Right here is a safe technique to put money that you just kind not have any idea when you may need to use or your emergency fund.

The September 2024’s SSB bonds yield an hobby rate of 3.10%/yr for the next ten years. That you just may presumably observe by scheme of ATM or Web Banking by the three banks (UOB, OCBC, DBS)

Alternatively, in the occasion you handiest care for the SSB bonds for one year, with two semi-annual funds, your hobby rate is 3.06%/yr.

The one-year SSB yield seems to be heading down, showing a much less flat curve.

$10,000 will grow to $13,103 in 10 years.

The Singapore Authorities backs this bond, and it’s available so that you just can make investments in the occasion you have a CDP or SRS story (this entails Singapore Permanent Residents and Foreigners).

A single particular person can hold not extra than SG$200,000 price of Singapore Financial savings Bonds. That you just may moreover use your Supplementary Retirement Diagram (SRS) story to buy.

That you just may presumably safe out extra data in regards to the SSB right here.

Imprint that every month, there’ll be a brand new effort you may subscribe to by ATM. The 1 to 10-year yield you may fetch will range from this month’s ladder, as shown above.

Closing month’s bond yields 3.22%/yr for ten years and 3.19%/yr for twelve months.

Right here is the unusual historical SSB 10-365 days Yield Curve with the 1-365 days Yield Curve since Oct 2015, when SSB used to be started (Click on on the chart, and circulate over the line to hunt for the real yield for that month):

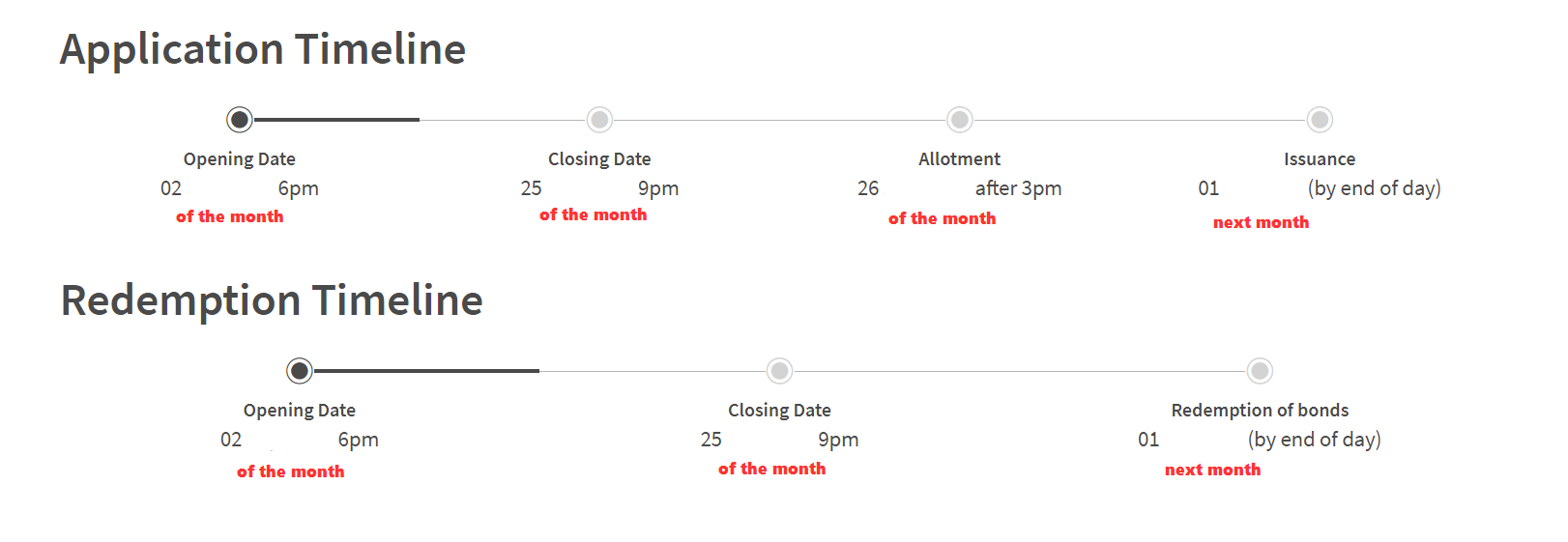

Guidelines on how to Follow for the Singapore Financial savings Bond – Software and Redemption Agenda

You will be succesful to examine for the bonds in the direction of the month. At the terminate of the month, you may know how many of the bonds you applied have been profitable.

