Here is a safe potential to lower your expenses you enjoy now not any thought for these who will desire to command or your emergency fund.

The October 2024 SSB bonds yield an curiosity price of 2.77%/365 days for the following ten years. You would possibly perchance perchance perchance observe by ATM or Net Banking by technique of the three banks (UOB, OCBC, DBS)

Then again, whereas you easiest protect the SSB bonds for one 365 days, with two semi-annual funds, your curiosity price is 2.59%/365 days.

The one-365 days SSB yield seems to be to be heading down, exhibiting a less flat curve.

$10,000 will grow to $12,781 in 10 years.

The Singapore Authorities backs this bond, which it’s likely you’ll perchance perchance make investments in whereas you enjoy a CDP or SRS story (this involves Singapore Eternal Residents and Foreigners).

A single particular person can dangle now not extra than SG$200,000 worth of Singapore Financial savings Bonds. You would possibly perchance perchance perchance additionally command your Supplementary Retirement Draw (SRS) story to procure a possess account for.

You would possibly perchance perchance also discover extra files about the SSB here.

Show that every month, there can be a recent arena it’s likely you’ll perchance perchance subscribe to by technique of ATM. The 1 to 10-365 days yield it’s likely you’ll perchance perchance bag will vary from this month’s ladder, as proven above.

Final month’s bond yields 3.10%/365 days for ten years and 3.06%/365 days for one 365 days.

Here is the novel historic SSB 10-Year Yield Curve with the 1-Year Yield Curve since Oct 2015, when SSB became once began (Click on on the chart, and pass over the dual carriageway to scrutinize the categorical yield for that month):

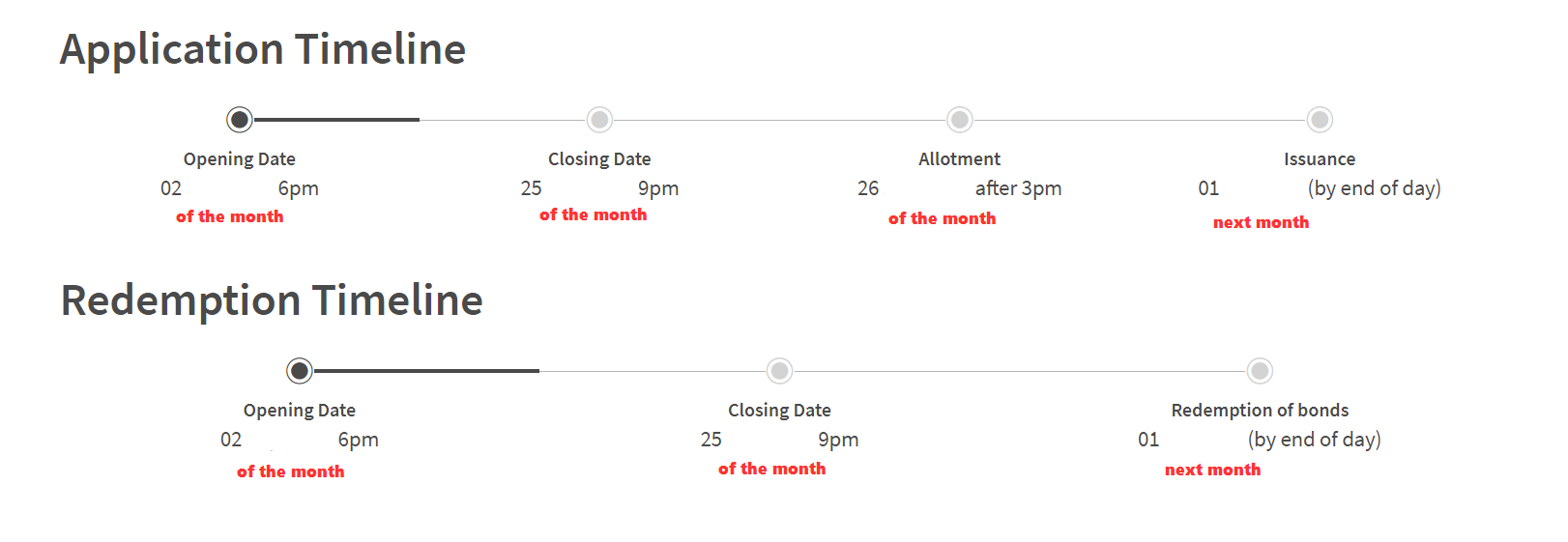

How to Practice for the Singapore Financial savings Bond – Utility and Redemption Schedule

