Here is a safe components to avoid wasting money that you manufacture no longer enjoy any knowing need to you would possibly well want to use or your emergency fund.

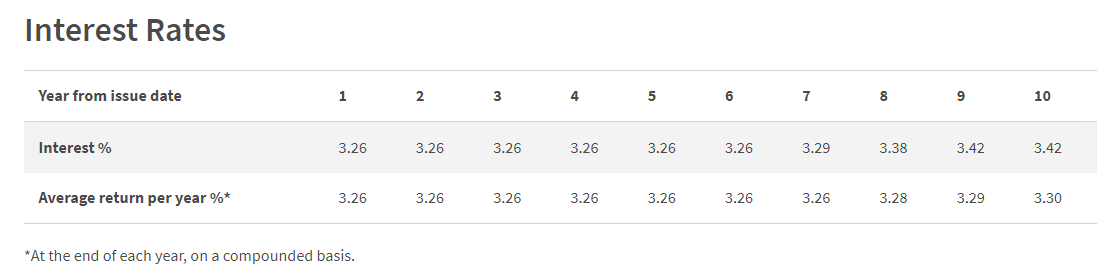

The July 2024’s SSB bonds yield an ardour rate of 3.30%/year for the next ten years. You would possibly well notice through ATM or Web Banking by means of the three banks (UOB, OCBC, DBS)

However, whenever you happen to finest withhold the SSB bonds for one three hundred and sixty five days, with two semi-annual payments, your ardour rate is 3.26%/year.

The one-three hundred and sixty five days SSB yield seems to be to be heading down, exhibiting a much less flat curve.

$10,000 will develop to $13,307 in 10 years.

The Singapore Executive backs this bond, and it’s readily in the market so that you can invest whenever you happen to would possibly per chance enjoy a CDP or SRS memoir (this contains Singapore Permanent Residents and Foreigners).

A single person can believe no longer bigger than SG$200,000 price of Singapore Savings Bonds. You would possibly well moreover use your Supplementary Retirement Plot (SRS) memoir to aquire.

Which you would possibly per chance moreover discover more knowledge about the SSB right here.

Display that every month, there would per chance be a brand unusual dispute that you would possibly moreover subscribe to by means of ATM. The 1 to 10-three hundred and sixty five days yield that you would possibly moreover rep will vary from this month’s ladder, as shown above.

Closing month’s bond yields 3.33%/year for ten years and 3.26%/year for one three hundred and sixty five days.

Here is truly the most contemporary historical SSB 10-Year Yield Curve with the 1-Year Yield Curve since Oct 2015, when SSB changed into started (Click on the chart, and cross over the motorway to stare the exact yield for that month):

