We saw that the US miniature cap index, such because the Russell 2000, place in two consecutive days of 3% transfer due to the favourable commentary from the FOMC meeting.

I would perhaps counsel investors don’t slump this.

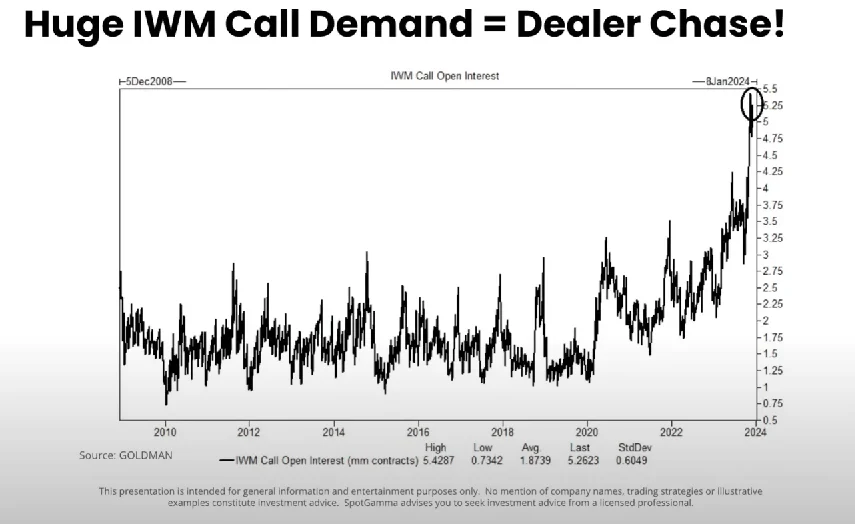

In a recurring episode of Extra Returns OPEX Attain, Brent Kochuba explains that extra calls are being sold than within the past. Traders try to situation for a duration where miniature cap are seasonally stronger. The different motive is that they’re making a bet on a broadening out of this market improvements to other sectors of the economy.

If there are such heaps of name alternatives on the Russell 2000 ETFs, it methodology that alternatives market makers or dealers are selling a quantity of name alternatives to these other folks. The alternatives market makers’ purpose is to non-public money but additionally stay relatively market-unbiased. Since selling name alternatives is a bearish situation they favor to “neutralize” this by a bullish situation which is to aquire the underlying index. That procuring for action is itself bullish and when traders peep designate up, they purchase extra name alternatives, and extra name alternatives methodology extra procuring for from market makers and also you accumulate this roughly crazy up strikes.

This likelihood power will discontinue upon likelihood expiry which takes living after this Friday (this evening undoubtedly).

What happens subsequent week is any individual’s guess.

Brent explains that the alternatives skew, which is the pricing of name and place alternatives is particular towards the name aspect (name alternatives at the equivalent delta designate higher than the place alternatives at the equivalent delta), which is much less neatly-liked which signifies there is extra pastime to be bullish than neatly-liked.

There must peaceable peaceable be ample forces for the remainder of the year but this seasonal bullish or bearish stuff is no longer continually comely. There are weak seasonal forces that are in living, but these seasonal forces would perhaps perhaps even be overwritten by changes on the market because the market is a machine that repeatedly tries to designate in issues. If without note there is a sudden signal that the market is no longer doing apart from to it is, then the market will designate in higher gross bearishness within the subsequent six months.

Nevertheless, must you are fascinated by adding because you are feeling that here’s an correct time to be capable to add, presumably don’t carry out it comely now for the explanation that transfer up would perhaps perhaps also merely be due to the a couple of forces that are much less fundamentals pushed.

Some extra on the miniature cap seasonality:

Moderate efficiency for the $SPX ( in crimson) and miniature-cap Russell 2000 (in inexperienced), normalized since 1993, reveals the propensity for miniature caps to outperform early within the Sleek one year, on the total because they’re subject to undue tax-loss selling into year-discontinue #fairleadstrategies pic.twitter.com/QJVekPnymJ

— Katie Stockton, CMT (@StocktonKatie) December 12, 2023

RUSSELL 2000 / S&P500 💡

The #smallcap rally is heading within the appropriate path to be undoubtedly grand!

I’ve emphasized this a couple of instances: Small-cap stocks stay exceptionally undervalued when in contrast to the mid and largecap segment. Now this doesn’t point out that the broader indices would perhaps perhaps also merely no longer impression… pic.twitter.com/jJvg9PHORG

— BACH (@MortensenBach) December 8, 2023

Whereas you are making an strive to interchange these stocks I talked about, that you just might perhaps perhaps commence an chronicle with Interactive Brokers. Interactive Brokers is the main low-designate and ambiance pleasant dealer I exercise and belief to make investments & exchange my holdings in Singapore, the USA, London Stock Alternate and Hong Kong Stock Alternate. They allow you to interchange stocks, ETFs, alternatives, futures, forex, bonds and funds worldwide from a single built-in chronicle.

That you might perhaps read extra about my suggestions about Interactive Brokers in this Interactive Brokers Deep Dive Sequence, starting with one of the best technique to make & fund your Interactive Brokers chronicle without effort.

Kyith is the Proprietor and Sole Creator at the encourage of Funding Moats. Readers tune in to Funding Moats to learn and originate stronger, extra impregnable wealth foundations, one of the best technique to non-public a Passive funding technique, know extra about investing in REITs and the nuts and bolts of Tantalizing Investing.

Readers additionally phrase Kyith to learn the methodology to space effectively for Monetary Security and Monetary Independence.

Kyith labored as an IT operations engineer from 2004 to 2019. At this time, he works as a Senior Choices Specialist in Insurance coverage Start-up Havend. All opinions on Funding Moats are his decide up and does no longer signify the views of Providend.

That you might perhaps behold Kyith’s present portfolio here, which makes exercise of his Free Google Stock Portfolio Tracker.

His funding dealer of preference is Interactive Brokers, which permits him to make investments in securities from thoroughly different exchanges at some level of the realm, at very low price rates, without custodian prices, on the subject of field forex rates.

That you might perhaps read extra about Kyith here.

Latest posts by Kyith (peep all)