Right here is the update for my Daedalus portfolio for the month of May perhaps perhaps additionally simply 2024.

It’s seemingly you’ll perhaps per chance seemingly no longer be conscious mighty of what I talked about in the event you don’t learn this put up.

I’m going to strive to give as mighty of the update the save imaginable if work just isn’t any longer too busy.

All my non-public planning notes just like revenue planning, insurance planning, funding & portfolio construction will be beneath my non-public notes half of this weblog.

Portfolio Commerce Since Final Replace

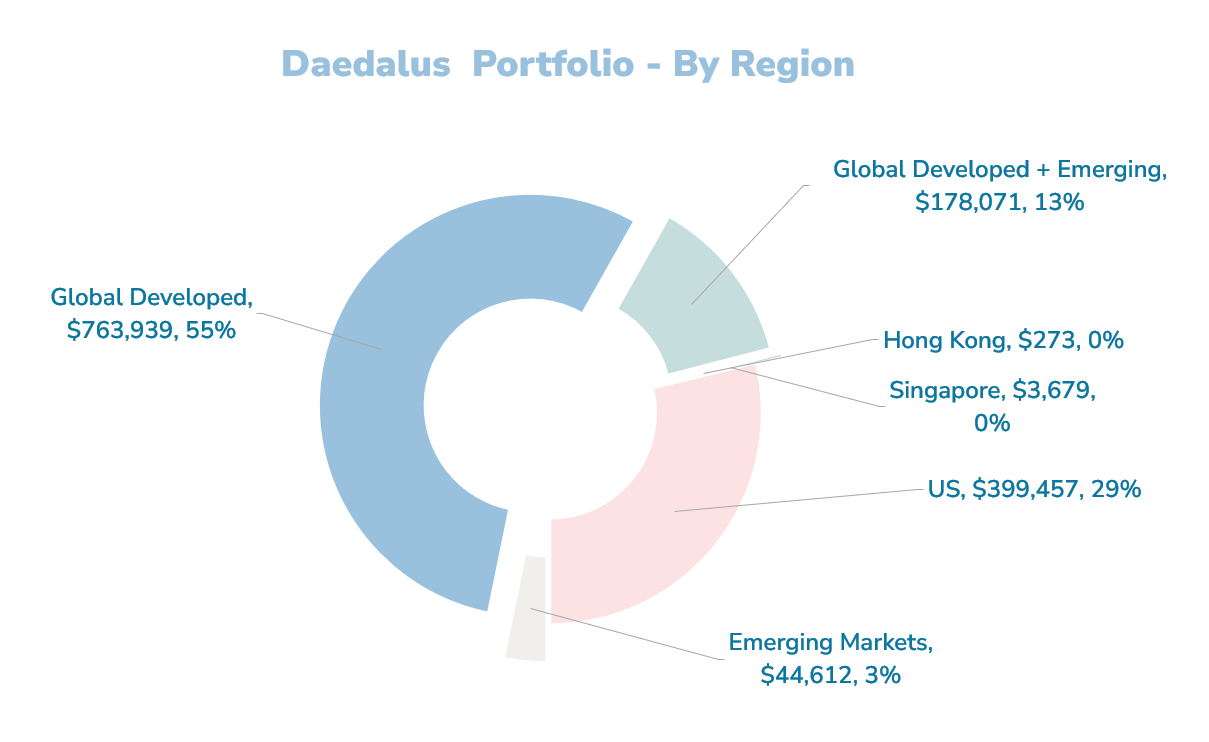

The portfolio used to be valued at $1.376 million at the terminate of May perhaps perhaps additionally simply and is currently at $1.390 million.

We reported a portfolio alternate of $12,000 for the month of May perhaps perhaps additionally simply 2024. The portfolio received 1.2% which equates to 80% of the Forefront FTSE All-World ETF, given the portfolio is 80% uncovered to equities and 20% to mounted revenue. The portfolio misplaced 0.85% to the strengthening of the SGD in opposition to the USD.

Characteristic of Portfolio

The aim of the portfolio is to give consistent, inflation-adjusted revenue for my wanted and fresh spending. The portfolio is sized according to a conservative 2-2.5% Preliminary Safe Withdrawal Rate (SWR) so that the revenue can final even brooding about tough historical sequences just like Colossal Sorrowful, external war and 30-years of high inflation averaging 5.5-6% p.a.

Timeframe that the revenue breeze to be planned for: 60-years to Perpetual

I’m currently no longer drawing down the portfolio.

