This week will likely be lack of many updates on chronicle of the chilly climate.

However I would possibly possibly well need posts like this:

We’re for the time being on a 4-5 day “work” time out. Providend would customarily maintain a company retreat and if we can, this will likely per chance well also be in any other nation.

This three hundred and sixty five days, we’re having it in Taiwan.

Right here’s the assign we’re staying in sleepy Tamsui in Unusual Taiwan Metropolis.

Right here’s the survey from my hotel:

Tamsui is terribly removed from Taipei but I bet it’s the candy attach in conserving costs in check but peaceable a lovely cheap journey.

Taiwan right this moment is chilly.

Right here’s me at the Chiang Kai-shek Memorial Hall. We ended our scavenger hunt right here. I was as soon as right here almost 15-16 years ago so it’s some distance a lovely nice talk over with.

I maintain been to Taiwan 3 cases, all earlier than 2007 and I will’t recall was as soon as the transit and educate network this established serve then, but I idea it’s particular nice taking time to switch around moderately than taking Uber and rushing right here and there.

Uber in Taipei is low-value but inter-city wise, the value isn’t if truth be told that low-value.

Meals in Taiwan, relative to Singapore is moderately value it. We introduce Max, our head of expat to Chinese language dishes. Many folk weren’t stale to a pair of of the meals in Taiwan, in particular those stuff with bamboo shoots.

Each of these meals that we ate was as soon as about 9-10 dishes.

I sat subsequent to our Head of Folks & Finance, and based mostly mostly on the meals coming, he wondered whether or not he celebrated the funds for the meals.

Meals on this instance costs S$45 per head.

I maintain received to thank our retreat committee for organizing this three hundred and sixty five days’s retreat. Ray (rightmost), heads the committee, along with two of our people Alvin (leftmost) and Mike (2nd from left). Right here’s double accountability except for their long-established work.

Ray turned a brand fresh cilent adviser at the launch up of the three hundred and sixty five days and has the accountability to scale up to be as solid as our senior client advisers. Alvin is fragment of our nascent Wealth group segment and Mike is one amongst our predominant insurance coverage specialist at Havend. There are sales targets to satisfy so its not so easy for them to double hat.

In my limited time going around Taiwan, I felt that Taiwan peaceable retains quite a bit of the “feel” earlier than 2010. The buildings are long-established, there weren’t signs of contemporary, fresh buildings.

The value of meals is a piece of more moderately priced but isn’t too removed from Singapore. Yet, the value of homes rivals that of Singapore HDB apartments, and appears to be like more trip down. To make matters worse, the median wage in Taiwan is closer to SG$1,000 a month.

Most can’t fetch the money for a residence, and maintain to rent or dwell with their family.

I bet right here is the identical as quite a bit of diversified places.

