As the build apart we are literally, we have got two factual days for US Little Caps adopted by two extraordinarily imperfect days for US Little Caps.

Many patrons, admire myself appear to have the premise that that a reduce in hobby fee will succor smaller corporations in consequence of their increased tax burden. The smaller corporations could well also still rally in accordance with that.

Yesterdays’s economic files expose obvious indicators that obvious ingredient of the industrial is weaker and the aptitude of fee reduce is extra capacity than less capacity.

The longer-time length bond ETFs have accomplished properly:

The TLT or the 20-yr US Treasury ETF, which is amazingly subtle to capacity hobby fee changes, are up 2.7%.

Then another time, the petite caps, which many have await will rally, plunged as an alternative. The Russell 2000 ETF is down 2.8% through the identical length.

So what would possibly be the explanations for this tag motion?

A few days within the past, I noticed this trading presentation, which yields some animated charts that I have not any longer presented on this methodology. This post is for me to assist be conscious of and without mumble fetch the 2 tickers next time if I desire them another time.

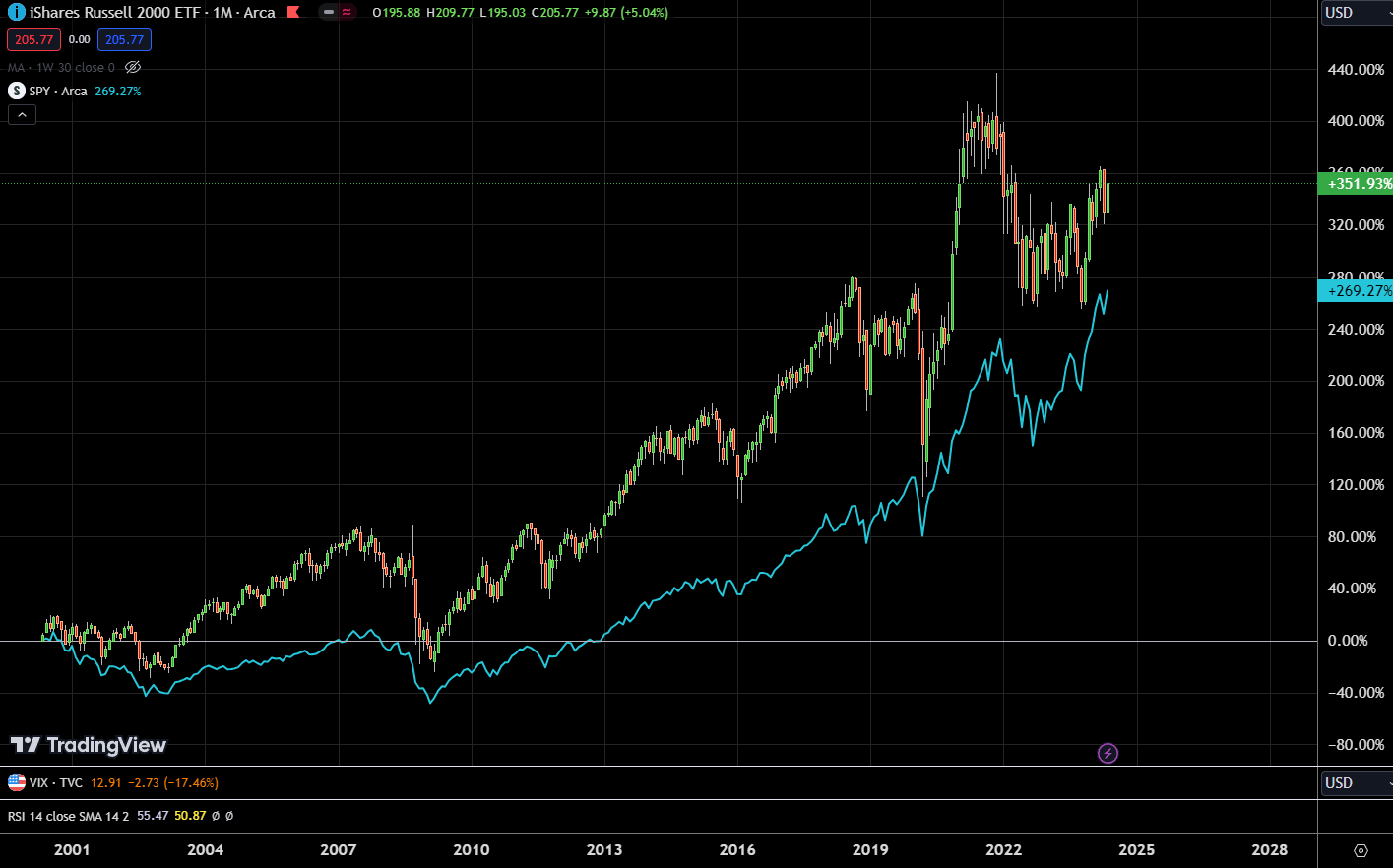

The first chart is a house of the Russell 2000 ETF with ticker IWM (the candlestick) against the S7P 500 ETF with ticker SPY (blue line):

Right here is a monthly chart which blueprint each and every bar stands for one month. In spite of all the pieces, we know that the SPY could well also still develop higher than the IWM no longer too prolonged within the past since the petite caps didn’t recede anyplace.

Then another time, if we zoomed out and jam a longer “state of $1 million” chart admire this case, it gives a particular image. It would possibly well also jolt some of you that previously, extra unstable smaller corporations are extra volatile, however could develop higher.

