I went to Malaysia two weeks in the past to dangle out with my buddy. He has been staying in Johor for a whereas and notion it’d be a like minded realizing for me to be in contact about with palm oil plantations contrivance Kota Tinggi.

The thunderstorm in the afternoon saved us, two cats and one canine, in the condo for a whereas. I took that different to update him on the adjustments to the healthcare system and what they point out to his monetary space.

There had been adjustments to how our health insurance works. Whenever you buy some protect conception and rider, it is doubtless you’ll must co-pay about 5-10% of the bill. Whenever you desire for an even bigger funds for most cancers treatment, it is doubtless you’ll possibly possibly must gather a rider. A rider is now not lawful to decrease out-of-pocket charges in smartly-liked anymore.

We then focus on whether or now not he has a like minded conception if a first-rate illness hits him this day, day after lately, twenty years from now, or 40 years from now, for a semi-financially self reliant particular person.

Colorful what I do know, there are gaps in his coverage. He has an developed-stage serious illness conception as a lot as 65 years light. If a first-rate illness hits him in the later years, that expense will come from his earnings portfolio for his day by day living.

“How would I do know if my earnings portfolio can present for that? It sounds love it’ll be a astronomical sum for a length!” He is suitable, and there are doubtless change-offs. Some of his day by day spending will must be decrease down, and even then, how worthy are we talking about every time that happens?

A solution for this is to buy a first-rate illness till 99 years light, however that’s now not foolproof, in my leer. Whenever you desire a one-time lump sum of $70,000 this day to alleviate your out-of-pocket price, you can aquire $100,000 of CI till 99 coverage.

40 years from now, would the nominal price of what you want reside at $70,000?

If now not, how worthy more insurance till 99 years light raise out you are alive to on to can aquire?

I shared with him that my private conception is to supplement my fresh serious illness coverage with a medical sinking fund that will most doubtless be provided when the serious illness coverage runs out.

I enjoy written a non-public imprint on this: $50,000 Portfolio to Complement Lifetime Serious Illness Protection.

A medical sinking fund for serious illness coverage is being very intentional in saving up for a dear sum that we would want later on in our life. By setting aside this from the the relaxation of our monetary targets, we are going to be certain that there may be now not any double-counting and the cash is there for us when we desire it roughly.

While I modified into writing that non-public imprint, I believed, why now not raise out something extra and relieve him work out how worthy he wants this day to supplement his existing CI coverage?

This submit is to tackle his wants specifically however there may possibly possibly be substances of this that would show precious for you.

What is Your Serious Illness Need Presently?

Whenever you face a excessive serious illness match this day, how worthy raise out you want?

This quiz will mess up rather a pair of folks and it does mess me up ample. Whenever you’ll want to always now not contrivance retirement, or financially self reliant, or produce up your wealth, the quantity you want is develop up of two substances:

- Changing 3-5 years of your annual earnings or charges in speak that it is doubtless you’ll stop your job and fight the illness effectively.

- A lump sum for out-of-pocket wants be it to alleviate dear different medical treatment, hiring care givers and varied charges.

My buddy is style of financially self reliant, so #1 is less of a wretchedness. What he wants to determine may possibly possibly be quantity 2.

I recede this as a lot as him, however if he has no realizing the put aside to commence, he can raise a search data from on the breakdown of how I catch $74,000 in this day’s cash.

How the Clinical Sinking Fund Works

So right here is roughly the wretchedness definition:

- My buddy is in the mean time 39 years light.

- He owns a $150,000 developed-stage serious illness conception that covers him till 65 years light.

- No varied conception.

I’ll let my buddy work out how worthy he wants this day, however let us judge that my buddy figured he wants a lump sum of $70,000 in this day’s bucks.

