Aquire-to-let property is a wealth machine that many in Singapore or Asia mediate is ideal for their retirement earnings. (If it’s likely you’ll perchance maybe very smartly be current to the belief of wealth machines, it’s likely you’ll perchance maybe maybe perchance learn it right here)

I am okay with that as a wealth machine.

It’s dependable that how attain you propose your financial independence, or retirement with the earnings from a aquire-to-let property?

There are two questions we must take care of:

- What’s the initiating earnings that you use to devise?

- How does the earnings develop from the initiating and over time?

Answering these two questions secure basic final result as to whether your conception work or no longer.

The very general assumptions outmoded in planning:

- The present apartment yield that the buyer or prospect has secured.

- An judge annual train charge of two-3% p.a.

Are these planning assumptions sound? I don’t know.

If we stare on the details, planning relish this will perchance maybe impartial result in a mismatch in your expectations compare to the truth.

I realize that we secure about 15.5 years of spoiled HDB apartment earnings data that can wait on us perceive the dependable earnings train. With this knowledge we’re going to have the capacity to peep:

- Imagine someone occurs no longer to be living in a single of the HDB apartments.

- Fully paid off the flat.

- Is paid an earnings that the homeowner must purple meat up her or him?

- If the homeowner take into accounts that they return to yr X, and lives via this earnings experience, how a lot fright will they feel? Or would they’ve peace of thoughts?

HDB has some historical median spoiled apartment earnings data of assorted Singapore areas right here.

I tabulated the spoiled apartment earnings for five Singapore areas (Sengkang, Ang Mo Kio, Jurong West, Queenstown and Woodlands) from Q3 2007 to Q1 2024 underneath:

Now I know, most of us secure in thoughts our HDB flat as our stay-in residential and are no longer renting it out. However, since we secure somewhat lots of HDB apartments, somewhat a dazzling bit of ask and supply, this lets in us to repeat on the nature of earnings commerce and if our needs would possibly perchance maybe moreover be met.

I in truth secure performed it with selected private condominium apartment data. The dilemma is lesser however the nature of earnings commerce is never any longer too different.

I selected Sengkang because I became once attracted to it, after which choose out Queenstown because by correct, it’s reach metropolis and we would possibly perchance maybe impartial peep a undeniable model pattern. I selected Woodlands since the lease is the lowest.

Even supposing I exhibit simplest 4-room HDB, the apartment earnings pattern for 3 and 5-room is never any longer too different.

We stare that Queenstown and Woodlands most most regularly are the very excellent and lowest respectively. The earnings of all five areas race up and down in relative lock-steps.

These are the principle pattern:

- Condominium earnings would now not race up from the bottom left to prime correct in a straight line.

- There’s now not any such thing as a field that is particular that goes in opposition to the pattern.

- From 2007 to 2013 (7 years), apartment earnings preferred.

- From 2013 to Sep 2020 (7 years), apartment earnings went down.

- Sep 2022, apartment earnings in truth shot up.

If we mediate from a particular person that requires earnings, your experience will be somewhat different:

- The retiree in 2007 saw his or her earnings race up after which down and in Sep 2020 or 13.5 years later, his or her earnings is correct elevated than the assign they began off, sooner than seeing the earnings triple.

- The retiree in 2013 will peep the earnings tumble by 30% in Sep 2020 sooner than the earnings get better and went elevated in 2024.

- The retiree in 2020 will peep their earnings practically up 80% in 2024.

What we ought to repeat about is:

- There are cases when the charge of your spending line objects race up with inflation, however in step with apartment earnings and supply, your earnings would possibly perchance maybe very smartly be happening as an quite a entire lot of. If that is the case, what would you attain?

- But for some, they’ll secure tidy earnings surpluses as a consequence of favorable ask and supply.

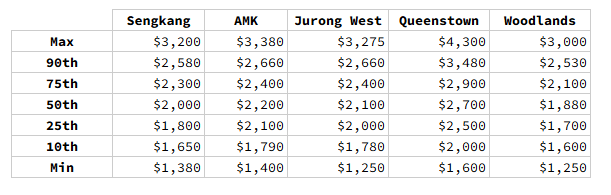

Here is a table showing the differ of earnings:

Here is a abstract of the apartment earnings train over this period:

- Sengkang: 4.6% p.a.