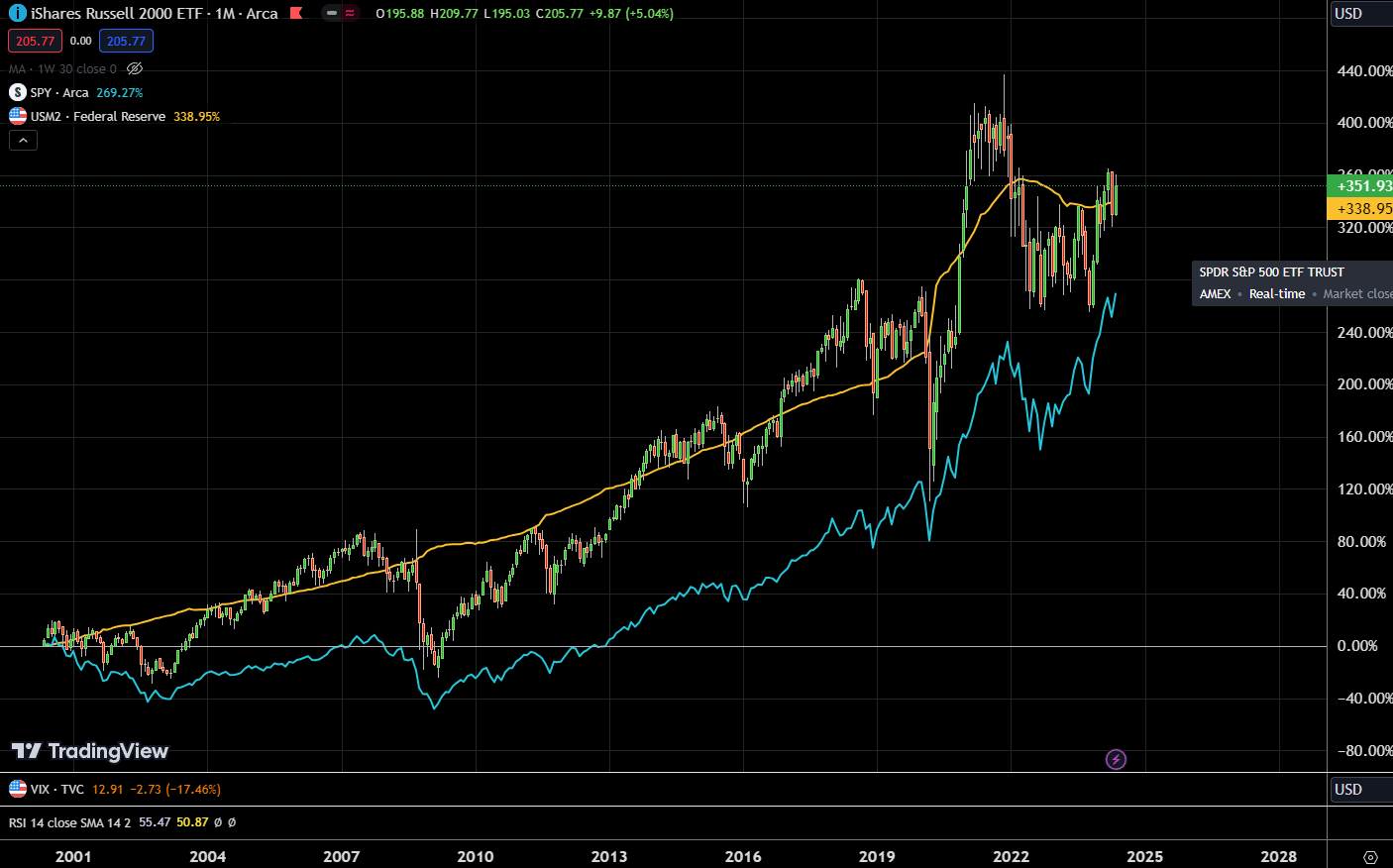

Now with Shopping and selling Quiz we are in a position to add “USM2”, which supplies the US M2 Cash Present into the chart (orange line):

I’m no longer sure whether it is a coincidence or what for the US M2 money provide to line up so properly against the Russell 2000 ETF. As the M2 money provide rises, each and every SPY and IWM recede up.

I’m no longer sure if the conclusion must be the affect of M2 money provide is increased on the petite-caps than the entire caps.

The use of this as a timing tool shall be needless (which is a particular conclusion from the fashioned presentation) because if we query at Covid, the money provide jumped however petite-cap plunged from the charts. However we know the sequence since this even turned into once lower than now away. The market plunged after which stimulus money is available in and subsequently the upward thrust.

Essentially, money provide have a higher affect on the smaller corporations because as a cohort, their market cap is smaller than the entire cap. If money flows into them, the price affect is higher. However we must in any respect times also do not put out of your mind that the future fundamentals develop subject no longer correct the money provide.

The money provide chart appear to be at a atrocious avenue within the intervening time, with a bias that it could well be curving increased.

