I went on idea to be one of my leave days to satisfy up with my supreme friend.

I extinct to accept the possibility to satisfy my chums extra as we labored in the identical place of work, but since I left and commenced working in Tanjong Pagar, it is awfully nice we silent retain in contact.

Our dialog sooner or later led to development on the slump of financial independence. The topic of cash isn’t very persistently easy and generally non-public ample that it is delicate for folk to accept a deep and meaningful dialog spherical it.

I’m extra appreciative if I’m in a position to sense that right here’s a deep ample topic where members feel that there would possibly be one thing on the road, where the burden of the financial determination is important.

I gave him my tips on his financial affirm, but unlike others (I suspect…), I tried my finest to allege why I imagine he’s in a gradual bid, with the desired each day life that he desires, even supposing he thinks it is a brief few years away. Right here’s due to the I know we obtained’t feel mentally convinced that we’re in a gradual bid with our milestone if what we fear is left unresolved mentally.

Which brings us to the topic for on the original time.

All of us body comfort and safety in F.I. very in every other case.

I strongly imagine that comfort and safety would possibly almost definitely well well be completed sooner or later with ample capital relative to the earnings an particular person or family wants.

Most members preserve varied beliefs and are very investment-focused and imagine that investment returns are a serious section of making the view work. But if because it’ll be guided, they too will understand that there would possibly be not such a thing as a technique to this. The amount of capital equals comfort and safety.

When you accept less capital, either you hope that you just are lucky in existence or that if you happen to are sooner or later unlucky, you will want to not too unlucky.

What we gaze below is a undoubtedly basic framing of their F.I. view so as that some can earn comfort:

They accept got a portfolio that supplies them with earnings. But I suspect what gave them comfort is a pair of alternative fallback plans, alongside side the capability to return to work.

There are a pair of questions that I’m in a position to set up forth for folk with this framing to think about:

Is there some double-counting? In some instances, I suspect we can accept a amount of cash earmarked for quite a bit of issues. But affirm you REALLY plow via that very difficult, unlucky period, would your view be okay since this amount of cash is supposed for 2 and even three varied issues?

At what point would you feel that the selection of fallbacks is ample? I wonder if members are ready to identify the slit abet-off amount of cash or “reserve buckets” they require to feel protected ample. Folks proceed to work due to the mentally, they don’t feel protected ample, and they also don’t accept a slit abet-off figure.

But realistically, members are either basing the fallback on hope (since the view is less mathematical), or they obtain comfort in collecting extra and extra of these fallbacks which lead them to the concept that “issues cannot be this wicked.”

The final point is that if we desire so well-known fallback to feel protected, then wouldn’t the money danger aside for these fallback need to be section of the portfolio? In my ogle it’ll silent.

And if that case, what gives you comfort is typically…. extra capital than you think that you just want.

Comfort in Conservative Returns or Dividend Yields

A determined methodology to declare comfort is via the returns that you just make say of to space for:

Folks can unsuitable their planning on returns or dividend yields.

The glaring flaw is the risks of heterosexual-line return and inflation assumptions. Historically there are classes where returns are 12% a yr, and inflation is 5.5% a yr and you silent speed out of cash prematurely. Right here’s what we call the detrimental sequence of return, or that the sequence of when the returns, inflation development comes matter.

Most are practical that returns or dividends procedure not stop fixed and so to be conservative they’ll say a psychological decrease sure of returns or dividends in their planning.

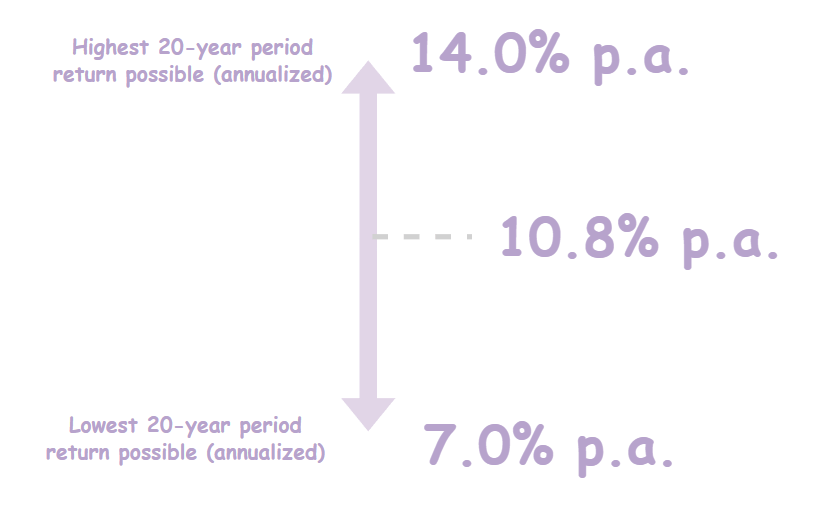

So in the differ above, you would say 7% or spherical 7% to your planning (right here’s the 20-one year S&P 500 annualized return over a obvious period)

If the returns are above this decrease sure, their view will likely be okay, so the protection lies in the differ of the limits.