For additional reading on:

- My notes regarding my wanted spending.

- My notes regarding my fresh spending.

- My elaboration of the Safe Withdrawal Rate: Article | YouTube Video

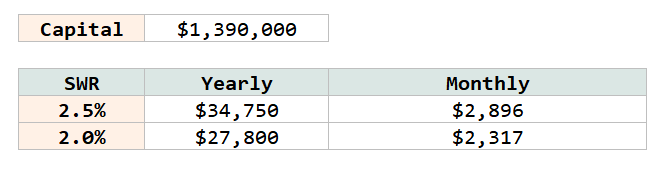

Per the present portfolio of $1.39 million, the projected starting up revenue is:

The lower the SWR, the extra capital most well-known, nonetheless the extra resilient is the revenue.

Nature of the Profits I Planned for

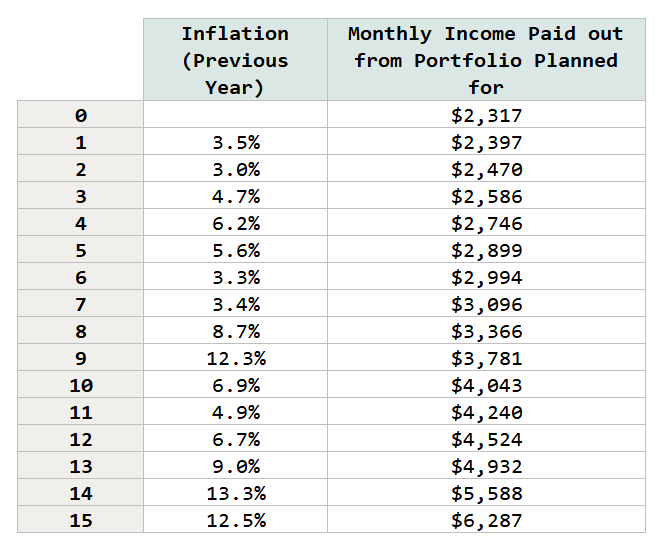

Tell when I commence drawing the revenue, the old 365 days inflation goes in this sequence and here is the corresponding revenue to be drawn out:

The revenue device is constructed to face up to this high inflation

Funding Approach & Philosophy

After attempting my fully to learn to invest for some time, the portfolio expresses my thoughts about investing at this level.

The portfolio is breeze in a

- Strategic: allocation doesn’t alternate by non permanent events.

- Systematic: ideas/resolution-tree-basically basically based mostly performed either myself or an external supervisor.

- Low-cost: funding implementation cost is stored reasonably low both on the fund stage nonetheless also custodian stage.

- Passive: I employ reasonably diminutive effort mentally brooding about investments and also breeze-wise.

It’s seemingly you’ll perhaps per chance learn extra in this convey article: Deconstructing Daedalus My Passive Profits Funding Portfolio for My Well-known & In vogue Spending.

Portfolio Commerce Since Final Replace (Normally Final Month)

Determined to grab my SRS fund to invest in:

- Dimensional World Equity Fund SGD Accumulating.

- Dimensional Global Targeted Place SGD Accumulating.

With this, I potentially delight in $1,000 extra to invest this 365 days.

