Right here is a stable technique to attach cash that you originate now not hang any belief whenever you would possibly perhaps want to use or your emergency fund.

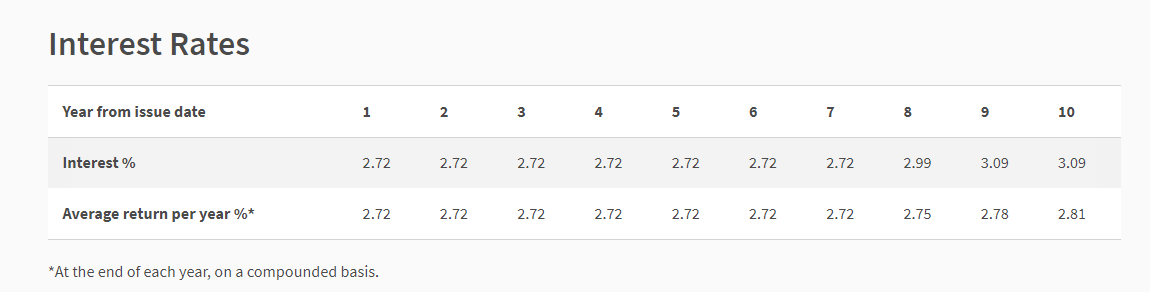

The February 2024’s SSB bonds yield an pastime fee of 2.81%/yr for the next ten years. You might well note by ATM or Net Banking via the three banks (UOB, OCBC, DBS)

However, whenever you most effective hang the SSB bonds for one year, with two semi-annual payments, your pastime fee is 2.72%/yr.

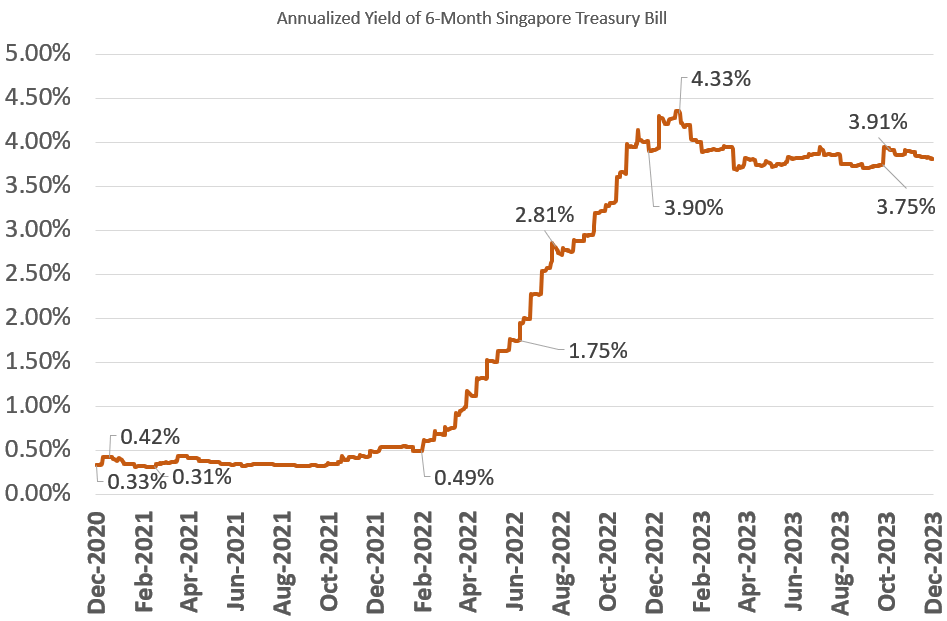

The one-year SSB yield seems to be to be to be heading down, exhibiting a much less flat curve.

$10,000 will grow to $12,821 in 10 years.

The Singapore Authorities backs this bond, and it’s available for you to make investments whenever you hang a CDP or SRS story (this entails Singapore Everlasting Residents and Foreigners).

A single individual can own now not more than SG$200,000 worth of Singapore Savings Bonds. You would additionally use your Supplementary Retirement Plot (SRS) story to aquire.

You might well discover more data about the SSB right here.

Repeat that every month, there will be a brand contemporary anxiousness you would possibly perhaps subscribe to via ATM. The 1 to 10-year yield you would possibly perhaps safe will differ from this month’s ladder, as shown above.