This can’t be the finest, but there would possibly be a diploma of conservatism.

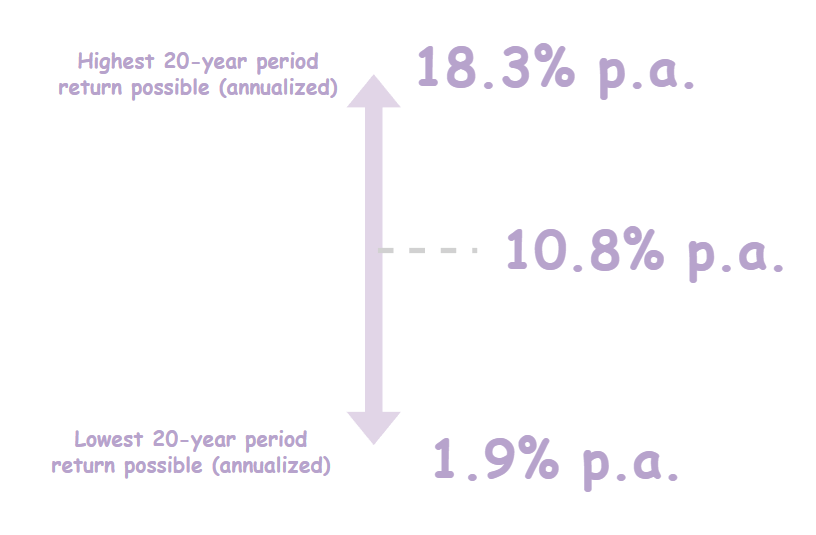

The anxiousness is… members would possibly almost definitely well well be too optimistic in the differ of returns they think they’d get. If we undoubtedly scale out the time period to 1926 to 2023, right here is the differ of 20-yr annualized return:

The finest 20-yr returns are bigger, the worst 20-yr return is decrease.

Now, in the event you are engaged on minute knowledge that is important to your determination-making, you would accept grossly miscalculated the amount of capital that you just danger aside.

So affirm you want $24,000 and your model plans for a pessimistic 7% return; your capital would roughly be $343,000, but now we know the pessimistic return would possibly almost definitely well well be 2%, your capital need to be $1.2 million.

Huge misjudgement there.

It doesn’t motivate that the weak point is that primarily based completely on historical returns, there would possibly almost definitely well well be a worse off 20-yr period that we would possibly almost definitely well moreover not accept encountered.

I don’t persistently think we ought to silent view for the worse-case affirm but with better knowledge we would possibly almost definitely well well be extra roughly correct than precisely unsuitable.

Planning without any knowledge visibility is precisely awful.

Comfort in the Safe Withdrawal Price

Many would feel that I hyped up the protected withdrawal price (SWR) but beat down on other stuff too well-known, but I procedure think that in the event you gawk upon the SWR as the final consequence of a strategy of research, the capability answers rather a range of the stuff you undoubtedly wanted, and provide a blueprint the methodology you would moreover adapt to what’s your most current.

Eric Kong of Mixture Asset Administration once extinct that methodology to come abet up with why an initial 5% would work for a tag-focused technique. These with other asset allocation, or retirement tenor say the methodology accordingly.