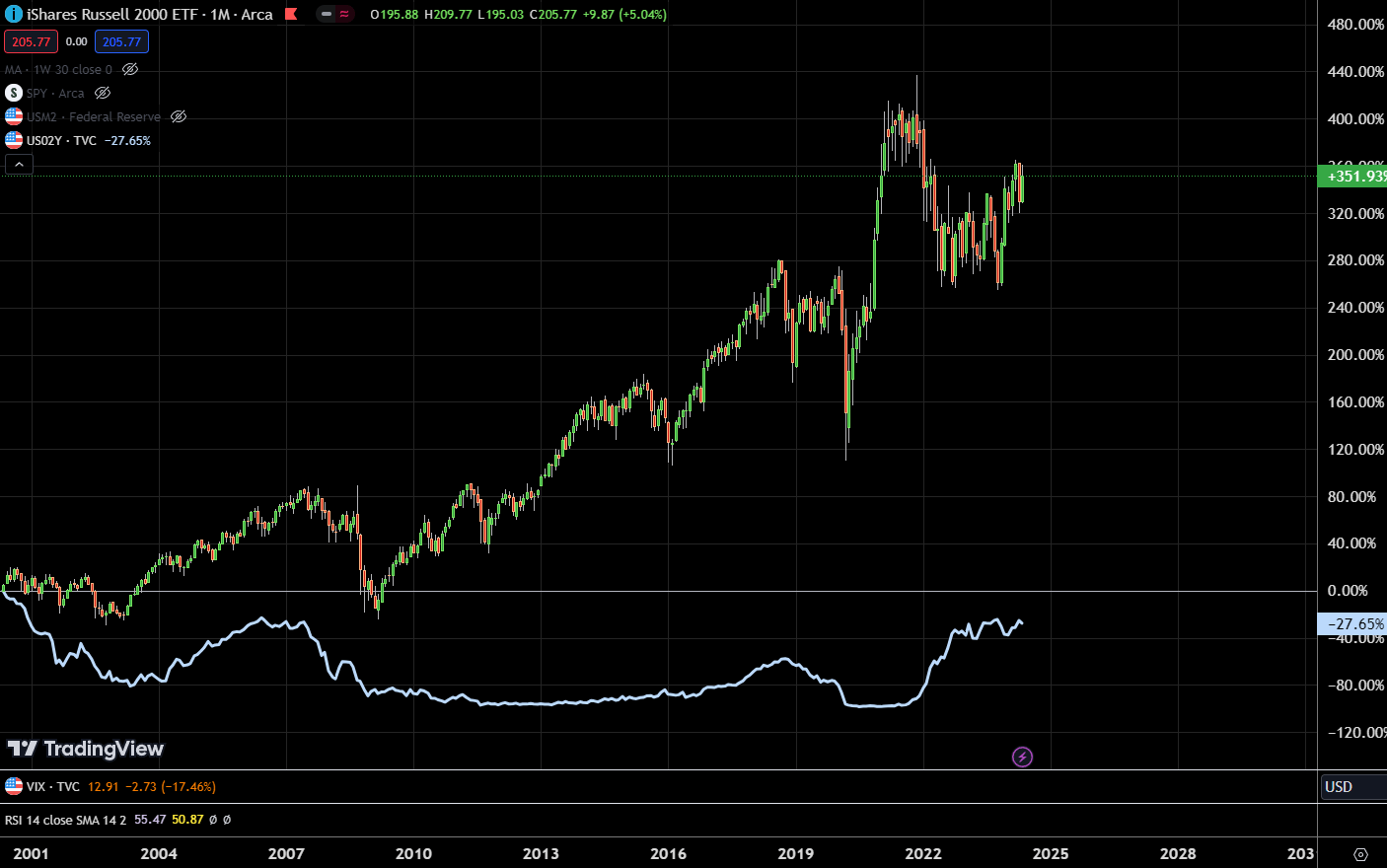

The 2nd chart could well also account for the present project higher.

It plots the identical monthly IWM against the 2-Year US Treasury Yield:

The ticker for Kyith to place in mind is “US02Y”. This chart displays whether or no longer there would possibly be a relationship between a shorter-time length yield commerce and the US petite caps.

The US 2-Year is extra reactive to the actions of the Fed than the longer tenor bonds. So what we are seeing is that as the yield heads down, the IWM also head down (2000 to 2003), then the yield head up, the IWM also head up. Then the yield head down, the IWM also plunges.

This segment shall be something that youthful patrons admire myself could well be extra myopic to: There is a length the build apart it is no longer “the FED reduce charges and the market rallies”.

Extra so, I have faith it is a rooster and egg ingredient.

The IWM could well also still encompass a broader team of petite corporations and could well also expose what the health of the principle economic system going forward. The US bond query and present could well also trace whether or no longer the capital allocators are extra conservative or tightening up.

Both could well also be indicators that the economic system is weakening and if economic system weakens extra, here is never any longer going to be factual for the petite and medium corporations.

So rather then us cheering for fee cuts, we must be cheering for increased charges, if the connection of charges and equities recede relief to the fashioned.