Perfect month’s bond yields 3.00%/yr for ten years and 3.07%/yr for 12 months.

Right here is the most up to date historical SSB 10-12 months Yield Curve with the 1-12 months Yield Curve since Oct 2015, when SSB became once began (Click on the chart, and transfer over the line to gaze the actual yield for that month):

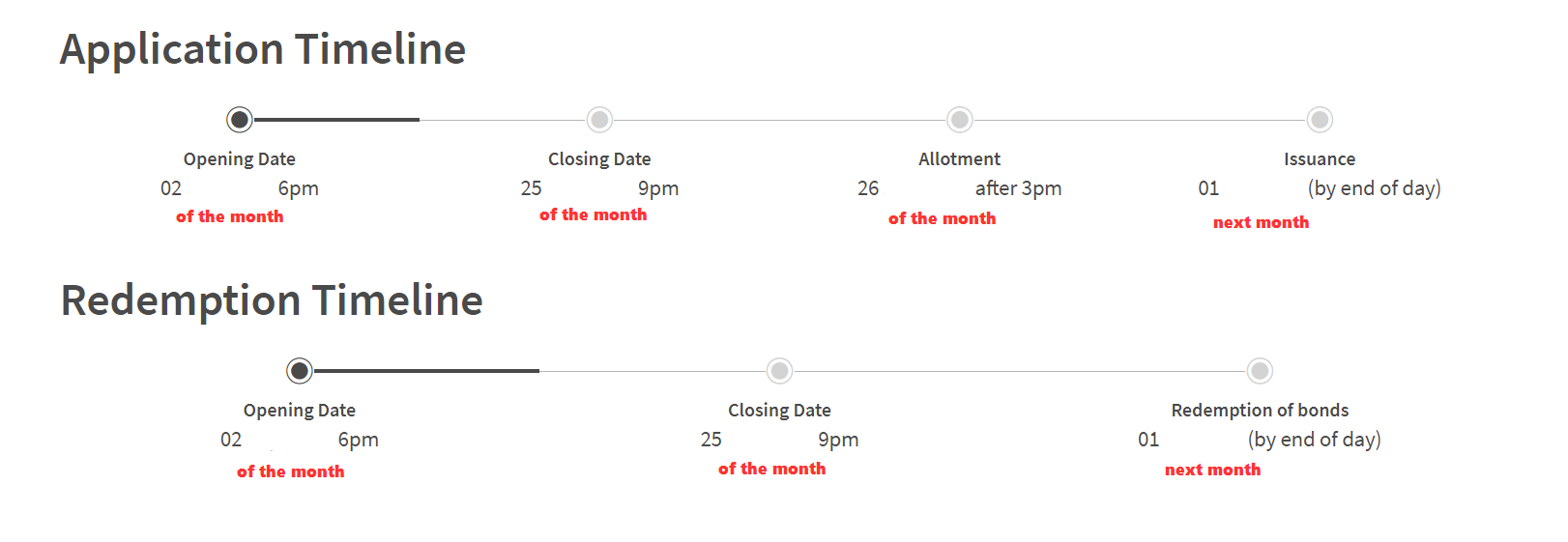

How to Apply for the Singapore Savings Bond – Application and Redemption Time desk

You are going to note for the bonds within the route of the month. At the end of the month, you would possibly perhaps know how plenty of the bonds you utilized had been worthwhile.

Right here is the schedule for application and redemption whenever you esteem to promote:

You hang from the 2d day of the month to about the twenty fifth of the month (technically the 4th day from the closing working day) to note or mediate to redeem the SSB you esteem to redeem.

Your bond will be on your CDP on the first of the next month. You are going to gaze your income your checking story linked to your CDP story on the first of subsequent month.

You Could well well No longer Score Your entire Singapore Savings Bonds That You Apply For

Enact demonstrate that whenever you note for the Singapore Savings Bonds, you would possibly perhaps well now not safe all that you note for. Maintain of this as you are bidding for an quantity which is evident by the ask and present of Singapore Savings Bonds.

When the pastime fee is low, the ask tends to be decrease relative to history, and also you would possibly perhaps safe a more fundamental quantity. Aloof, if the pastime fee is extremely high, ask would perhaps well even be so overwhelming that you would possibly perhaps safe a minute half you note for.