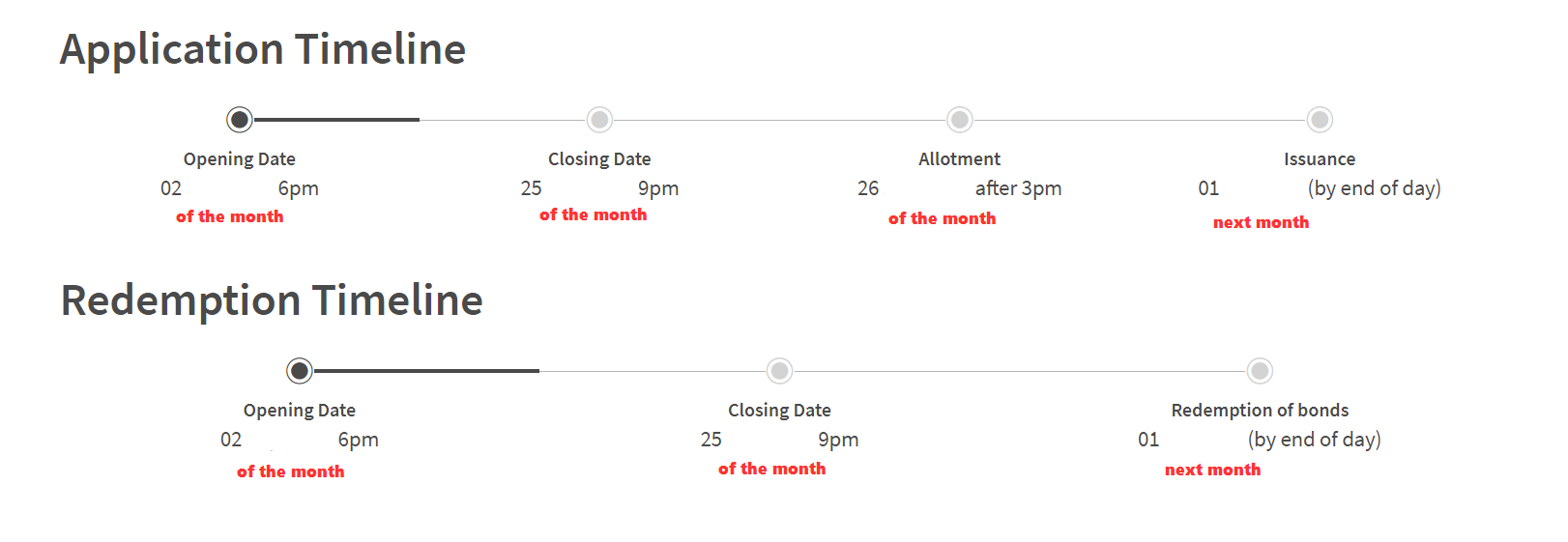

Suggestions to Apply for the Singapore Savings Bond – Application and Redemption Schedule

You would possibly well notice for the bonds at some stage in the month. On the discontinue of the month, you would possibly well know the map many of the bonds you utilized were a success.

Here is the agenda for utility and redemption whenever you happen to must always promote:

You enjoy from the 2nd day of the month to about the 25th of the month (technically the 4th day from the closing working day) to note or resolve to redeem the SSB you’ll want to always redeem.

Your bond would per chance be for your CDP on the 1st of the next month. You would possibly well survey you money for your bank memoir linked to your CDP memoir on the 1st of subsequent month.

You Would possibly per chance well Not Catch The total Singapore Savings Bonds That You Apply For

Lift out present that need to you notice for the Singapore Savings Bonds, that you would possibly moreover no longer rep all that you notice for. Deem of this as that you would possibly moreover be bidding for an amount which is undeniable by the inquire of and present of Singapore Savings Bonds.

When the fervour rate is low, the inquire of tends to be decrease relative to history, and also that you would possibly moreover rep a more main amount. Tranquil, if the fervour rate is terribly high, inquire of would per chance well moreover be so overwhelming that that you would possibly moreover rep a diminutive half you notice for.

For instance, in the August 2022 dispute, that you would possibly moreover notice for $100,000, but essentially the most disbursed amount per person changed into $9,000 finest. Whenever you utilized for $8,000, that you would possibly per chance rep your total $8,000 allocation.

To investigate the previous half pattern, that you would possibly moreover steal a stare at SSB Allotment Outcomes right here.