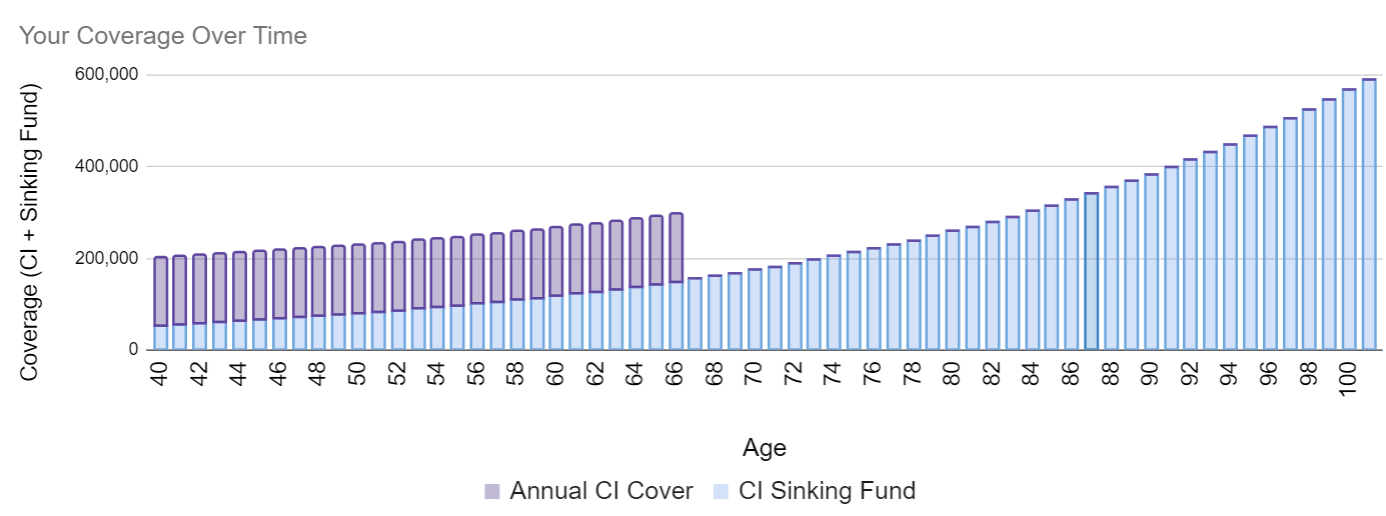

I teach his existing insurance coverage against his CI wants in the chart beneath:

The $150,000 coverage is flat and can flee out after 65 years light. Detect that the $70,000 wants to increase with inflation. I am using 3% p.a. in inflation for this $70,000. When my buddy is 85 years light, the an identical may possibly possibly be $272,653.

I’m wondering what number of understand this flat payout and inflation medical wants wretchedness.

So we are going to introduce a medical sinking fund.

This medical sinking fund:

- It is an investment portfolio.

- Whenever you are alive to on to must expend an endowment, it is doubtless you’ll raise out so however raise out imprint that what drives the expansion of either the portfolio or the endowment is the return of the underlying sources minus the price. There is now not any such thing as a magic to it.

- My conversation with my buddy tells me he would expend SSAC (iShares MSCI ACWI UCITS ETF using Interactive Brokers) however more on this later.

- The portfolio must grow over time.

- Any time you want it, dump a fraction or all of it to fund your medical wants.

Here is how the portfolio price (CI Sinking Fund) and the insurance plans coverage stack up over time:

I’m hoping I don’t spell it wrongly as CI Stinking fund.

The cost of the sinking fund grows over time. On this illustration, we’re using an awfully lengthy time length investment fee of return of 4% p.a. The coverage of the CI conception is stacked above (in red).

The portfolio can enjoy about 25 years to grow and capture the lengthy-time length returns.

So let us add aid my buddy’s CI Wants into the chart:

I’ll possibly possibly now not raise out a stack column chart in speak that you simply guys can search it clearer.

We can search that each one the sunshine blue bars are larger than the red line, indicating that if my buddy wants the cash at any point, there’ll be an inflation-adjusted lump sum for him.

Essentially the most level-headed phase is when my buddy turns 65-66 years light. He mustn’t enjoy any CI coverage and the portfolio can enjoy in speak to supply him with $155,490 (what the $70,000 is price then). Therefore, it is doubtless you’ll wonder what happens when we don’t hit that return?

Now that I enjoy explained the conception, let us attempt to be in contact about across the conception.

Planning Around Variable CI Wants, Healthcare Inflation and Investment Returns.

Explore, it is terribly tough to conception for a future that you simply and I’d admit that is unsure:

- We must now not distinct if the lump sum we conception for is ample. Did we ignored out on some stuff or did we ingredient in too worthy stuff?

- There is a unfold of inflation of healthcare and non-healthcare wants.

- There is a unfold of investment returns.

I told my buddy that if assuring main illness is this form of astronomical thing for him that he wants to verify he has ample cash to stand a combating chance, then he must:

- Exercise a larger lump sum in planning.

- The next lengthy-time length inflation fee.

- A decrease investment return.

It will be a conservative conception however the flip aspect is that he’ll prefer to put aside aside rather a pair of cash. In all likelihood he has to scavenge that from his earnings portfolio.

I came up with a desk beneath for him to develop his decision:

The desk reveals varied minimum starting quantity for the CI Sinking Fund depend on the CI Need this day, healthcare inflation and investment fee of return.

As an instance whereas you intend for $100,000 and love to conception with a conservative inflation fee of 4% and a 3% investment return, then you definately will want $190,000 in the Sinking fund this day.

You will most doubtless be able to learn about something: If the inflation fee is expounded to the investment return, you usually want roughly the lump sum this day. The investment return usually retains tempo with inflation.

I enjoy also incorporated a Multiplier in speak that it is doubtless you’ll roughly calculate if your CI Wants is now not 70k, 100k or 150k.

As an instance, you learn about that if inflation is 4% and the investment return is 6%, the multiplier is 0.6.

Whenever you desire $250,000 this day, then the quantity to your sinking fund is 250,000 x 0.60 = 150,000.

The utilization of the Desk in Reverse.

The excellent thing about this desk is that we are going to expend it in reverse.

Bellow you need to make a contribution $100,000 this day.

What does contributing $100,000 manner?

If we check on the desk:

- CI wants $150,000 this day if inflation is 4% and the investment fee of return is 6%.

- CI wants $100,000 this day if inflation is 3% and the investment fee of return is 4%.