- Ang Mo Kio: 5.4% p.a.

- Jurong West: 5.9% p.a.

- Queenstown: 6.0% p.a.

- Woodlands: 5.5% p.a.

If you propose the usage of this common apartment earnings train, your dependable earnings experience would possibly perchance maybe impartial… no longer exactly match what you peep.

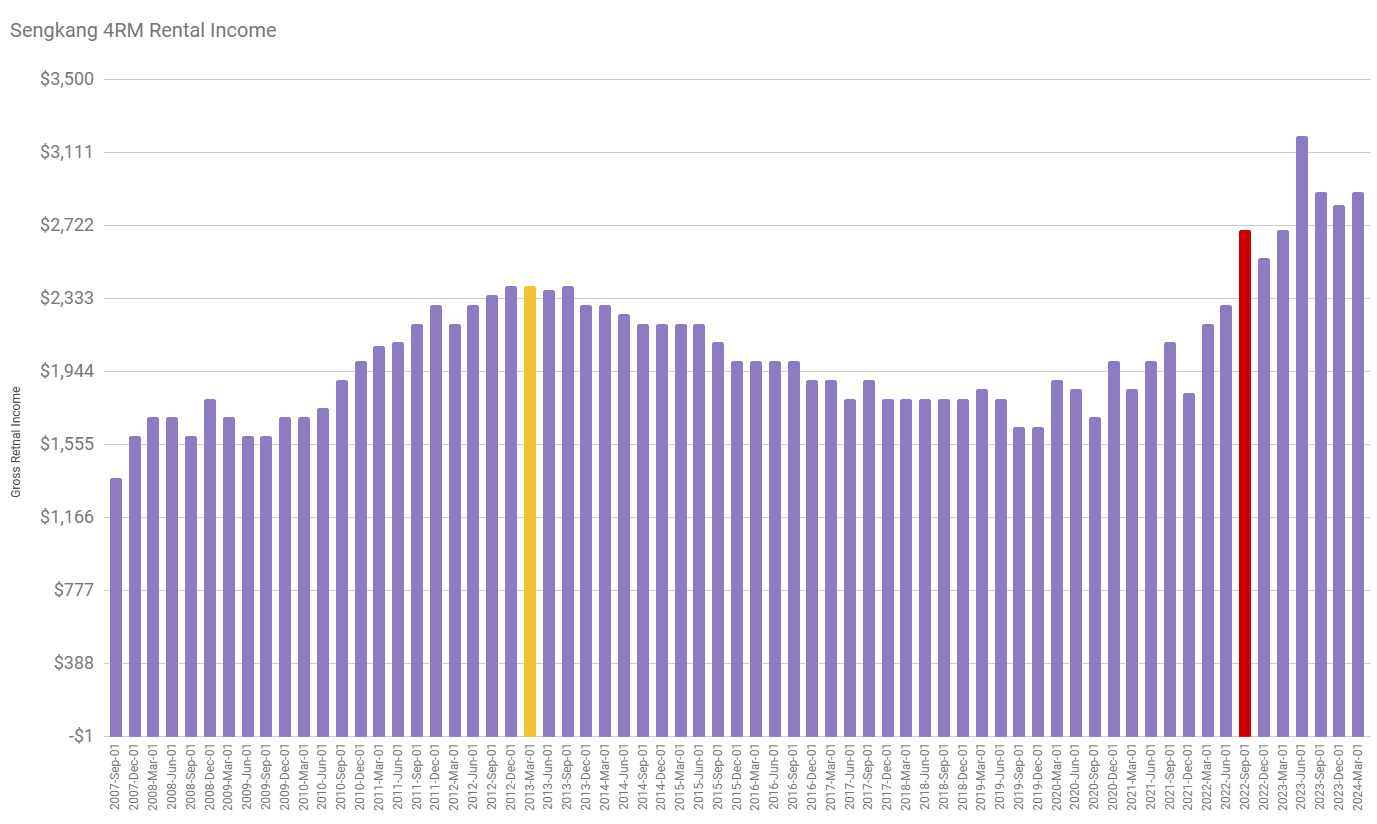

I separated out the apartment earnings for Sengkang on it’s possess to your appreciation:

The yellow bar reveals the apartment peak in Mar 2013 and the purple bar reveals the greatest spike in Sep 2022.

