yield from the On a usual foundation Closing Yield of Fresh MAS Payments.

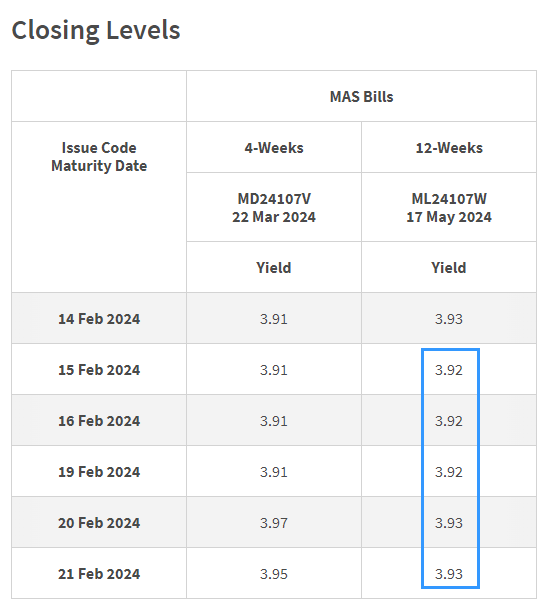

On occasion, the Financial Authority of Singapore (MAS) will project a 4-week and a 12-week MAS Bill to institutional traders.

The credit quality or the credit danger of the MAS Bill must be very corresponding to Singapore T-bills for the rationale that Singapore authorities issues each and every. The 12-week MAS Bill (3 months) must be the closest term to the six-month Singapore T-bills.

Thus, we are in a position to impact insights into the yield of the upcoming T-bill from the on a usual foundation closing yield of the 12-week MAS Bill.

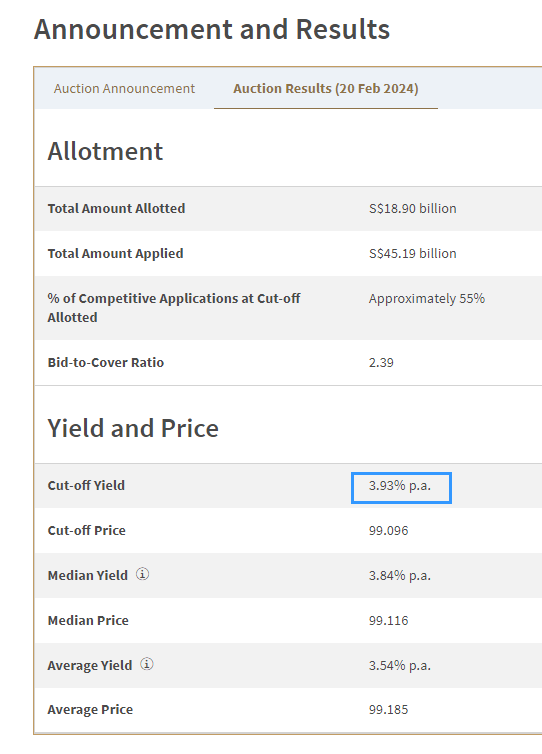

The nick-off yield for basically the most up to the moment MAS bill auctioned on twentieth Feb (two days within the past) is 3.93%. The MAS bill is a little bit decrease than the last project two weeks within the past.

Currently, the MAS Bill trades shut to three.92%.

On condition that the MAS 12-week yield is at 3.92% and the last traded 6-month T-bill yield is at 3.61%, what’s once in a whereas the T-bill yield this time spherical?

The three-month and 6-month Singapore Bond Yield trades at a bigger distinction for the time being. This also can demonstrate that the 6-month tenor is popping into more sensitive to adjustments within the market yield. This might maybe well indicate that the 12-Week MAS bill has much less predictive indication of the direction of the 6-month Tbill Yield.

I don’t ask the yields on the 6-month to coast essential on this project, but given the upper inflation readings not too prolonged within the past, I suspect that inflation would maybe maybe be more digested better within the subsequent project.

The yield for the project must be nearer to 3.55% on this project.

Right here are your varied Elevated Return, Safe and Short-Term Savings & Investment Alternate solutions for Singaporeans in 2023

You also can very effectively be questioning whether varied savings & investment alternate solutions provide you with better returns but are serene somewhat score and liquid ample.