Recent Holdings

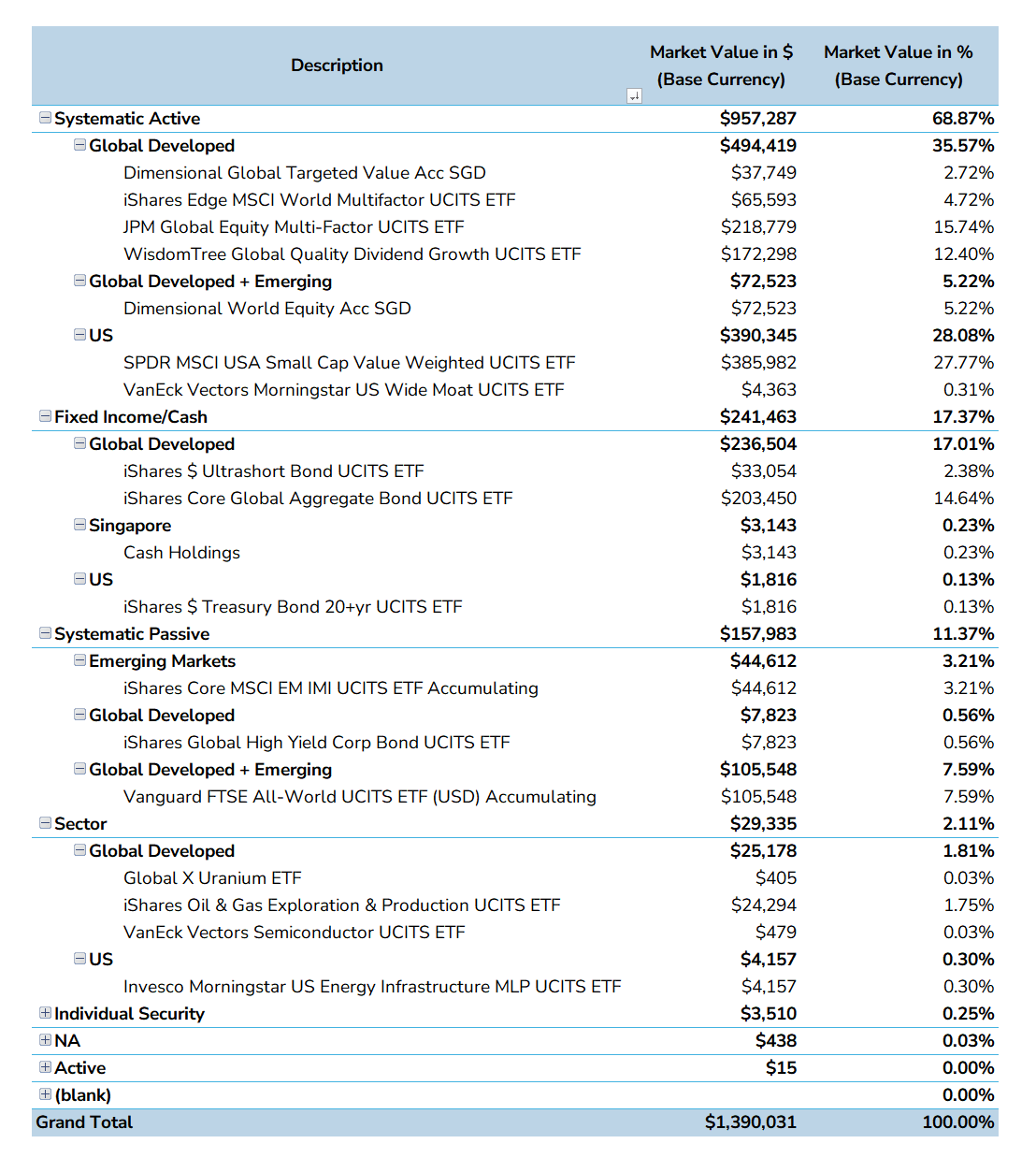

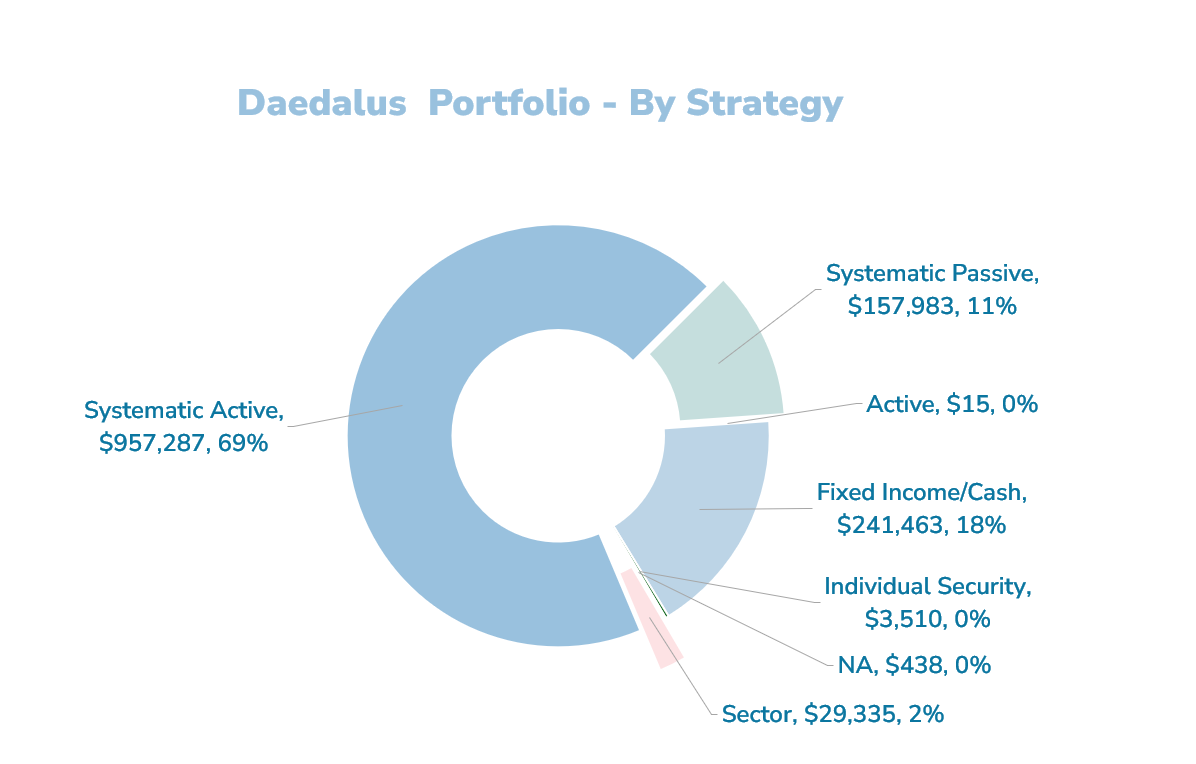

The next table is grouped according to traditional device, whether or no longer they are:

- Mounted Profits / Cash to lower volatility.

- Systematic Passive, which tries to grab the market threat in a systematic system.

- Systematic Active, which tries to grab assorted, proven threat premiums just like fee, momentum, quality, high profitability, size in a systematic system.

- Long-term sectorial positions.