To illustrate, within the August 2022 anxiousness, you would possibly perhaps note for $100,000, however the maximum distributed quantity per individual became once $9,000 most effective. Whenever you utilized for $8,000, you would possibly perhaps safe your total $8,000 allocation.

To test the past allotment constructing, you would possibly perhaps take a stare upon SSB Fragment Results right here.

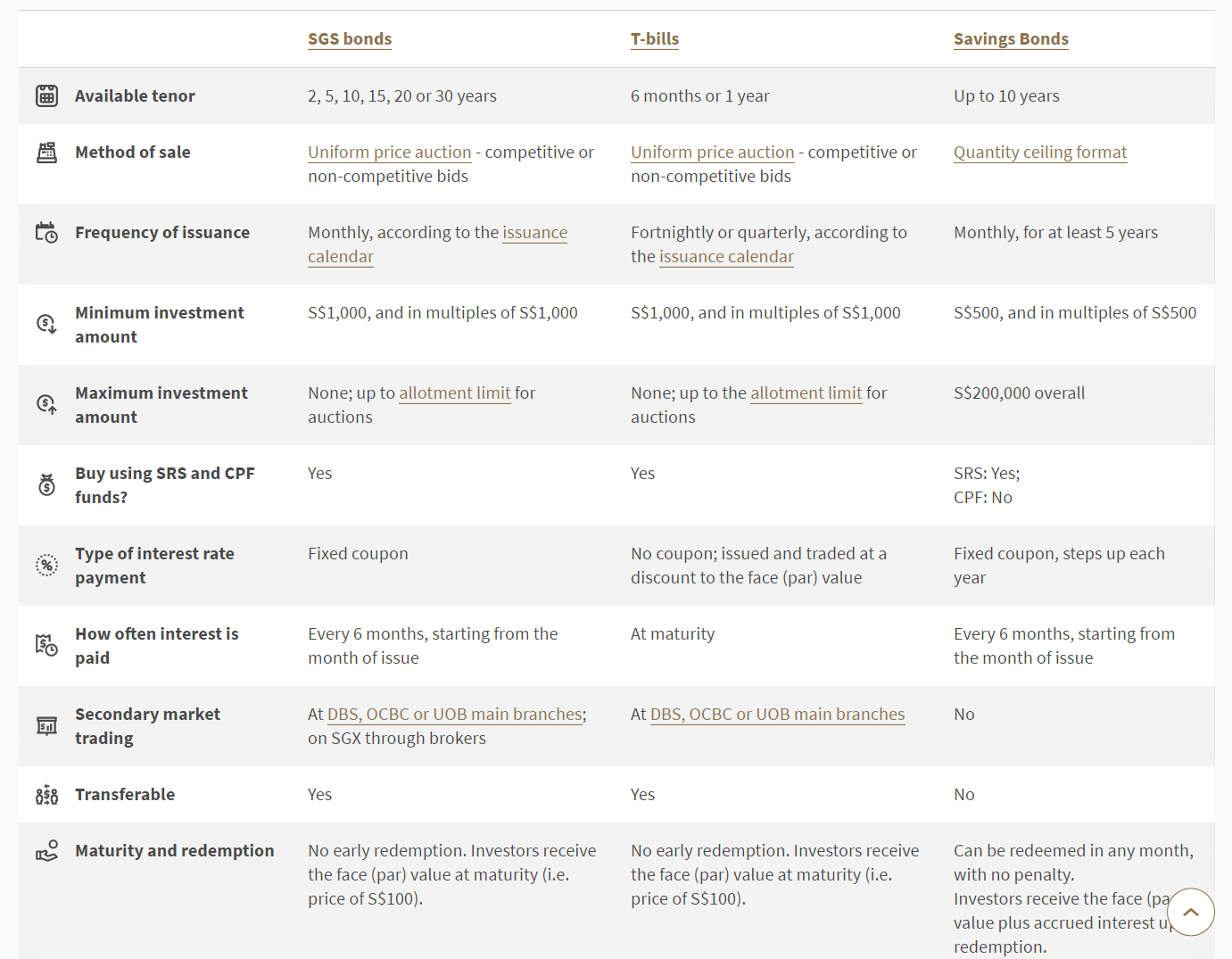

How end the Singapore Savings Bonds Compare to SGS Bonds or Singapore Treasury Bills?

