Beauty and cosmetics retailer Ulta Beauty (NASDAQ: ULTA)‘s place action has been the leisure but rather over the final six months. Slowing roar and slipping profit margins beget precipitated the inventory to falter; shares beget fallen from nearly $600 to below $400 in exactly the past six months.

Even supposing the inventory had causes for slipping, the inventory market in total gets overzealous. There’s a reliable argument that Ulta Beauty’s selling has gone too some distance, and shares are poised to rebound strongly. Right here is why Ulta Beauty is a great aquire for merchants upright now.

Why has the inventory fallen so worthy?

Beauty and cosmetics are cultural staples, no longer perfect in The usa, but worldwide. Ulta Beauty is the ideal cosmetics retailer within the United States, with 1,395 stores and an e-commerce retailer. It sells tens of hundreds of products from hundreds of manufacturers. Ulta has additionally become a stout-fledged brand; the firm engages with possibilities thru social media and loyalty functions.

Ulta had perfect 449 stores in 2011. Progressively opening contemporary stores has fueled slightly uninterrupted gross sales roar for years exterior the pandemic, which hurt nearly any industrial with bodily stores. Fixed, a hit roar has made Ulta Beauty a market-beater; the inventory has outperformed the S&P 500 roughly 3-to-1 for the explanation that firm’s IPO in 2007.

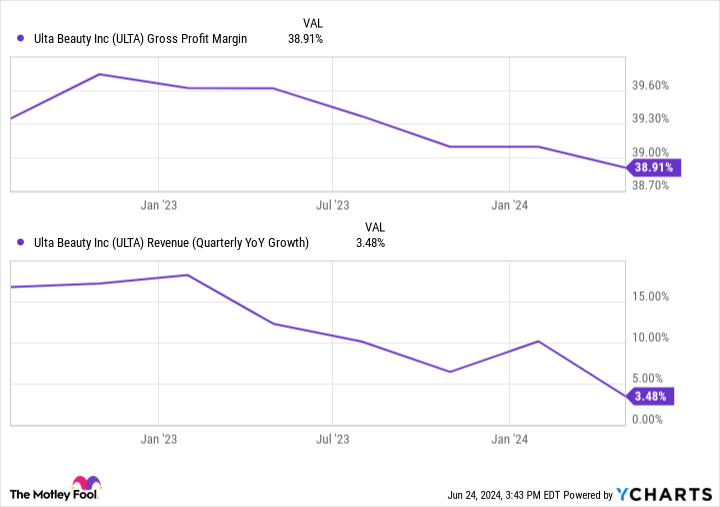

Consumers were flush with money coming out of the pandemic, which boosted Ulta’s industrial. On the opposite hand, these tailwinds beget primitive. Sales roar has incessantly slowed since peaking in 2021, whereas immoral profit margins peaked in slack 2022:

Administration has pointed to increased theft and decrease-margin gross sales because the culprits within the good thing about margin pressures. That makes sense; user financial savings rates beget fallen below pre-pandemic ranges. Naturally, a retailer will fight if possibilities beget less money and are buying and selling right down to less expensive manufacturers. As worthy as other folks might maybe try and take care of their class routine, cosmetics are within the waste a discretionary funds merchandise.

Or no longer it is no longer all noxious

The right recordsdata is that Ulta Beauty’s formula for achievement has worked for heaps of years, and there might be rarely any longer really worthy motive to imagine it might most likely maybe also no longer continue.

The firm is soundless opening contemporary stores and transforming existing locations. Administration forecasts 60 to 65 contemporary retailer openings in 2024 and any other 40 to forty five remodels. Modern stores will enhance total locations by 4% to 5%, which essentially builds low-single-digit income roar into the industrial.

Remodels and an eventual user restoration might maybe soundless enhance gross sales at existing stores. Analysts imagine Ulta Beauty’s annual income roar will moderate between 5% and 6% over the lengthy urge.

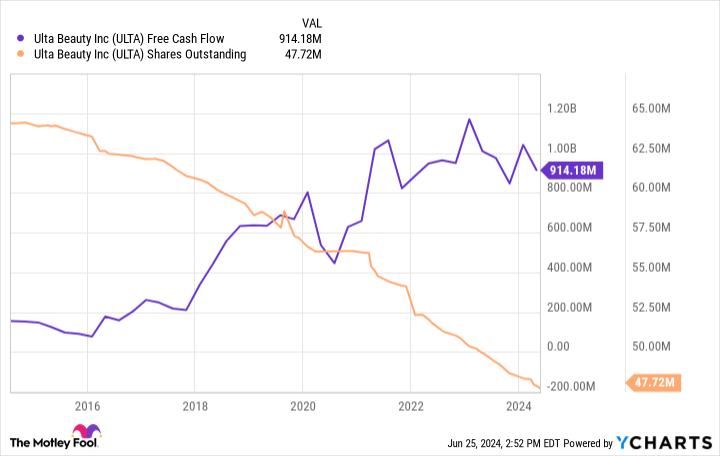

Ulta Beauty’s margin declines are no longer essentially a motive to apprehension. This day’s immoral margins of 38.9% are soundless severely bigger than earlier than the pandemic, when Ulta’s margins were roughly 36%. The firm’s free money waft is soundless within shouting distance of decade highs, which might maybe soundless continue to gas future allotment repurchases. It has diminished its allotment count by 26% over the final decade, which helps power earnings-per-allotment roar.

In the waste, merchants must resolve whether or no longer Ulta Beauty can continue riding lengthy-term roar. Nothing here seems to reveal that it might most likely maybe no longer.

The selling has gone some distance ample

The market has aggressively provided off Ulta Beauty inventory over the final few months, and shares beget become cheap. The firm averaged a spot-to-earnings ratio of 32 over the final decade. This day, Ulta Beauty is buying and selling at perfect 15 times its estimated 2024 earnings — decrease than half of its lengthy-term moderate valuation.

It might most likely maybe catch sense if Ulta Beauty’s industrial were severely broken, but that would now not seem to be the case, as mentioned. Additionally, analysts are optimistic and ask of the firm to develop earnings by a median of over 12% as soon as a year over the lengthy urge.

There’s a notorious asserting that the inventory market can customarily be irrational. That asserting works in each instructions, meaning shares can become remarkably expensive or cheap, counting on Wall Boulevard’s whims. Ulta Beauty has fallen out of type, and the market has worn some respectable non eternal urge bumps to promote the inventory into the floor unfairly.

The inventory is a cut price at this place, making it a compelling aquire for lengthy-term merchants tantalizing to end up for these challenges to subside.

Ought to soundless you make investments $1,000 in Ulta Beauty upright now?

Before you aquire inventory in Ulta Beauty, beget in thoughts this:

The Motley Fool Stock Advisor analyst crew perfect known what they imagine are the 10 most arresting shares for merchants to aquire now… and Ulta Beauty wasn’t surely one of them. The 10 shares that made the decrease might maybe assemble monster returns within the coming years.

Blueprint terminate into account when Nvidia made this record on April 15, 2005… will beget to you invested $1,000 at the time of our advice, you’d beget $757,001!*

Stock Advisor provides merchants with a straightforward-to-apply blueprint for achievement, at the side of guidance on building a portfolio, fashioned updates from analysts, and two contemporary inventory picks every month. The Stock Advisor service has bigger than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

Justin Pope has no place in any of the shares mentioned. The Motley Fool has positions in and recommends Ulta Beauty. The Motley Fool has a disclosure protection.

This Market-Beating Stock Is a Delicate Purchase Appropriate Now turn out to be initially printed by The Motley Fool