Right here are varied varied categories of securities to take into fable:

| Security Kind | Vary of Returns | Lock-in | Minimal | Remarks |

|---|---|---|---|---|

| Mounted & Time Deposits on Promotional Rates | 4% | 12M -24M | ||

| Singapore Savings Bonds (SSB) | 2.9% – 3.4% | 1M | An accurate SSB Example.” knowledge-advise=”Max $200k per particular person. When in question, it will even be not easy to catch an allocation. An accurate SSB Example.”>Max $200k per particular person. When in question, it will even be not easy to catch an allocation. An accurate SSB Example. | |

| SGS 6-month Treasury Payments | 2.5% – 4.19% | 6M | How to aquire T-bills guide.” knowledge-advise=”Upright if you happen to would maybe maybe possess loads of cash to deploy. How to aquire T-bills guide.”>Upright if you happen to would maybe maybe possess loads of cash to deploy. How to aquire T-bills guide. | |

| SGS 1-three hundred and sixty five days Bond | 3.72% | 12M | How to aquire T-bills guide.” knowledge-advise=”Upright if you happen to would maybe maybe possess loads of cash to deploy. How to aquire T-bills guide.”>Upright if you happen to would maybe maybe possess loads of cash to deploy. How to aquire T-bills guide. | |

| Short-term Insurance Endowment | 1.8-4.3% | 2Y – 3Y | An accurate example Gro Capital Ease” knowledge-advise=”Be decided that they are capital guaranteed. On the entire, there is a maximum quantity it’s doubtless you’ll maybe maybe aquire. An accurate example Gro Capital Ease“>Be decided that they are capital guaranteed. On the entire, there is a maximum quantity it’s doubtless you’ll maybe maybe aquire. An accurate example Gro Capital Ease | |

| Cash-Market Funds | 4.2% | 1W | Upright if you happen to would maybe maybe possess loads of cash to deploy. A fund that invests in mounted deposits will actively let you grab the best prevailing passion charges. Enact study up the factsheet or prospectus to be decided that the fund handiest invests in mounted deposits & equivalents. |

This table is up to this level as of 17th November 2022.

There are varied securities or merchandise that also can fail to meet the criteria to give again your predominant, high liquidity and appropriate returns. Structured deposits dangle derivatives that develop better the diploma of danger. Many money administration portfolios of Robo-advisers and banks dangle rapid-length bond funds. Their values also can fluctuate within the rapid term and can’t be very perfect if you happen to require a 100% return of your predominant quantity.

The returns provided are not cast in stone and can fluctuate in accordance with the present rapid-term passion charges. It’s essential to adopt more purpose-based planning and use basically the most appropriate instruments/securities to let you catch or use down your wealth as an different of having all your money briefly-term savings & investment alternate solutions.

In advise so that you can trade these shares I talked about, it’s doubtless you’ll maybe maybe beginning an fable with Interactive Brokers. Interactive Brokers is the leading low-cost and atmosphere pleasant broker I use and belief to invest & trade my holdings in Singapore, the United States, London Stock Alternate and Hong Kong Stock Alternate. They’ll let you trade shares, ETFs, alternate solutions, futures, forex, bonds and funds worldwide from a single built-in fable.

You should the option to study more about my solutions about Interactive Brokers in this Interactive Brokers Deep Dive Sequence, starting with the appropriate method to keep & fund your Interactive Brokers fable without anguish.

Kyith is the Proprietor and Sole Creator within the again of Investment Moats. Readers tune in to Investment Moats to study and develop stronger, more impregnable wealth foundations, the appropriate method to possess a Passive investment approach, know more about investing in REITs and the nuts and bolts of Active Investing.

Readers also educate Kyith to intention programs to devise effectively for Financial Security and Financial Independence.

Kyith worked as an IT operations engineer from 2004 to 2019. Currently, he works as a Senior Alternate solutions Specialist in Insurance Birth-up Havend. All opinions on Investment Moats are his possess and would not signify the views of Providend.

You should the option to discover Kyith’s current portfolio right here, which uses his Free Google Stock Portfolio Tracker.

His investment broker of desire is Interactive Brokers, which permits him to invest in securities from varied exchanges at some level of the world, at very low price charges, without custodian bills, shut to plot forex charges.

You should the option to study more about Kyith right here.

Most modern posts by Kyith (seek all)