Right here is the agenda for application and redemption in the occasion you may even be attempting to sell:

That you just may moreover have from the 2d day of the month to in regards to the twenty fifth of the month (technically the 4th day from the closing working day) to appear at or settle on to redeem the SSB you may even be attempting to redeem.

Your bond will be for your CDP on the 1st of the following month. You will be succesful to search to your revenue your checking story linked to your CDP story on the 1st of subsequent month.

You Could No longer Catch The complete Singapore Financial savings Bonds That You Follow For

Carry out designate that after you observe for the Singapore Financial savings Bonds, you may moreover not fetch all that you just observe for. Judge of this as you may even be bidding for an amount which is quandary by the question and present of Singapore Financial savings Bonds.

When the hobby rate is low, the question tends to be lower relative to historical previous, and you may fetch a extra necessary amount. Unexcited, if the hobby rate is terribly excessive, question may moreover moreover be so overwhelming that you just can moreover fetch a shrimp portion you observe for.

As an illustration, in the August 2022 effort, you may observe for $100,000, however the utmost disbursed amount per particular person used to be $9,000 handiest. For of us that applied for $8,000, you may fetch your complete $8,000 allocation.

To be taught in regards to the previous share pattern, you may take hold of a seek for at SSB Half Results right here.

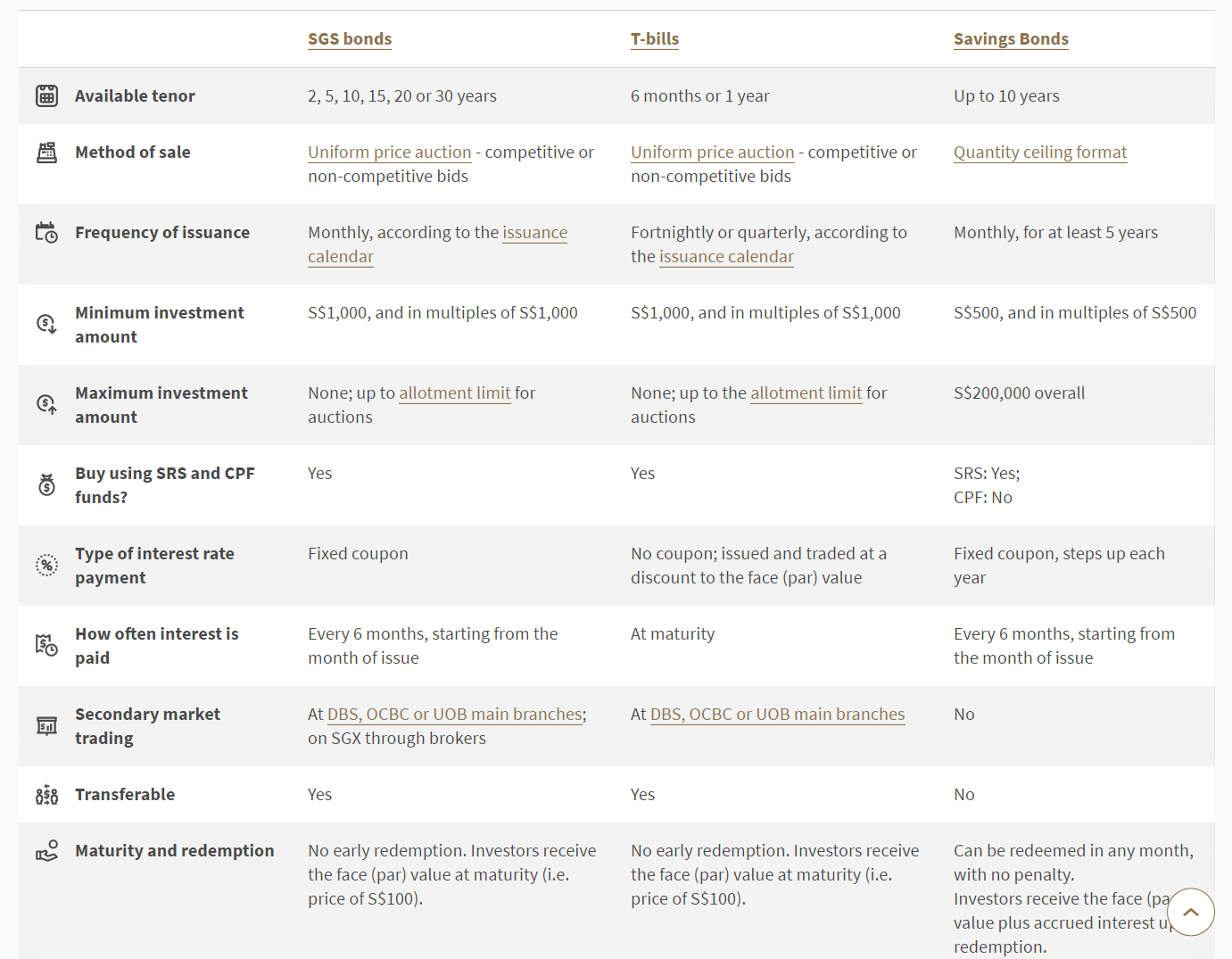

How stay the Singapore Financial savings Bonds Overview to SGS Bonds or Singapore Treasury Bills?

Singapore financial savings bonds are love a “unit belief” or a “fund” of SGS Bonds.

However what is the variation between procuring SGS Bonds and its sister, the T-Bills, without lengthen?

The SGS Bonds and T-Bills are also issued by the Authorities and are AAA rated.

Right here is a MAS detailed comparison of the three:

The most critical excellent thing in regards to the 1-year SGS Bonds and Six-month Singapore Treasury Bills is that you may fetch a extra necessary allocation at point out when put next with the Singapore Financial savings Bonds. This implies that if it would be necessary to make a excellent hobby yield of $400,000, you fetch a more in-depth chance to fulfil that with 1-year SGS Bonds and Six-month Treasury Bills.

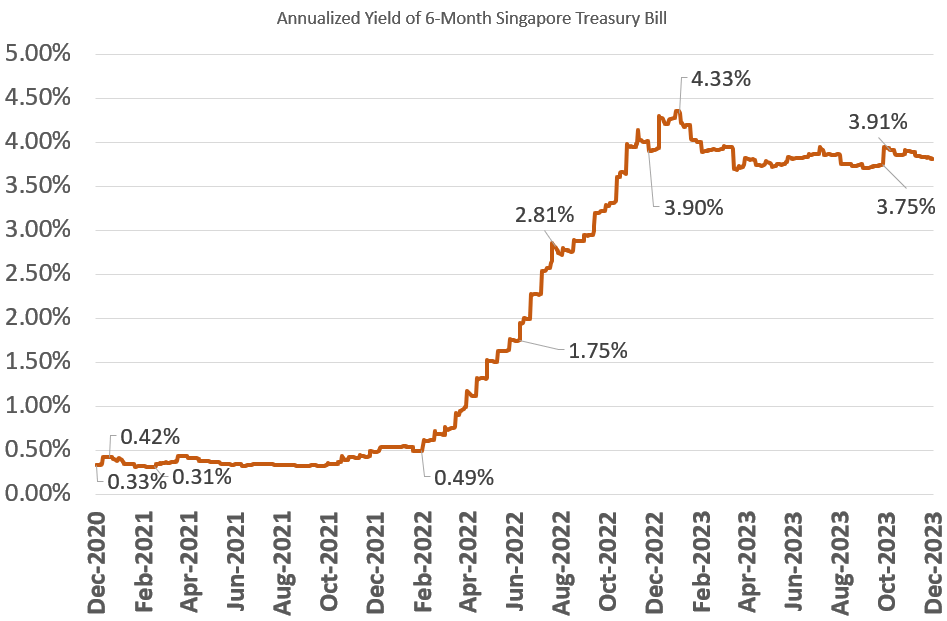

The short-time length hobby rates are getting rather thrilling, and short-time length SGS bonds and treasury bills may moreover very neatly be applicable to complement your Singapore Financial savings Bonds allocation.