You will observe for the bonds at some level of the month. On the tip of the month, it’s likely you’ll perchance perchance know how many of the bonds you applied were worthwhile.

Here is the time table for utility and redemption whereas you like to promote:

You enjoy from the 2d day of the month to about the twenty fifth of the month (technically the 4th day from the closing working day) to observe or resolve to redeem the SSB you like to redeem.

Your bond can be in your CDP on the first of the following month. You will look your profit your financial institution story linked to your CDP story on the first of next month.

You Would perchance objective No longer Gain Your entire Singapore Financial savings Bonds That You Practice For

Operate bid that for these who observe for the Singapore Financial savings Bonds, it’s likely you’ll perchance perchance also now not bag all that you observe for. Hold of this as it’s likely you’ll perchance perchance also perchance be bidding for an quantity which is determined by the question and provide of Singapore Financial savings Bonds.

When the curiosity price is low, the question tends to be decrease relative to history, and it’s likely you’ll perchance perchance bag a extra famous quantity. Restful, if the curiosity price is amazingly excessive, question would be so overwhelming that it’s likely you’ll perchance perchance also bag a little share you observe for.

For instance, within the August 2022 arena, it’s likely you’ll perchance perchance observe for $100,000, nevertheless primarily the most disbursed quantity per particular person became once $9,000 easiest. Must you applied for $8,000, it’s likely you’ll perchance perchance bag your entire $8,000 allocation.

To test the past portion vogue, it’s likely you’ll perchance perchance take a stare upon SSB Share Results here.