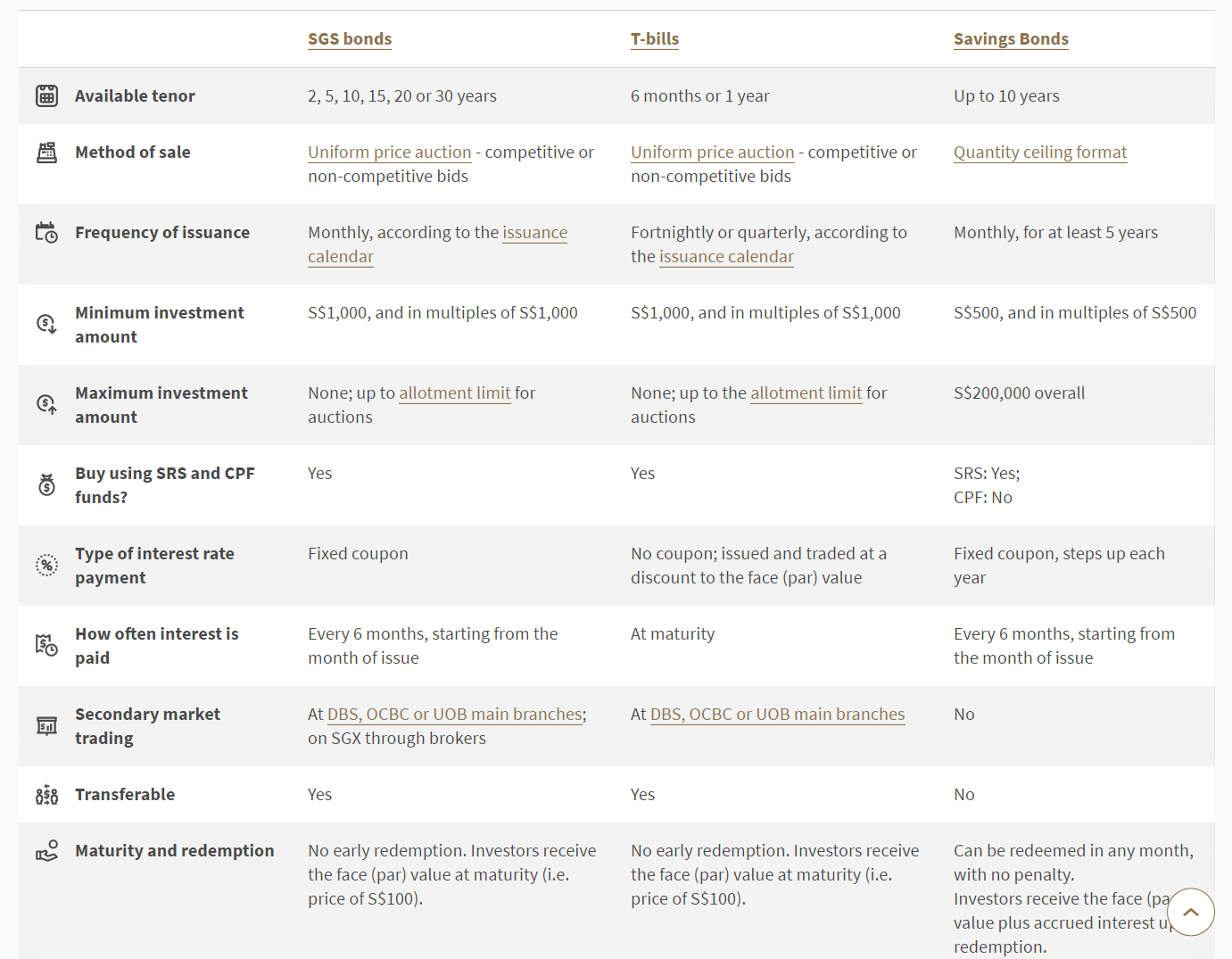

How attain the Singapore Savings Bonds Overview to SGS Bonds or Singapore Treasury Funds?

Singapore savings bonds are treasure a “unit believe” or a “fund” of SGS Bonds.

But what’s the variation between buying SGS Bonds and its sister, the T-Funds, at as soon as?

The SGS Bonds and T-Funds are moreover issued by the Executive and are AAA rated.

Here is a MAS detailed comparability of the three:

The predominant excellent thing about the 1-three hundred and sixty five days SGS Bonds and Six-month Singapore Treasury Funds is that that you would possibly moreover rep a more main allocation at the moment when put next to the Singapore Savings Bonds. This signifies that in recount so that you can perform a merely ardour yield of $400,000, you rep the next likelihood to fulfil that with 1-three hundred and sixty five days SGS Bonds and Six-month Treasury Funds.