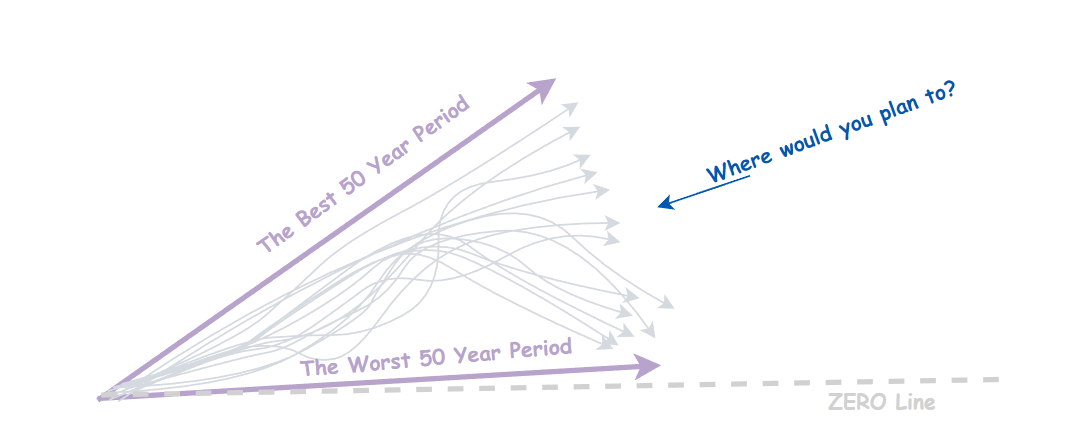

SWR to set up it merely, is that for quite a bit of tenor where you want the earnings (on this illustration affirm 50 years), the info allow us to gawk many a amount of outcomes if we employ fixed with a obvious technique.

There are difficult and extremely easy 50-yr classes.

Most incessantly, if we prefer to be conservative, to feel comforted and stable, we would possibly almost definitely well well be obvious our view takes care of even the worse 50-yr period.

With ample capital, you would moreover be obvious the money final for 50-years in that worse case affirm.

The SWR weak point is that if there would possibly be a uniquely worse 50-yr period that we have not encountered despite the previous 150 years, then we would possibly almost definitely well moreover not accept factored in and accept ample.

If we procedure not accept ample historical knowledge, SWR can moreover be frail.

SWR weak point is the energy of mathematical fashions like Monte Carlo simulation.

SWR’s energy is that it answers rather a range of your “psychological what-ifs” akin to:

- What if I happen to retire on the open of a despair?

- Or a excessive inflation period?

- Or when inflation comes later?

- Or despair comes later?

- What if I’m flexible by spending it this methodology?

The methodology, done and presented in a obvious methodology, helps answers your psychological questions.

Yet any other energy of SWR is that it is extra relatable in a technique that you just would moreover allege better what were factored in to consumers.

Imagine in the event you point a gun to my head and demand of me how protected is the view. I’m in a position to give you a undoubtedly sure description. I would possibly almost definitely well well be less vague with other systems.

Comfort in Straightforward Monte Carlo Simulations

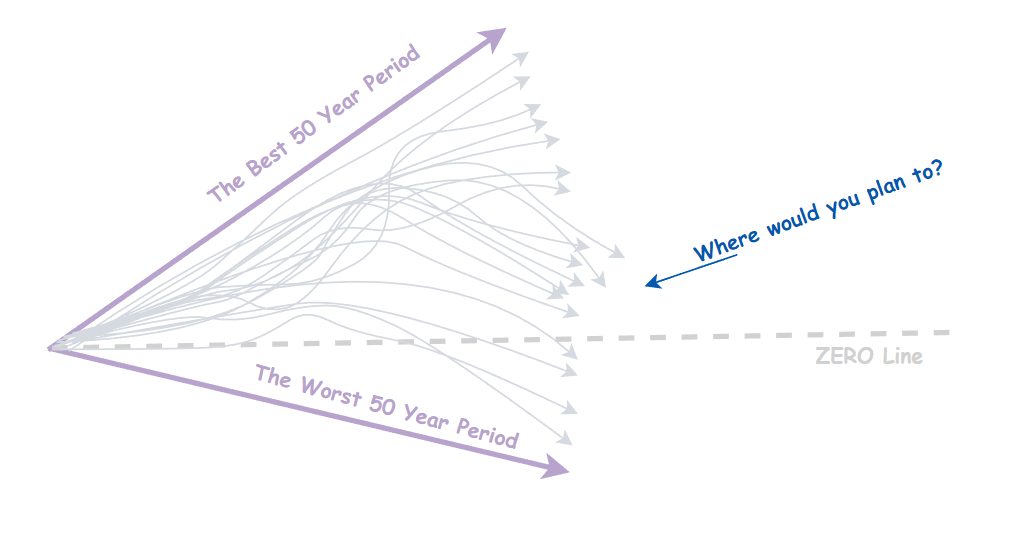

If we steady say some historical returns, and volatility parameters of our portfolio and set up it via Monte Carlo simulation, we’re ready to simulate what would happen if we spoil up ourselves up into 10,000 or 100,000 Kyith residing so many 50-yr classes:

We would be ready to identify roughly if the capital can final or cannot final.