- CI wants $70,000 this day if inflation is 3% and the investment fee of return is 3%.

- CI wants $70,000 this day if inflation is 4% and the investment fee of return is 4%.

You may possibly possibly presumably search the differ of optimism and pessimism to your conception.

You may possibly possibly presumably conception for $70,000 however there may be a chance it is doubtless you’ll enjoy an an identical of $150,000 this day if the returns are like minded ample.

Setup the Portfolio For Greater Threat However Conception with a Conservative Price of Return.

How unstable is a portfolio that my buddy can expend?

The largest consideration is whether or now not or now not he has ample runway to capture the return of a unstable portfolio. The worst equity sequence for the US market is that it spends 14 years of now not earning anything else. Which is a decrease very lengthy time length fee of return than 3% p.a.

My leer is that to capture the return of a 100% equity portfolio, it is recommended that it is doubtless you’ll possibly possibly must enjoy 20-23 years between whereas you want the cash and this day.

In my buddy’s case, that is 25-26 years away so he can invest in a 100% equity portfolio technically if he wishes to.

He can no doubt invest in a less unstable portfolio in particular if his willingness to raise chance is now not so excessive.

A Clinical Sinking Fund Tackles What-Ifs Better As a end result of You Delight in the Energy is In Your Fingers.

Whenever you buy a CI time length or multi-pay CI time length till 99 years light, it is doubtless you’ll possibly possibly pay a top fee in change for somebody to supply the sum whereas you want it.

That $100,000 or $200,000 is more sure than doing it to your comprise.

Most shoppers must now not sophisticated investors. I’m wondering what number of even understand my sinking fund illustration and SSAC in the main space.

Even when they take into accout the truth that phase, they’ll now not be delighted that they’ll mark the return 25 years from now. There is a body of labor to total to be delighted of the conviction of a broadly diverse equity and fastened-earnings portfolio.

After which… it would relieve whereas you had this capital in the main space.

Now not many enjoy the privilege to supply this up, other than their children’s university and their comprise retirement earnings conception.

A medical sinking fund is expounded to your retirement earnings conception. Earlier than you produce your wealth, you buy time length life insurance unless age 65 must you passed away and your dependents can reside a same old life. After 65, you would enjoy produce up your retirement fund and your dependents don’t want you, or your wealth will also be activated to relieve them.

Those with manner would produce up the medical sinking fund for a time you most want it.

Some may possibly possibly scream that the an identical of $70,000 years from now may possibly possibly now not enjoy accounted for something, however we are going to scream the same for the CI insurance that it is doubtless you’ll possibly possibly enjoy deliberate for. Lots of the arguments against the sinking fund exposes the CI insurance the same manner.

The put watch over for the sophisticated comes whereas you manage to mark a median return of 6-7% p.a. You enjoy the flexibility to put watch over the inflation-adjusted want and whereas it is doubtless you’ll possibly possibly enjoy a metamorphosis of coronary heart, it is doubtless you’ll reallocate your sources to varied targets.

The cash is fungible.

However if You Would really like to Fetch Serious Illness Till 99…

Whenever it is doubtless you’ll possibly possibly enjoy a varied philosophy to my buddy and me, there are time length plans till 99 years light.

There are also multipay plans till 99 years light. Now not too lengthy in the past, there enjoy also been LIMITED Pay TERM Plans!

Whenever you are , it is doubtless you’ll continuously write into Havend, and my colleagues can raise you by an InsureWell Overview of your insurance wants. Let them know that it is doubtless you’ll possibly possibly be to shore up your serious illness wants.

Whenever you are alive to on to must change these shares I talked about, it is doubtless you’ll commence an legend with Interactive Brokers. Interactive Brokers is the leading low-price and efficient dealer I expend and believe to invest & change my holdings in Singapore, the US, London Stock Alternate and Hong Kong Stock Alternate. They permit you to interchange shares, ETFs, choices, futures, foreign change, bonds and funds worldwide from a single integrated legend.

You may possibly possibly presumably learn more about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to supply & fund your Interactive Brokers legend without issues.

Kyith is the Proprietor and Sole Writer in the aid of Investment Moats. Readers tune in to Investment Moats to learn and produce stronger, more impregnable wealth foundations, how to enjoy a Passive investment approach, know more about investing in REITs and the nuts and bolts of Active Investing.

Readers also observe Kyith to how one can conception effectively for Financial Security and Financial Independence.

Kyith worked as an IT operations engineer from 2004 to 2019. For the time being, he works as a Senior Solutions Specialist in Insurance coverage Starting up up-up Havend. All opinions on Investment Moats are his comprise and doesn’t signify the views of Providend.

You may possibly possibly presumably leer Kyith’s fresh portfolio right here, which makes expend of his Free Google Stock Portfolio Tracker.

His investment dealer of selection is Interactive Brokers, which enables him to invest in securities from varied exchanges all the contrivance by the sector, at very low commission charges, without custodian prices, contrivance teach currency charges.

You may possibly possibly presumably learn more about Kyith right here.

Latest posts by Kyith (search all)