Singapore savings bonds are esteem a “unit have confidence” or a “fund” of SGS Bonds.

Nonetheless what’s the variation between shopping for SGS Bonds and its sister, the T-Bills, right this moment?

The SGS Bonds and T-Bills are also issued by the Authorities and are AAA rated.

Right here is a MAS detailed comparability of the three:

The principle advantage of the 1-year SGS Bonds and Six-month Singapore Treasury Bills is that you would possibly perhaps safe a more fundamental allocation currently in contrast with the Singapore Savings Bonds. This means that that whenever it’s good to abolish a factual pastime yield of $400,000, you safe a higher probability to fulfil that with 1-year SGS Bonds and Six-month Treasury Bills.

The non permanent pastime charges are getting rather animated, and non permanent SGS bonds and treasury payments would perhaps well perhaps be appropriate to supplement your Singapore Savings Bonds allocation.

I wrote a recordsdata to cowl the technique to without deliver aquire the Singapore Treasury Invoice and SGS Bonds right here. You might well read How to Aquire Singapore 6-Month Treasury Bills (T-Bills) or 1-12 months SGS Bonds.

My Previous Brand Add Articles Concerning the Singapore Savings Bonds

Be taught my past write-ups:

- This Singapore Savings Bonds: Liquidity, Larger Returns and Authorities Backing. Dream?

- Extra minute print of the Singapore Savings Bond. Looks esteem my Emergency Funds now

- Singapore Savings Bonds Max Preserving Limit is $200,000 for now. Apply via DBS, OCBC, UOB ATM

- Singapore Savings Bonds’ Inflation Protection Talents

- Some instructions on straightforward tips on how to note for the Singapore Savings Bonds

Previous Elements of SSB and their Charges:

- 2015 Oct

- 2015 Nov

- 2015 Dec

- 2016 Jan

- 2016 Feb

- 2016 Mar

- 2016 Apr

- 2016 Could well well

- 2016 Jun

- 2016 Jul

- 2016 Aug

- 2016 Sep

- 2016 Oct

- 2016 Nov

- 2016 Dec

- 2017 Jan

- 2017 Feb

- 2017 Mar

- 2017 Apr

- 2017 Could well well

- 2017 Jun

- 2017 Jul

- 2017 Aug

- 2017 Sep

- 2017 Oct

- 2017 Nov

- 2018 Jan

- 2018 Feb

- 2018 Mar

- 2018 Apr

- 2018 Could well well

- 2018 Jun

- 2018 Jul

- 2018 Aug

- 2018 Sep

- 2018 Oct

- 2018 Nov

- 2018 Dec

- 2019 Jan

- 2019 Feb

- 2019 Mar

- 2019 Apr

- 2019 Could well well

- 2019 Jun

- 2019 Jul

- 2019 Aug

- 2019 Sep

- 2019 Oct

- 2019 Nov

- 2019 Dec

- 2020 Jan

- 2020 Feb

- 2020 Mar

- 2020 Apr

- 2020 Could well well

- 2020 Jun

- 2020 Jul

- 2020 Aug

- 2020 Oct

- 2020 Nov

- 2020 Dec

- 2021 Feb

- 2021 Mar

- 2021 Apr

- 2021 Could well well

- 2021 June

- 2021 July

- 2021 Aug

- 2021 Sep

- 2021 Oct

- 2021 Nov

- 2021 Dec

- 2022 Jan

- 2022 Feb

- 2022 Mar

- 2022 Apr

- 2022 Could well well

- 2022 June

- 2022 July

- 2022 Aug

- 2022 Sep

- 2022 Oct

- 2022 Nov

- 2022 Dec

- 2023 Jan

- 2023 Feb

- 2023 Mar

- 2023 Apr

- 2023 Could well well

- 2023 Jun

- 2023 Jul

- 2023 Aug

- 2023 Sep

- 2023 Oct

- 2023 Nov

- 2023 Dec

- 2024 Jan

Right here are your assorted Larger Return, Score and Immediate-Term Savings & Funding Alternate choices for Singaporeans in 2023

You might be questioning whether assorted savings & investment alternate choices give you higher returns but are restful moderately stable and liquid ample.