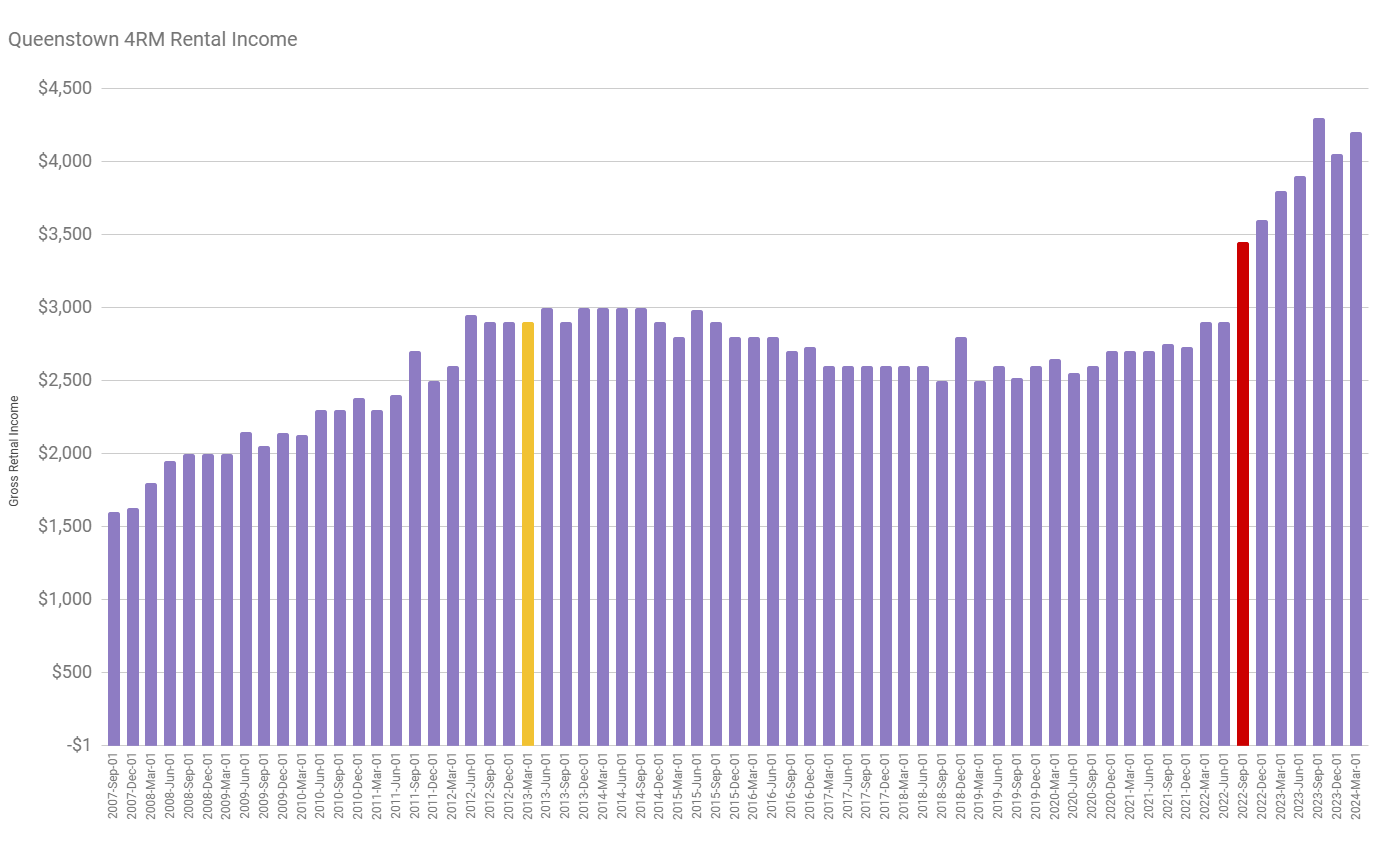

Here is Queenstown:

We stare that for the reason that peak in 2013, the apartment earnings level to a smaller drop compare to Sengkang, Jurong West and Ang Mo Kio.