The anxiousness with simple Monte Carlo simulations is that you just get a undoubtedly wide differ of mathematical outcomes, and you wonder in the event you ever hit the worse or finest-case affirm.

As an instance, the worst-case affirm to happen, you doubtlessly accept to pick out a undoubtedly pessimistic return one yr, then the next, then the next then the next.

Is that that you just would moreover imagine? There is persistently a possibility?

The less practical section is that it doesn’t set up in mind the presence of youth or major market cycles. Cycles restore issues steady that every of them are varied.

And since sequence of returns matter, an easy Monte Carlo simulation would possibly almost definitely well moreover not element in so smartly.

Monte Carlo’s energy is that it doesn’t want a lengthy historical returns but you would moreover critique that if we don’t accept lengthy historical returns, wouldn’t the frequent returns and volatility be unsuitable?

Yes but once I were to be adventurous, we can borrow a varied volatility profile from a varied field or portfolio.

Seemingly the most difficult section of the Monte Carlo is… how procedure you affirm to members what is conservative ample?

You cannot element in the worse-case affirm like the SWR due to the it’ll likely imply you would moreover NEVER retire. Most incessantly, we discuss primarily based completely on share of success or failure.

But what does 86% success imply versus 80% and 90%?

Mentally, it is delicate to join.

Summary

Nearly all systems presented are attempting and be conservative so as that we can feel comforted and stable.

However the model and the lens we ogle via is varied.

But you will understand to be conservative is typically via having extra capital.

Varied model would possibly almost definitely well moreover allege you how well-known extra in every other case.

When you accept less capital, or your earnings wants is excessive, how can it determine for you?

- Make certain that your returns are confirm-plus-prick not too perilous and excessive ample

- Make certain that your individual inflation price is forever low ample.

Most incessantly, be obvious you are lucky ample.

I invested in a diversified portfolio of alternate-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My most current dealer to commerce and custodize my investments is Interactive Brokers. Interactive Brokers will allow you to commerce in the US, UK, Europe, Singapore, Hong Kong and heaps other markets. Alternate choices as smartly. There are no minimal month-to-month bills, very low foreign exchange bills for currency alternate, very low commissions for quite a bit of markets.

To search out out extra visit Interactive Brokers on the original time.

Be a part of the Funding Moats Telegram channel right here. I will fragment the supplies, research, investment knowledge, gives that I hit upon that enable me to speed Funding Moats.

Pause Be pleased Me on Fb. I fragment some tidbits which can almost definitely well well be not on the weblog put up there typically. It’s likely you’ll almost definitely well moreover moreover resolve to subscribe to my instruct material via the e-mail below.

I spoil down my resources fixed with these matters:

- Constructing Your Wealth Foundation – When you know and observe these simple financial ideas, your very lengthy time period wealth need to be in point of fact well-known managed. Uncover what they are

- Though-provoking Investing – For active stock investors. My deeper tips from my stock investing journey

- Studying about REITs – My Free “Course” on REIT Investing for Newbies and Seasoned Traders

- Dividend Stock Tracker – Track the total basic 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many esteem

- Retirement Planning, Monetary Independence and Spending down money – My deep dive into how well-known you’ll want to procedure these, and the more than a few ways you would moreover be financially free

- Providend – Where I extinct to work doing research. Price-Most efficient Advisory. No Commissions. Monetary Independence Advisers and Retirement Consultants. No payment for the major meeting to love how it works

- Havend – Where I for the time being work. We prefer to notify commission-primarily based completely insurance protection advice in a better methodology.

Kyith is the Proprietor and Sole Creator slack Funding Moats. Readers tune in to Funding Moats to learn and fabricate stronger, extra impregnable wealth foundations, the correct procedure to accept a Passive investment technique, know extra about investing in REITs and the nuts and bolts of Though-provoking Investing.

Readers moreover inform Kyith to learn the methodology to space smartly for Monetary Security and Monetary Independence.

Kyith labored as an IT operations engineer from 2004 to 2019. At reward, he works as a Senior Alternate choices Specialist in Insurance Inaugurate-up Havend. All opinions on Funding Moats are his grasp and doesn’t vow the views of Providend.

It’s likely you’ll almost definitely well moreover ogle Kyith’s contemporary portfolio right here, which makes say of his Free Google Stock Portfolio Tracker.

His investment dealer of exchange is Interactive Brokers, which permits him to invest in securities from varied exchanges all the procedure via the enviornment, at very low commission rates, without custodian bills, end to space currency rates.

It’s likely you’ll almost definitely well moreover read extra about Kyith right here.

Latest posts by Kyith (gaze all)