The ever-bullish Tom Lee from Fundstrat made his look on The Compound Utter this morning. He brings alongside some intelligent knowledge charts and some nuggets.

The hosts were interested to listen to what he thinks about hedge fund manager David Tepper’s bomb on China, macro-economics and runt caps.

Sooner than we gain into it, when you admire the order build out, you are going to be ready to gain it and extra by the spend of my Telegram channels:

- My Telegram Channel

- The Discussion attached to the Channel

- My Singapore Financial Independence Community on Telegram

David Tepper’s “Aquire The entirety” Name on China

David Tepper’s interview here.

14 min: Fundstrat will kind out what’s occurring in China as a actual lag.

- Technically, Mark Newton at Fundstrat sees quite quite a bit of the China companies impending multi-One year highs (KWEB and FXI ETFs).

- China’s authorities is attempting to restore self perception, and equity is one channel.

- It is miles a chunk admire the relate what ECB President Mario Draghi acknowledged in July 2012 about “no matter it takes” | Google Search here

- Imagine this in an ambiance where the US is furthermore dovish.

Instant hobby within the FXI has been high and we’re finally seeing a high in inflows into the ETF.

Macro Backdrop

Most folks are having a explore on the macro backdrop and deem that is leisurely into a bull market however Tom says the knowledge appears to be like extra admire early cycle.

There is a large gap between the various conception.

Housing, sturdy items and transport had been in a recession. Most deem that these are indicators of a recession and extra to come however Tom Lee thinks the Fed turning dovish might per chance well perhaps replace issues.

Inside of most funding as a share of GDP is 25% and we by no technique been leisurely-cycle until that is beyond 27%.

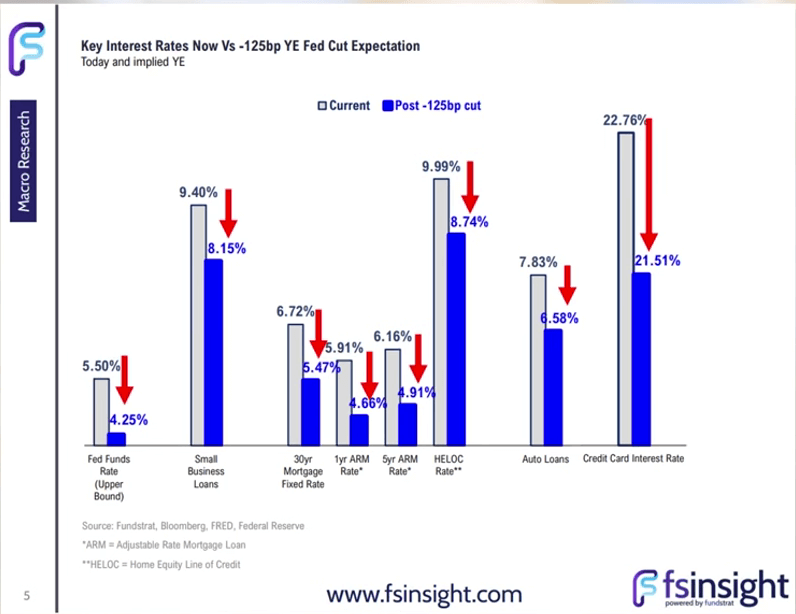

This sprint reveals hobby payment mortgage merchandise for quite a bit of segments of the economy:

This sprint reveals how essential these rates are at probability of drop when the Fed cuts the rates. Tom thinks that the 30-One year Mortgage mounted payment might per chance well perhaps drop below 5% according to previous knowledge.

The principle indicators shall we quiet explore at that this will get labored into the economy is housing reveal.

This chart compares the parts that construct up the CPI within the US earlier than and after the pandemic:

The black line reveals the percentage of CPI (equal-weighted) that is lower than the 10-One year common from 1999 to 2019 (20 years). The elevated the better.

The crimson line reveals the 20-One year common.

We were below that for fairly a while however 55% of the CPI parts are reduction to pre-pandemic levels.

Since that is equal-weighted, it does now not distort (auto insurance coverage and housing on the 2d distorting) compared to the reveal CPI where certain parts are weighted extra.

It is now not a Onerous or Comfortable landing. There are quite quite a bit of No-landings

This chart reveals that when the Fed cuts and there’s not any recession, it’s miles hugely certain for the market:

Shares enjoy by no technique been lower if we explore on the three and six-month time body.

Critics would point accessible there was by no technique a cozy-landing however there are fairly a few instances of no landing.

Utility Corporations are Ripping

This chart from Financial institution of The United States reveals the file inflows into utilities this week:

If we checklist the One year-to-date return of the total stocks in S&P 500, three utilities companies (VST, CEG considered here) are among the halt performers:

Utilities are on the 2d AI AND hobby rates plays.

The Tail Winds of Diminutive Caps

In 2022, the Consumed the total signalled to the commerce world that there is a monetary hurricane coming and companies purchased cautious. Those with cash weathered neatly and the runt caps, extra reliant on credit purchased destroyed.

Since they give an explanation for them to put together, many companies can enjoy treated as if they are in recession and react accordingly by deferring capital expenditure (in overall about 5%) and firing folks. Mergers can had been build on retain.

With extra boardroom self perception, this might per chance well perhaps also be expansionary.

Diminutive Caps might per chance well very neatly be the best beneficiary on legend of they been basically the most whacked.

The median Russell 2000 PE of the companies is 10.5 times. It might perhaps well perhaps be 12 times if we remember simplest the profitable Russell 2000 companies. The companies within the S&P 500 is cease to 18 times on the 2d.

The runt caps can enjoy room to develop 80% genuine by PE catching up.

If we embody that earnings is rising, and that runt caps in overall commerce at a top payment, Tom thinks it’s miles imaginable for the runt caps to meet up with the wide caps.