Right here are assorted assorted categories of securities to hang in mind:

| Security Kind | Vary of Returns | Lock-in | Minimum | Remarks |

|---|---|---|---|---|

| Mounted & Time Deposits on Promotional Charges | 4% | 12M -24M | ||

| Singapore Savings Bonds (SSB) | 2.9% – 3.4% | 1M | A factual SSB Example.” data-allege=”Max $200k per individual. When in ask, it would perhaps well even be now not easy to safe an allocation. A factual SSB Example.”>Max $200k per individual. When in ask, it would perhaps well even be now not easy to safe an allocation. A factual SSB Example. | |

| SGS 6-month Treasury Bills | 2.5% – 4.19% | 6M | How to aquire T-payments recordsdata.” data-allege=”Genuine whenever you hang plenty of cash to deploy. How to aquire T-payments recordsdata.”>Genuine whenever you hang plenty of cash to deploy. How to aquire T-payments recordsdata. | |

| SGS 1-12 months Bond | 3.72% | 12M | How to aquire T-payments recordsdata.” data-allege=”Genuine whenever you hang plenty of cash to deploy. How to aquire T-payments recordsdata.”>Genuine whenever you hang plenty of cash to deploy. How to aquire T-payments recordsdata. | |

| Immediate-term Insurance Endowment | 1.8-4.3% | 2Y – 3Y | A factual instance Gro Capital Ease” data-allege=”Safe certain they are capital guaranteed. Most regularly, there would possibly perhaps be a maximum quantity you would possibly perhaps aquire. A factual instance Gro Capital Ease“>Safe certain they are capital guaranteed. Most regularly, there would possibly perhaps be a maximum quantity you would possibly perhaps aquire. A factual instance Gro Capital Ease | |

| Money-Market Funds | 4.2% | 1W | Genuine whenever you hang plenty of cash to deploy. A fund that invests in fixed deposits will actively relief you grab the absolute top prevailing pastime charges. Enact read up the factsheet or prospectus to carry out certain the fund most effective invests in fixed deposits & equivalents. |

This desk is up up to now as of 17th November 2022.

There are assorted securities or products which will fail to meet the criteria to give abet your main, high liquidity and factual returns. Structured deposits hang derivatives that amplify the degree of possibility. Many cash administration portfolios of Robo-advisers and banks hang short-period bond funds. Their values would perhaps well fluctuate within the short term and would perhaps well now not be excellent whenever you require a 100% return of your main quantity.

The returns supplied are now not solid in stone and can fluctuate in response to the most up to date non permanent pastime charges. You ought to undertake more goal-basically based entirely mostly planning and use the most honest devices/securities that can help you get or utilize down your wealth in decision to having all of you cash in non permanent savings & investment alternate choices.

Whenever you esteem to need to replace these stocks I mentioned, you would possibly perhaps originate an story with Interactive Brokers. Interactive Brokers is the main low-fee and efficient broker I use and have confidence to make investments & replace my holdings in Singapore, the USA, London Stock Alternate and Hong Kong Stock Alternate. They can relief you replace stocks, ETFs, alternate choices, futures, forex, bonds and funds worldwide from a single integrated story.

You might well read more about my strategies about Interactive Brokers in this Interactive Brokers Deep Dive Series, beginning with straightforward tips on how to develop & fund your Interactive Brokers story without deliver.

Kyith is the Proprietor and Sole Author within the abet of Funding Moats. Readers tune in to Funding Moats to learn and develop stronger, firmer wealth foundations, straightforward tips on how to hang a Passive investment approach, know more about investing in REITs and the nuts and bolts of Active Investing.

Readers also apply Kyith to search out out straightforward tips on how to devise effectively for Monetary Security and Monetary Independence.

Kyith worked as an IT operations engineer from 2004 to 2019. For the time being, he works as a Senior Solutions Specialist in Insurance Launch-up Havend. All opinions on Funding Moats are his own and does now not signify the views of Providend.

You might well leer Kyith’s most up to date portfolio right here, which uses his Free Google Stock Portfolio Tracker.

His investment broker of replacement is Interactive Brokers, which lets in him to make investments in securities from assorted exchanges within the route of the area, at very low commission charges, without custodian charges, approach space currency charges.

You might well read more about Kyith right here.

Most up-to-date posts by Kyith (gaze all)