I wrote a data to demonstrate the manner you may simply buy the Singapore Treasury Invoice and SGS Bonds right here. That you just may presumably be taught Guidelines on how to Purchase Singapore 6-Month Treasury Bills (T-Bills) or 1-365 days SGS Bonds.

My Previous Price Add Articles Regarding the Singapore Financial savings Bonds

Learn my previous write-ups:

- This Singapore Financial savings Bonds: Liquidity, Greater Returns and Authorities Backing. Dream?

- Extra shrimp print of the Singapore Financial savings Bond. Looks love my Emergency Funds now

- Singapore Financial savings Bonds Max Holding Limit is $200,000 for now. Follow by DBS, OCBC, UOB ATM

- Singapore Financial savings Bonds’ Inflation Security Abilities

- Some instructions on programs to appear at for the Singapore Financial savings Bonds

Previous Factors of SSB and their Charges:

- 2015 Oct

- 2015 Nov

- 2015 Dec

- 2016 Jan

- 2016 Feb

- 2016 Mar

- 2016 Apr

- 2016 Could

- 2016 Jun

- 2016 Jul

- 2016 Aug

- 2016 Sep

- 2016 Oct

- 2016 Nov

- 2016 Dec

- 2017 Jan

- 2017 Feb

- 2017 Mar

- 2017 Apr

- 2017 Could

- 2017 Jun

- 2017 Jul

- 2017 Aug

- 2017 Sep

- 2017 Oct

- 2017 Nov

- 2018 Jan

- 2018 Feb

- 2018 Mar

- 2018 Apr

- 2018 Could

- 2018 Jun

- 2018 Jul

- 2018 Aug

- 2018 Sep

- 2018 Oct

- 2018 Nov

- 2018 Dec

- 2019 Jan

- 2019 Feb

- 2019 Mar

- 2019 Apr

- 2019 Could

- 2019 Jun

- 2019 Jul

- 2019 Aug

- 2019 Sep

- 2019 Oct

- 2019 Nov

- 2019 Dec

- 2020 Jan

- 2020 Feb

- 2020 Mar

- 2020 Apr

- 2020 Could

- 2020 Jun

- 2020 Jul

- 2020 Aug

- 2020 Oct

- 2020 Nov

- 2020 Dec

- 2021 Feb

- 2021 Mar

- 2021 Apr

- 2021 Could

- 2021 June

- 2021 July

- 2021 Aug

- 2021 Sep

- 2021 Oct

- 2021 Nov

- 2021 Dec

- 2022 Jan

- 2022 Feb

- 2022 Mar

- 2022 Apr

- 2022 Could

- 2022 June

- 2022 July

- 2022 Aug

- 2022 Sep

- 2022 Oct

- 2022 Nov

- 2022 Dec

- 2023 Jan

- 2023 Feb

- 2023 Mar

- 2023 Apr

- 2023 Could

- 2023 Jun

- 2023 Jul

- 2023 Aug

- 2023 Sep

- 2023 Oct

- 2023 Nov

- 2023 Dec

- 2024 Jan

- 2024 Feb

- 2024 Mar

- 2024 Apr

- 2024 Could

- 2024 Jun

- 2024 Jul

- 2024 Aug

Right here are your varied Greater Return, Safe and Immediate-Timeframe Financial savings & Funding Alternate choices for Singaporeans in 2023

That you just may moreover very neatly be wondering whether or not varied financial savings & investment alternatives present you with greater returns but are nonetheless barely safe and liquid sufficient.