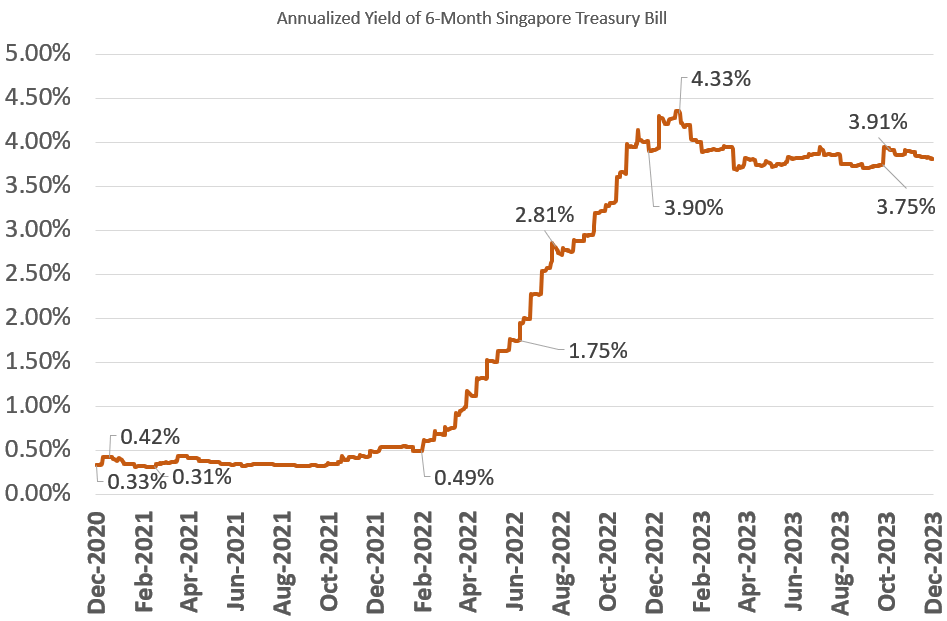

The transient ardour charges are getting somewhat thrilling, and transient SGS bonds and treasury bills would per chance be appropriate to supplement your Singapore Savings Bonds allocation.

I wrote a knowledge to ticket the vogue that you would possibly moreover with out problems aquire the Singapore Treasury Invoice and SGS Bonds right here. You would possibly well learn Suggestions to Aquire Singapore 6-Month Treasury Funds (T-Funds) or 1-Year SGS Bonds.

My Previous Impress Add Articles When it comes to the Singapore Savings Bonds

Learn my previous write-ups:

- This Singapore Savings Bonds: Liquidity, Higher Returns and Executive Backing. Dream?

- More details of the Singapore Savings Bond. Looks to be treasure my Emergency Funds now

- Singapore Savings Bonds Max Maintaining Restrict is $200,000 for now. Apply by means of DBS, OCBC, UOB ATM

- Singapore Savings Bonds’ Inflation Protection Abilities

- Some instructions on easy tips on how to note for the Singapore Savings Bonds

Previous Points of SSB and their Rates:

- 2015 Oct

- 2015 Nov

- 2015 Dec

- 2016 Jan

- 2016 Feb

- 2016 Mar

- 2016 Apr

- 2016 Would possibly per chance well

- 2016 Jun

- 2016 Jul

- 2016 Aug

- 2016 Sep

- 2016 Oct

- 2016 Nov

- 2016 Dec

- 2017 Jan

- 2017 Feb

- 2017 Mar

- 2017 Apr

- 2017 Would possibly per chance well

- 2017 Jun

- 2017 Jul

- 2017 Aug

- 2017 Sep

- 2017 Oct

- 2017 Nov

- 2018 Jan

- 2018 Feb

- 2018 Mar

- 2018 Apr

- 2018 Would possibly per chance well

- 2018 Jun

- 2018 Jul

- 2018 Aug

- 2018 Sep

- 2018 Oct

- 2018 Nov

- 2018 Dec

- 2019 Jan

- 2019 Feb

- 2019 Mar

- 2019 Apr

- 2019 Would possibly per chance well

- 2019 Jun

- 2019 Jul

- 2019 Aug

- 2019 Sep

- 2019 Oct

- 2019 Nov

- 2019 Dec

- 2020 Jan

- 2020 Feb

- 2020 Mar

- 2020 Apr

- 2020 Would possibly per chance well

- 2020 Jun

- 2020 Jul

- 2020 Aug

- 2020 Oct

- 2020 Nov

- 2020 Dec

- 2021 Feb

- 2021 Mar

- 2021 Apr

- 2021 Would possibly per chance well

- 2021 June

- 2021 July

- 2021 Aug

- 2021 Sep

- 2021 Oct

- 2021 Nov

- 2021 Dec

- 2022 Jan

- 2022 Feb

- 2022 Mar

- 2022 Apr

- 2022 Would possibly per chance well

- 2022 June

- 2022 July

- 2022 Aug

- 2022 Sep

- 2022 Oct

- 2022 Nov

- 2022 Dec

- 2023 Jan

- 2023 Feb

- 2023 Mar

- 2023 Apr

- 2023 Would possibly per chance well

- 2023 Jun

- 2023 Jul

- 2023 Aug

- 2023 Sep

- 2023 Oct

- 2023 Nov

- 2023 Dec

- 2024 Jan

- 2024 Feb

- 2024 Mar

- 2024 Apr

- 2024 Would possibly per chance well

- 2024 Jun

Here are your other Higher Return, Protected and Speedy-Timeframe Savings & Funding Alternatives for Singaporeans in 2023

You would possibly well be questioning whether other savings & funding recommendations give you higher returns but are peaceable reasonably safe and liquid sufficient.