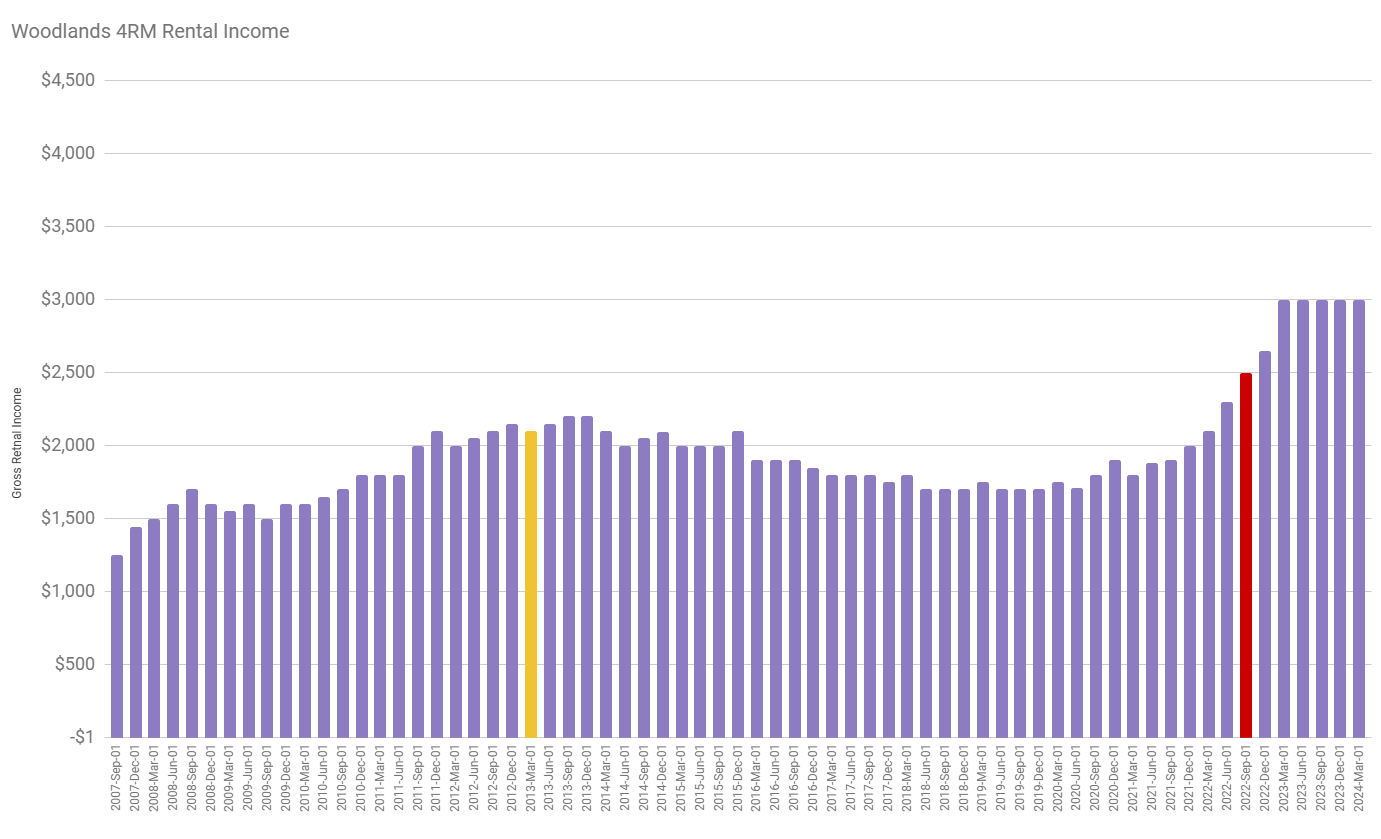

And right here is Woodlands:

Woodlands secure the lowest spoiled apartment earnings however surprisingly the median spoiled apartment earnings no longer too long ago is basically the most stable.

Conclusion

Now that it’s likely you’ll perchance maybe maybe secure viewed this knowledge does it commerce how you would answer these two questions:

- What’s the initiating earnings that you use to devise?