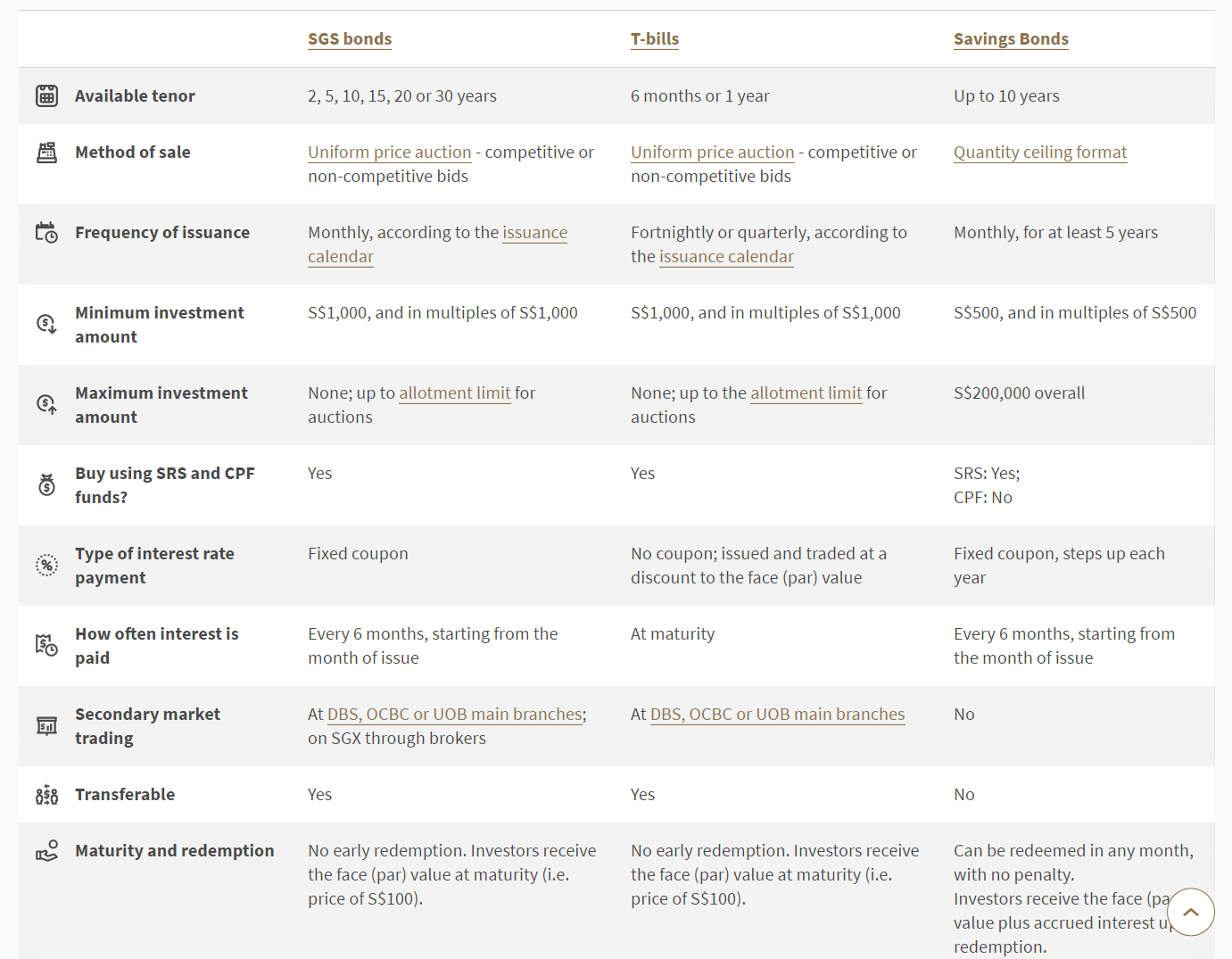

How attain the Singapore Financial savings Bonds Overview to SGS Bonds or Singapore Treasury Funds?

Singapore savings bonds are like a “unit belief” or a “fund” of SGS Bonds.

Nonetheless what is the incompatibility between procuring SGS Bonds and its sister, the T-Funds, straight?

The Authorities additionally components the SGS Bonds and T-Funds, which would possibly perchance perchance perchance be AAA rated.

Here is a MAS detailed comparison of the three:

The predominant ideal thing about the 1-365 days SGS Bonds and Six-month Singapore Treasury Funds is that it’s likely you’ll perchance perchance bag a extra famous allocation presently when in comparison with the Singapore Financial savings Bonds. This implies that if it’s crucial to procure a real curiosity yield of $400,000, you bag a bigger likelihood to fulfil that with 1-365 days SGS Bonds and Six-month Treasury Funds.