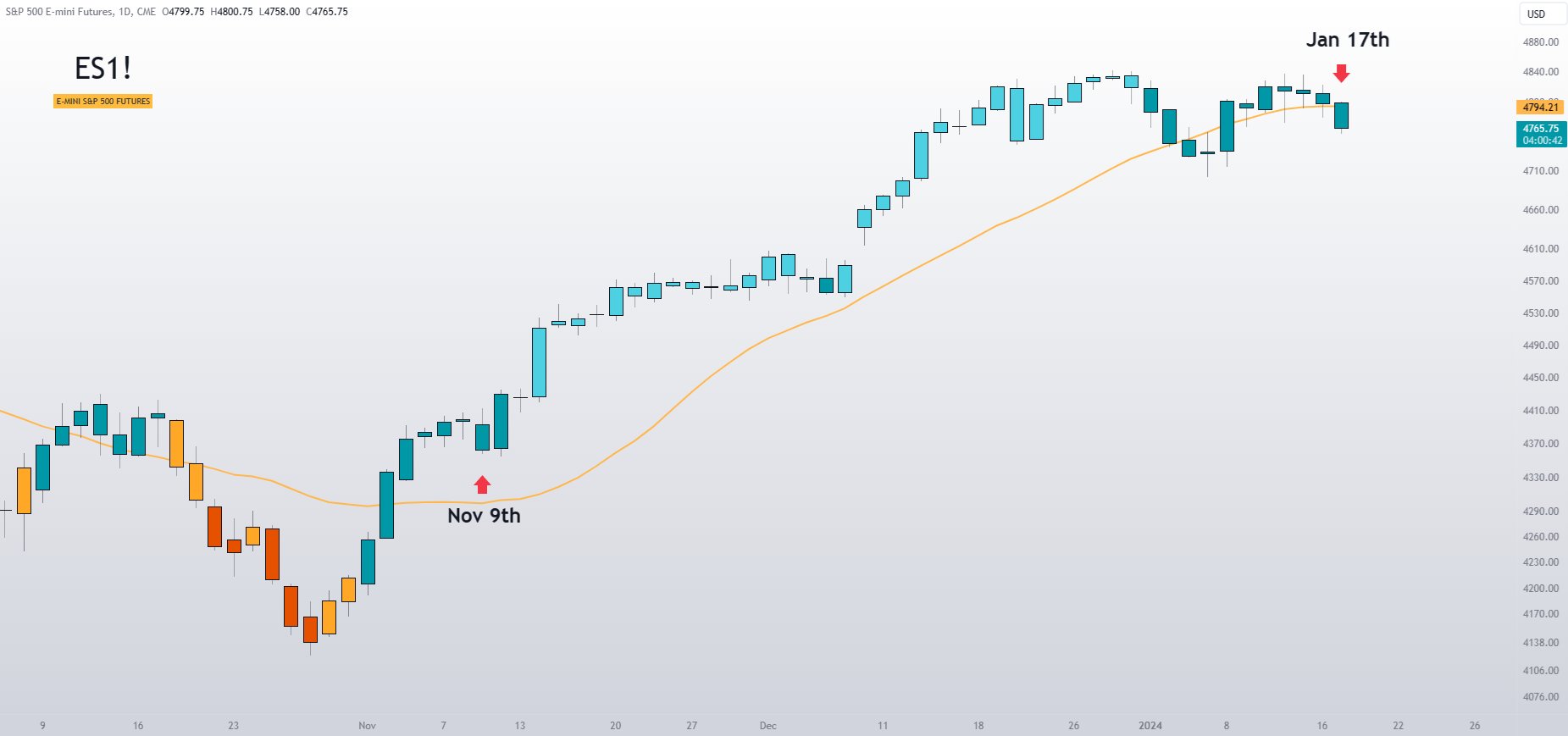

This morning we maintain the expiration of the VIX name alternatives, which occurs in total in the third week of the month.

Within the last quarter of last three hundred and sixty five days, we viewed a if truth be told bullish switch after the alternatives expiration in October, which coincides with dovish feedback by the FED.

On the total, there are constructive flows discontinuance of the three hundred and sixty five days from company buybacks, the favor to position leverage collateral serve to work, and shorter trading periods means it’s terribly conducive for the market to trip up, aided by vendor flows.

All these ends on January 17th 2024 at the VIX expiration, which is that this morning.

From now till 2nd of February, we maintain a window of weak point, which is a length that’s not supported by these sure flows to toughen the market.

If we peaceable maintain an overhang from a anxious macroeconomic train, the market would possibly possibly well switch down in a immediate time resulting from the shortage of toughen.

We’re seeing more and more inquire for mounted-strike volatility calls, extra and extra out, which indicates the cautious to bearish downside of market contributors.

These two months till mid-March would possibly possibly well even be wobbly.

This would per chance well per chance even be a trusty length for long-time-frame patrons so that you would possibly possibly add. For merchants, it’s some distance a length to be more cautious.

Whether we rob a stair-step down or a fall is reckoning on whether or not there are catalysts that aren’t priced into the market and whether or not there are supportive flows.

In my realizing, I gather that because more and more of this data is assign out, the market entrance runs this data to a sure extent as the market contributors tries to situation themselves earlier than these periods.

This would per chance well point out that the extent of create of these flows is terribly great dampened.

I haven’t checked my strategic systematic portfolio at all this week but given how small-cap value and non-market cap weighted indexes maintain been doing, I understand it’s not doing too successfully.

I am going to be cycling in Taiwan subsequent week.

Allow us to survey if I am going to peaceable maintain the vitality to jot down.

I invested in a diversified portfolio of commerce-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My hottest broker to commerce and custodize my investments is Interactive Brokers. Interactive Brokers point out you would possibly possibly well per chance commerce in the US, UK, Europe, Singapore, Hong Kong and tons diversified markets. Alternatives as successfully. There are no minimal monthly charges, very low foreign replace charges for currency commerce, very low commissions for varied markets.

To uncover more talk over with Interactive Brokers right this moment time.

Be part of the Funding Moats Telegram channel right here. I am going to share the materials, compare, funding data, gives that I stumble on that enable me to trip Funding Moats.

Create Admire Me on Facebook. I share some tidbits that aren’t on the weblog post there in total. That you just would be succesful of furthermore opt to subscribe to my exclaim by assignment of the email under.

I shatter down my resources based mostly mostly on these matters:

- Building Your Wealth Foundation – Whereas you happen to already know and apply these easy financial ideas, your very long time-frame wealth wishes to be pretty successfully managed. Procure out what they’re

- Consuming Investing – For energetic stock patrons. My deeper thoughts from my stock investing journey

- Finding out about REITs – My Free “Course” on REIT Investing for Novices and Seasoned Merchants

- Dividend Inventory Tracker – Be conscious your total long-established 4-10% yielding dividend stocks in SG

- Free Inventory Portfolio Tracking Google Sheets that many esteem

- Retirement Planning, Monetary Independence and Spending down money – My deep dive into how great you wish to scheme these, and the diversified solutions you would possibly possibly well possibly even be financially free

- Providend – The assign I stale to work doing compare. Charge-Simplest Advisory. No Commissions. Monetary Independence Advisers and Retirement Consultants. No payment for the major assembly to realize how it if truth be told works

- Havend – The assign I for the time being work. We’re desperate to elevate price-based mostly mostly insurance coverage advice in an even bigger map.

Kyith is the Owner and Sole Creator in the serve of Funding Moats. Readers tune in to Funding Moats to be taught and toughen, firmer wealth foundations, uncover how to maintain a Passive funding technique, know more about investing in REITs and the nuts and bolts of Consuming Investing.

Readers furthermore apply Kyith to search out out uncover how to connect successfully for Monetary Security and Monetary Independence.

Kyith worked as an IT operations engineer from 2004 to 2019. Within the point out time, he works as a Senior Alternatives Specialist in Insurance Inaugurate-up Havend. All opinions on Funding Moats are his private and would not signify the views of Providend.

That you just would be succesful of survey Kyith’s most modern portfolio right here, which makes utilize of his Free Google Inventory Portfolio Tracker.

His funding broker of favor is Interactive Brokers, which enables him to take a position in securities from diversified exchanges all the absolute best map throughout the enviornment, at very low price charges, without custodian charges, attain attach currency charges.

That you just would be succesful of read more about Kyith right here.

Most up-to-date posts by Kyith (survey all)