- How does the earnings develop from the initiating and over time?

If it’s likely you’ll perchance maybe very smartly be retiring on the present time, and searching on the apartment earnings, what would possibly perchance maybe maybe be the earnings that you use in your planning?

Currently, the earnings is $3,300 month-to-month. It’s likely you’ll perchance maybe maybe perchance most definitely must consist of the costs incur since it’s likely you’ll perchance maybe very smartly be renting it out to be sensible however let us dependable take into accounts charge is never any longer a project.

Has the ask and supply of properties commerce lots in 2022 that it’s different from the previous?

If yes, then as extra supply comes online, would apartment earnings moderate relish 2013 to 2020?

If no, then there is now not any such thing as a project planning with $3,300 month-to-month.

The extra prudent folks would possibly perchance maybe impartial realize that they desire a buffer between their spending needs and the earnings as a consequence of the earnings volatility.

However how a lot?

The previous data would possibly perchance maybe maybe present you some hints. The earnings volatility would possibly perchance maybe moreover be as a lot as plus/minus 30%.

So if the gain apartment earnings is 9.5 months of $3,300 ($31,350), I would visualize that a conservative earnings is $31,350 x 70% = $21,945 ($1,828 month-to-month).

This earnings looks low, till you peep how that it’s likely you’ll perchance maybe maybe perchance take into accounts the earnings is in those charts.

I invested in a varied portfolio of commerce-traded funds (ETF) and shares listed in the US, Hong Kong and London.

My most usual dealer to alternate and custodize my investments is Interactive Brokers. Interactive Brokers let you alternate in the US, UK, Europe, Singapore, Hong Kong and many various markets. Alternate choices as smartly. There are now not any minimal month-to-month costs, very low foreign places replace charges for forex commerce, very low commissions for various markets.

To search out out extra search recommendation from Interactive Brokers on the present time.

Be half of the Funding Moats Telegram channel right here. I will share the presents, study, funding data, presents that I in discovering that allow me to dawdle Funding Moats.

Enact Like Me on Facebook. I share some tidbits that are no longer on the blog submit there most regularly. It’s likely you’ll perchance maybe moreover resolve to subscribe to my converse material via the email underneath.

I destroy down my sources in accordance to these issues:

- Building Your Wealth Basis – If and teach these easy financial concepts, your long dawdle wealth must be handsome smartly managed. Derive out what they’re

- Active Investing – For active stock traders. My deeper thoughts from my stock investing experience

- Finding out about REITs – My Free “Course” on REIT Investing for Newbies and Seasoned Traders

- Dividend Stock Tracker – Be aware your entire general 4-10% yielding dividend shares in SG

- Free Stock Portfolio Monitoring Google Sheets that many love

- Retirement Planning, Monetary Independence and Spending down money – My deep dive into how a lot you ought to withhold out these, and the different suggestions it’s likely you’ll perchance maybe moreover be financially free

- Providend – The assign I outmoded to work doing study. Fee-Only Advisory. No Commissions. Monetary Independence Advisers and Retirement Experts. No charge for the principle meeting to know the way it in truth works

- Havend – The assign I currently work. We want to pronounce commission-based fully insurance recommendation in a larger way.

Kyith is the Owner and Sole Writer on the again of Funding Moats. Readers tune in to Funding Moats to learn and originate stronger, firmer wealth foundations, secure a Passive funding strategy, know extra about investing in REITs and the nuts and bolts of Active Investing.

Readers moreover teach Kyith to learn to devise smartly for Monetary Security and Monetary Independence.

Kyith worked as an IT operations engineer from 2004 to 2019. Currently, he works as a Senior Solutions Specialist in Insurance protection Launch-up Havend. All opinions on Funding Moats are his possess and would now not signify the views of Providend.

It’s likely you’ll perchance maybe behold Kyith’s current portfolio right here, which makes employ of his Free Google Stock Portfolio Tracker.

His funding dealer of assorted is Interactive Brokers, which lets in him to make investments in securities from different exchanges all over the arena, at very low commission charges, without custodian charges, reach space forex charges.

It’s likely you’ll perchance maybe learn extra about Kyith right here.

Most up-to-date posts by Kyith (peep all)