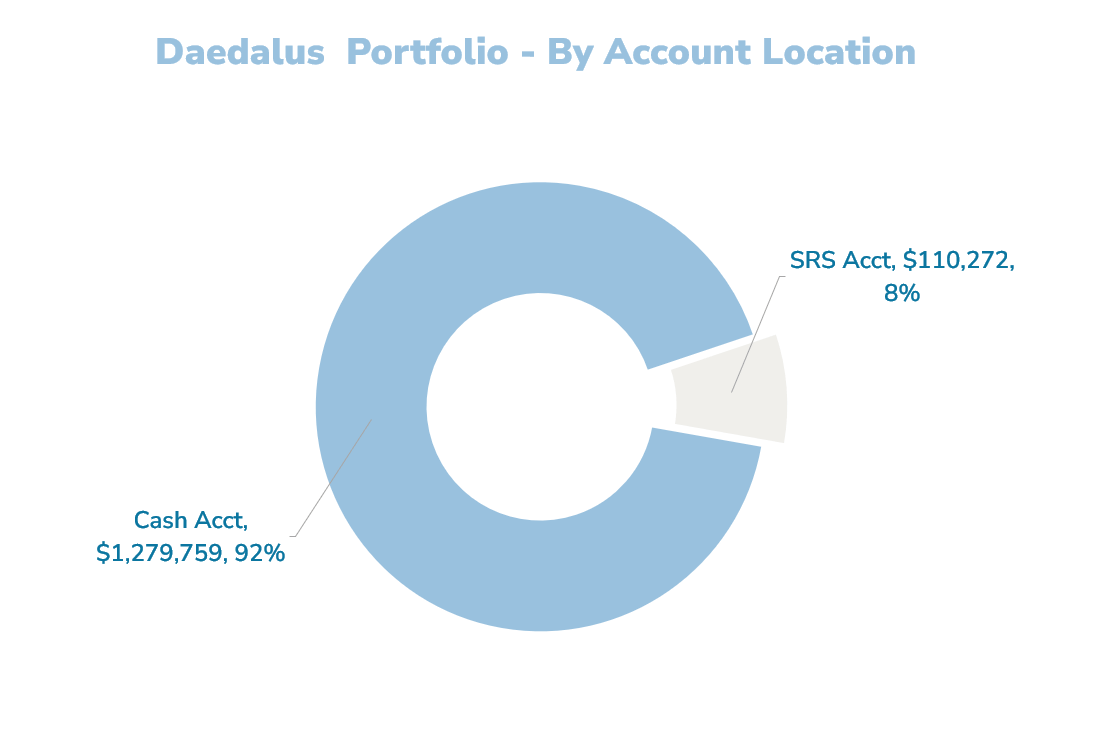

Portfolio by Story Self-discipline

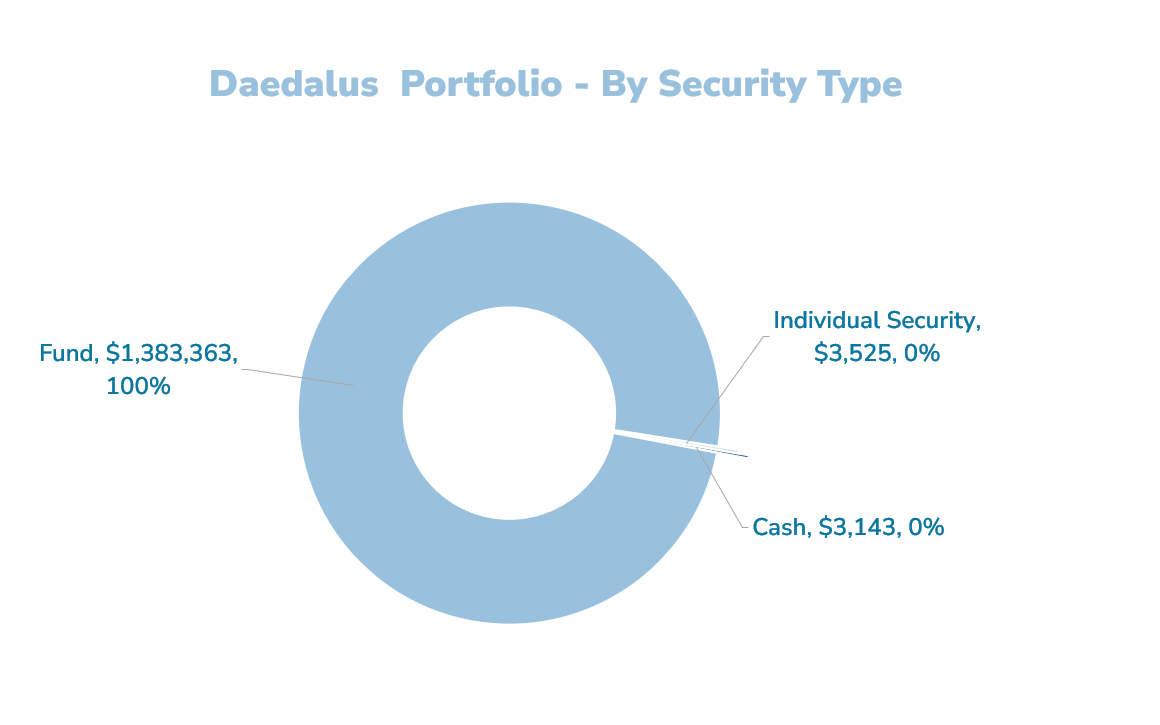

Portfolio by Do of Securities

Portfolio by Fund, Cash or Particular person Security

Portfolio by Approach.

Most well-known Custodians

The present custodians are:

- Cash: Interactive Brokers LLC (no longer SG)

- SRS: iFAST Monetary

In case you favor to pray to alternate these stocks I mentioned, you would per chance perhaps per chance delivery an story with Interactive Brokers. Interactive Brokers is the leading low-cost and atmosphere pleasant broker I employ and belief to invest & alternate my holdings in Singapore, the United States, London Stock Alternate and Hong Kong Stock Alternate. They’d let you alternate stocks, ETFs, choices, futures, foreign replace, bonds and funds worldwide from a single constructed-in story.

It’s seemingly you’ll perhaps per chance learn extra about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Sequence, starting up with the proper arrangement to compose & fund your Interactive Brokers story with out complications.

Kyith is the Owner and Sole Author in the encourage of Funding Moats. Readers tune in to Funding Moats to learn and carry out stronger, firmer wealth foundations, the proper arrangement to thrill in a Passive funding device, know extra about investing in REITs and the nuts and bolts of Active Investing.

Readers also apply Kyith to learn to devise nicely for Monetary Security and Monetary Independence.

Kyith worked as an IT operations engineer from 2004 to 2019. Currently, he works as a Senior Solutions Specialist in Insurance protection Beginning-up Havend. All opinions on Funding Moats are his possess and doesn’t portray the views of Providend.

It’s seemingly you’ll perhaps per chance glimpse Kyith’s present portfolio here, which uses his Free Google Stock Portfolio Tracker.

His funding broker of choice is Interactive Brokers, which permits him to invest in securities from different exchanges in all places the field, at very low commission charges, with out custodian funds, reach diagram currency charges.

It’s seemingly you’ll perhaps per chance learn extra about Kyith here.

Most modern posts by Kyith (glimpse all)