Here are different other categories of securities to hang in thoughts:

| Security Model | Fluctuate of Returns | Lock-in | Minimal | Remarks |

|---|---|---|---|---|

| Mounted & Time Deposits on Promotional Rates | 4% | 12M -24M | ||

| Singapore Savings Bonds (SSB) | 2.9% – 3.4% | 1M | A merely SSB Instance.” knowledge-recount=”Max $200k per person. When in inquire of, it will moreover be demanding to rep an allocation. A merely SSB Instance.”>Max $200k per person. When in inquire of, it will moreover be demanding to rep an allocation. A merely SSB Instance. | |

| SGS 6-month Treasury Funds | 2.5% – 4.19% | 6M | Suggestions to aquire T-bills knowledge.” knowledge-recount=”Correct whenever you happen to would possibly per chance enjoy quite quite a bit of cash to deploy. Suggestions to aquire T-bills knowledge.”>Correct whenever you happen to would possibly per chance enjoy quite quite a bit of cash to deploy. Suggestions to aquire T-bills knowledge. | |

| SGS 1-Year Bond | 3.72% | 12M | Suggestions to aquire T-bills knowledge.” knowledge-recount=”Correct whenever you happen to would possibly per chance enjoy quite quite a bit of cash to deploy. Suggestions to aquire T-bills knowledge.”>Correct whenever you happen to would possibly per chance enjoy quite quite a bit of cash to deploy. Suggestions to aquire T-bills knowledge. | |

| Non permanent Insurance Endowment | 1.8-4.3% | 2Y – 3Y | A merely instance Gro Capital Ease” knowledge-recount=”Be jog they are capital guaranteed. Typically, there is a most amount that you would possibly moreover aquire. A merely instance Gro Capital Ease“>Be jog they are capital guaranteed. Typically, there is a most amount that you would possibly moreover aquire. A merely instance Gro Capital Ease | |

| Cash-Market Funds | 4.2% | 1W | Correct whenever you happen to would possibly per chance enjoy quite quite a bit of cash to deploy. A fund that invests in mounted deposits will actively enable you capture the finest prevailing ardour charges. Lift out learn up the factsheet or prospectus to make jog the fund finest invests in mounted deposits & equivalents. |

This desk is updated as of 17th November 2022.

There are other securities or merchandise that will fail to meet the requirements to present aid your main, high liquidity and merely returns. Structured deposits believe derivatives that rep bigger the stage of likelihood. Many money management portfolios of Robo-advisers and banks believe instant-length bond funds. Their values would per chance well moreover fluctuate in the instant term and is potentially no longer perfect whenever you happen to require a 100% return of your main amount.

The returns provided are no longer forged in stone and need to peaceable fluctuate in response to essentially the most contemporary transient ardour charges. You must peaceable adopt more goal-basically based planning and use essentially the most factual instruments/securities to enable you rep or exhaust down your wealth as a change of getting your total money in transient savings & funding recommendations.

Whenever you’ll want to always enjoy to commerce these stocks I talked about, that you would possibly moreover initiate an memoir with Interactive Brokers. Interactive Brokers is the main low-ticket and atmosphere friendly dealer I take advantage of and believe to speculate & commerce my holdings in Singapore, the US, London Stock Commerce and Hong Kong Stock Commerce. They enable you to commerce stocks, ETFs, recommendations, futures, forex, bonds and funds worldwide from a single built-in memoir.

You would possibly well learn more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Assortment, starting with easy tips on how to manufacture & fund your Interactive Brokers memoir with out problems.

Kyith is the Owner and Sole Creator in the aid of Funding Moats. Readers tune in to Funding Moats to learn and perform stronger, firmer wealth foundations, easy tips on how to enjoy a Passive funding approach, know more about investing in REITs and the nuts and bolts of Energetic Investing.

Readers moreover notice Kyith to learn to devise well for Monetary Security and Monetary Independence.

Kyith labored as an IT operations engineer from 2004 to 2019. For the time being, he works as a Senior Alternatives Specialist in Insurance Starting up up-up Havend. All opinions on Funding Moats are his believe and does no longer impart the views of Providend.

Which you would possibly per chance even see Kyith’s most contemporary portfolio right here, which makes use of his Free Google Stock Portfolio Tracker.

His funding dealer of different is Interactive Brokers, which permits him to put money into securities from different exchanges in every single save the enviornment, at very low commission charges, with out custodian costs, shut to map forex charges.

You would possibly well learn more about Kyith right here.

Most up-to-date posts by Kyith (survey all)