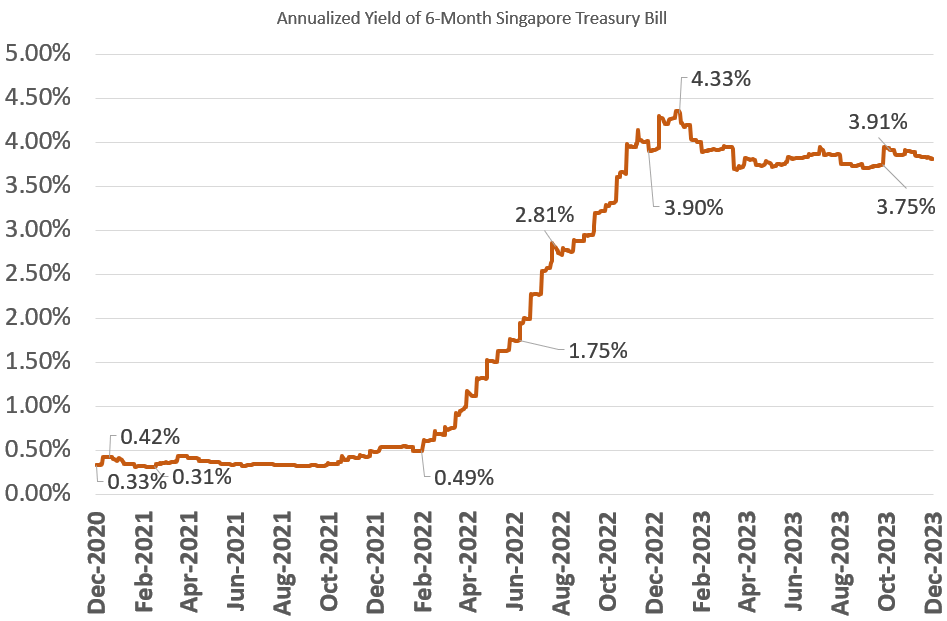

The temporary curiosity rates are getting comparatively appealing, and temporary SGS bonds and treasury funds can be acceptable to supplement your Singapore Financial savings Bonds allocation.

I wrote a files to illustrate the potential it’s likely you’ll perchance perchance easily aquire the Singapore Treasury Invoice and SGS Bonds here. You would possibly perchance perchance perchance learn How to Buy Singapore 6-Month Treasury Funds (T-Funds) or 1-Year SGS Bonds.

My Past Fee Add Articles Regarding the Singapore Financial savings Bonds

Read my past write-ups:

- This Singapore Financial savings Bonds: Liquidity, Elevated Returns and Authorities Backing. Dream?

- More particulars of the Singapore Financial savings Bond. Appears to be like like my Emergency Funds now

- Singapore Financial savings Bonds Max Preserving Restrict is $200,000 for now. Practice by technique of DBS, OCBC, UOB ATM

- Singapore Financial savings Bonds’ Inflation Protection Expertise

- Some instructions on the fashion to observe for the Singapore Financial savings Bonds

Past Disorders of SSB and their Rates:

- 2015 Oct

- 2015 Nov

- 2015 Dec

- 2016 Jan

- 2016 Feb

- 2016 Mar

- 2016 Apr

- 2016 Would perchance objective

- 2016 Jun

- 2016 Jul

- 2016 Aug

- 2016 Sep

- 2016 Oct

- 2016 Nov

- 2016 Dec

- 2017 Jan

- 2017 Feb

- 2017 Mar

- 2017 Apr

- 2017 Would perchance objective

- 2017 Jun

- 2017 Jul

- 2017 Aug

- 2017 Sep

- 2017 Oct

- 2017 Nov

- 2018 Jan

- 2018 Feb

- 2018 Mar

- 2018 Apr

- 2018 Would perchance objective

- 2018 Jun

- 2018 Jul

- 2018 Aug

- 2018 Sep

- 2018 Oct

- 2018 Nov

- 2018 Dec

- 2019 Jan

- 2019 Feb

- 2019 Mar

- 2019 Apr

- 2019 Would perchance objective

- 2019 Jun

- 2019 Jul

- 2019 Aug

- 2019 Sep

- 2019 Oct

- 2019 Nov

- 2019 Dec

- 2020 Jan

- 2020 Feb

- 2020 Mar

- 2020 Apr

- 2020 Would perchance objective

- 2020 Jun

- 2020 Jul

- 2020 Aug

- 2020 Oct

- 2020 Nov

- 2020 Dec

- 2021 Feb

- 2021 Mar

- 2021 Apr

- 2021 Would perchance objective

- 2021 June

- 2021 July

- 2021 Aug

- 2021 Sep

- 2021 Oct

- 2021 Nov

- 2021 Dec

- 2022 Jan

- 2022 Feb

- 2022 Mar

- 2022 Apr

- 2022 Would perchance objective

- 2022 June

- 2022 July

- 2022 Aug

- 2022 Sep

- 2022 Oct

- 2022 Nov

- 2022 Dec

- 2023 Jan

- 2023 Feb

- 2023 Mar

- 2023 Apr

- 2023 Would perchance objective

- 2023 Jun

- 2023 Jul

- 2023 Aug

- 2023 Sep

- 2023 Oct

- 2023 Nov

- 2023 Dec

- 2024 Jan

- 2024 Feb

- 2024 Mar

- 2024 Apr

- 2024 Would perchance objective

- 2024 Jun

- 2024 Jul

- 2024 Aug

- 2024 Sep

Here are your various Elevated Return, Safe and Short-Term Financial savings & Investment Choices for Singaporeans in 2023