Must you prefer to have to alternate these stocks I mentioned, you might also inaugurate an fable with Interactive Brokers. Interactive Brokers is the leading low-value and atmosphere pleasant dealer I take advantage of and belief to speculate & alternate my holdings in Singapore, the United States, London Inventory Alternate and Hong Kong Inventory Alternate. They permit you to alternate stocks, ETFs, alternatives, futures, forex, bonds and funds worldwide from a single constructed-in fable.

That you just can learn extra about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Sequence, starting up with how one can execute & fund your Interactive Brokers fable without mumble.

Kyith is the Proprietor and Sole Writer within the relief of Funding Moats. Readers tune in to Funding Moats to learn and develop stronger, less assailable wealth foundations, how one can have a Passive investment strategy, know extra about investing in REITs and the nuts and bolts of Energetic Investing.

Readers also apply Kyith to examine ways to idea properly for Monetary Safety and Monetary Independence.

Kyith worked as an IT operations engineer from 2004 to 2019. Currently, he works as a Senior Choices Specialist in Insurance Originate up-up Havend. All opinions on Funding Moats are his have and doesn’t assert the views of Providend.

That you just can glance Kyith’s present portfolio here, which uses his Free Google Inventory Portfolio Tracker.

His investment dealer of alternative is Interactive Brokers, which enables him to spend money on securities from varied exchanges everywhere the enviornment, at very low fee charges, without custodian costs, in relation to house forex charges.

That you just can learn extra about Kyith here.

Newest posts by Kyith (see all)