Right here are varied varied courses of securities to take hold of into story:

| Security Style | Differ of Returns | Lock-in | Minimal | Remarks |

|---|---|---|---|---|

| Mounted & Time Deposits on Promotional Charges | 4% | 12M -24M | ||

| Singapore Financial savings Bonds (SSB) | 2.9% – 3.4% | 1M | A respectable SSB Instance.” data-thunder=”Max $200k per particular person. When in question, it may moreover moreover be consuming to fetch an allocation. A respectable SSB Instance.”>Max $200k per particular person. When in question, it may moreover moreover be consuming to fetch an allocation. A respectable SSB Instance. | |

| SGS 6-month Treasury Bills | 2.5% – 4.19% | 6M | Guidelines on how to buy T-bills data.” data-thunder=”Correct in the occasion you have alternative money to deploy. Guidelines on how to buy T-bills data.”>Correct in the occasion you have alternative money to deploy. Guidelines on how to buy T-bills data. | |

| SGS 1-365 days Bond | 3.72% | 12M | Guidelines on how to buy T-bills data.” data-thunder=”Correct in the occasion you have alternative money to deploy. Guidelines on how to buy T-bills data.”>Correct in the occasion you have alternative money to deploy. Guidelines on how to buy T-bills data. | |

| Immediate-time length Insurance coverage Endowment | 1.8-4.3% | 2Y – 3Y | A respectable instance Gro Capital Ease” data-thunder=”Manufacture optimistic they are capital assured. Generally, there is a maximum amount you may buy. A respectable instance Gro Capital Ease“>Manufacture optimistic they are capital assured. Generally, there is a maximum amount you may buy. A respectable instance Gro Capital Ease | |

| Money-Market Funds | 4.2% | 1W | Correct in the occasion you have alternative money to deploy. A fund that invests in mounted deposits will actively enable you to capture the supreme prevailing hobby rates. Carry out be taught up the factsheet or prospectus to make certain the fund handiest invests in mounted deposits & equivalents. |

This desk is updated as of 17th November 2022.

There are varied securities or merchandise that may moreover fail to meet the requirements to present abet your necessary, excessive liquidity and excellent returns. Structured deposits contain derivatives that kind bigger the degree of possibility. Many money administration portfolios of Robo-advisers and banks contain short-length bond funds. Their values may moreover fluctuate in the short time length and is perchance not supreme in the occasion you require a 100% return of your necessary amount.

The returns supplied are not solid in stone and can fluctuate in accordance to the unusual short-time length hobby rates. You ought to nonetheless adopt extra aim-basically based mostly mostly planning and use the most simply instruments/securities to enable you to amass or use down your wealth in desire to getting all of you money in short-time length financial savings & investment alternatives.

In thunder so that you just can alternate these shares I discussed, you may originate an story with Interactive Brokers. Interactive Brokers is the leading low-impress and ambiance friendly broker I exploit and belief to make investments & alternate my holdings in Singapore, the United States, London Inventory Alternate and Hong Kong Inventory Alternate. They permit you to to alternate shares, ETFs, alternatives, futures, international change, bonds and funds worldwide from a single constructed-in story.

That you just may presumably be taught extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting up with programs to fetch & fund your Interactive Brokers story simply.

Kyith is the Owner and Sole Writer in the abet of Funding Moats. Readers tune in to Funding Moats to be taught and make stronger, firmer wealth foundations, programs to have a Passive investment strategy, know extra about investing in REITs and the nuts and bolts of Stuffed with life Investing.

Readers also observe Kyith to search out out programs to quandary neatly for Monetary Security and Monetary Independence.

Kyith worked as an IT operations engineer from 2004 to 2019. Currently, he works as a Senior Alternate choices Specialist in Insurance coverage Delivery-up Havend. All opinions on Funding Moats are his hold and does not signify the views of Providend.

That you just may presumably idea Kyith’s unusual portfolio right here, which uses his Free Google Inventory Portfolio Tracker.

His investment broker of preference is Interactive Brokers, which permits him to make investments in securities from varied exchanges for the duration of the arena, at very low commission rates, without custodian charges, shut to build forex rates.

That you just may presumably be taught extra about Kyith right here.

Most modern posts by Kyith (seek for all)