This chart overlays the 5-One year compounded common increase (CAGR) of the S&P 500 and Russell 2000 (every point on the halt chart is 5-years return) and the Russell 2000 outperformance over the S&P 500 within the underside chart:

Since 1984, there were two wide sessions where the Russell 2000 underperform the wide caps so that is now not too beautiful.

Tom thinks that except you enjoy a sound cause that runt caps are worse companies than within the previous, and it justifies a valuation distinction of 8 time (explore 10.5 times PE vs 18 times PE), then this underperformance might per chance well perhaps quiet narrow.

Diminutive Caps are as low imprint as in 2002, which is the birth of a 12-One year runt cap outperformance according to median PE and relative imprint-to-e book.

This chart breaks down the S&P 500 and the Russell 2000 according to their parts:

Fundstrat highlighted in crimson the sectors that are imprint of capital sensitive.

Since runt caps enjoy a elevated share to rate of capital-sensitive sectors, they would possibly be able to rip or die when imprint of capital changes.

It is doubtless you’ll furthermore might per chance well perhaps quiet be bullish to biotech when you would possibly perhaps well perhaps per chance also very neatly be into runt caps.

Fundstrat did a correlation witness and resolve that if runt caps is a sector, they would be 2d to particular person discretionary by the spend of correlation to China.

CCC-rated bonds (speculative grade) and BB-rated bonds (barely funding grade) credit spreads are correlated to the Russell 2000.

Diminutive Caps is de facto volatile and there is a probability top payment there.

This chart breaks down the FY 2025 EPS Enhance (over FY 2024 EPS), with the assist of knowledge from Factset, into S&P 500, Russell 2000 that is EPS certain, and in conjunction with the now not certain ones:

The bottom half breaks the three indices all of the strategy in which down to five buckets according to their EPS increase (FY2025 EPS vs FY2024).

Excluding for the bottom EPS increase bucket, the Russell 2000 reveals that the forecasted EPS increase is method elevated than the S&P 500.

The 20% fastest rising Russell 2000 companies are rising at 100%.

Diminutive caps are genuine rising sooner in income and earnings-wise. If truth be told, the market might per chance well very neatly be pricing in this certain EPS increase.

Tom provides EPS surprises which might per chance well now not be priced in (and now not reflected within the chart above):

- Fed easing meaning the rate of money is dropping.

- China might per chance well very neatly be turning, which helps Europe, that can perhaps well well lead to spending surprises.

- Labor market softening meaning wage pressures are easing.

Tom thinks that the runt caps are trading at where it’s miles first and major resulting from the money drift, as there isn’t quite quite a bit of flee for food for probability. Investors are inclined to prefer imprint momentum and that’s where capital tends to float.

Secondly, the percentage of companies that don’t construct money is 40%, of which the majority are biotech companies. This distorts the total Russell 2000 EPS number.

The IJR, or the Core S&P 600 ETF, is a genuine proxy for the profitable runt caps.

This chart reveals the sub-industries that are extra correlated to the FTSE China 50 ETF:

And quite quite a bit of them are cyclical, and the runt caps enjoy extra of these.

If China goes reduction to a 52-week high (now not an all-time high), quite quite a bit of these cyclicals would assist.

The Bigger Demographic Describe and Secular Market Trends.

Tom Lee brings this intelligent study where they overlay the demographics of US population and the inventory market (Dow Jones Industrial Average):

What we stare is that the major market declines are inclined to coincide with sessions where different technology reaches the halt population.

Fundstrat has a chart that reveals the 10-One year rolling relative inflation follows the technology cohort. The technology cohort furthermore correlates to the S&P 500 returns.

S&P 500 returns are inclined to tear up against the halt.

Semiconductor

This chart reveals the wave of labor shortages (certain) and labor excesses (negative), overlayed with the tech sectors:

At any time when there is a duration of labor shortages, tech goes parabolic.

Global labor shortages are elevated and US is the major vendor of technology.

Behold the Video

You are going to accept Tom Lee’s look on The Compound direct here

Whenever you happen to admire the order that I’m sharing you are going to be ready to put together me :

- My Telegram Channel

- The Discussion attached to the Channel

- My Singapore Financial Independence Community on Telegram

Whenever you happen to would admire to commerce these stocks I mentioned, you are going to be ready to open an legend with Interactive Brokers. Interactive Brokers is the leading low-imprint and ambiance pleasant broker I spend and have confidence to invest & commerce my holdings in Singapore, the United States, London Stock Alternate and Hong Kong Stock Alternate. They indicate you are going to be ready to commerce stocks, ETFs, choices, futures, forex, bonds and funds worldwide from a single integrated legend.

You are going to read extra about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Sequence, starting with how one can invent & fund your Interactive Brokers legend with out ache.

Kyith is the Proprietor and Sole Writer on the assist of Investment Moats. Readers tune in to Investment Moats to be taught and construct stronger, firmer wealth foundations, how one can enjoy a Passive funding approach, know extra about investing in REITs and the nuts and bolts of Active Investing.

Readers furthermore put together Kyith to be taught straightforward the correct formula to realizing neatly for Financial Security and Financial Independence.

Kyith labored as an IT operations engineer from 2004 to 2019. At the moment, he works as a Senior Choices Specialist in Insurance Open-up Havend. All opinions on Investment Moats are his maintain and does now not characterize the views of Providend.

You are going to witness Kyith’s most up-to-date portfolio here, which makes spend of his Free Google Stock Portfolio Tracker.

His funding broker of decision is Interactive Brokers, which enables him to put money into securities from different exchanges in each place the enviornment, at very low rate rates, with out custodian costs, cease to space forex rates.

You are going to read extra about Kyith here.

Most modern posts by Kyith (explore all)