You would possibly perchance perchance also be wondering whether various savings & funding solutions give you greater returns nevertheless are unruffled quite safe and liquid passable.

Here are various various classes of securities to protect in mind:

| Security Form | Range of Returns | Lock-in | Minimal | Remarks |

|---|---|---|---|---|

| Mounted & Time Deposits on Promotional Rates | 4% | 12M -24M | ||

| Singapore Financial savings Bonds (SSB) | 2.9% – 3.4% | 1M | A real SSB Instance.” files-account for=”Max $200k per particular person. When in question, it’ll be anxious to bag an allocation. A real SSB Instance.”>Max $200k per particular person. When in question, it’ll be anxious to bag an allocation. A real SSB Instance. | |

| SGS 6-month Treasury Funds | 2.5% – 4.19% | 6M | How to salvage T-funds files.” files-account for=”Compatible whereas you enjoy a quantity of cash to deploy. How to salvage T-funds files.”>Compatible whereas you enjoy a quantity of cash to deploy. How to salvage T-funds files. | |

| SGS 1-Year Bond | 3.72% | 12M | How to salvage T-funds files.” files-account for=”Compatible whereas you enjoy a quantity of cash to deploy. How to salvage T-funds files.”>Compatible whereas you enjoy a quantity of cash to deploy. How to salvage T-funds files. | |

| Transient Insurance coverage Endowment | 1.8-4.3% | 2Y – 3Y | A real example Gro Capital Ease” files-account for=”Build determined they’re capital guaranteed. Generally, there would possibly be a most quantity it’s likely you’ll perchance perchance aquire. A real example Gro Capital Ease“>Build determined they’re capital guaranteed. Generally, there would possibly be a most quantity it’s likely you’ll perchance perchance aquire. A real example Gro Capital Ease | |

| Money-Market Funds | 4.2% | 1W | Compatible whereas you enjoy a quantity of cash to deploy. A fund that invests in mounted deposits will actively enable you to snatch the most realistic prevailing curiosity rates. Operate learn up the factsheet or prospectus to procure obvious the fund easiest invests in mounted deposits & equivalents. |

This table is up-to-the-minute as of 17th November 2022.

There are various securities or merchandise that will fail to meet the criteria to give inspire your main, excessive liquidity and actual returns. Structured deposits have derivatives that magnify the stage of possibility. Many money management portfolios of Robo-advisers and banks have short-length bond funds. Their values also can fluctuate within the short term and would possibly perchance now not be most realistic whereas you require a 100% return of your main quantity.

The returns offered are now not solid in stone and would possibly perchance fluctuate in retaining with the novel temporary curiosity rates. You would possibly well unruffled adopt extra purpose-primarily primarily based fully planning and command primarily the most faithful instruments/securities to enable you to salvage or command down your wealth in desire to having your entire money in temporary savings & funding solutions.

In account for so that you can alter these shares I mentioned, it’s likely you’ll perchance perchance originate an story with Interactive Brokers. Interactive Brokers is the leading low-worth and efficient broker I command and belief to make investments & change my holdings in Singapore, the united states, London Stock Change and Hong Kong Stock Change. They enable you to alter shares, ETFs, solutions, futures, forex, bonds and funds worldwide from a single constructed-in story.

You would possibly perchance perchance perchance learn extra about my suggestions about Interactive Brokers in this Interactive Brokers Deep Dive Series, beginning with the fashion to develop & fund your Interactive Brokers story easily.

Kyith is the Owner and Sole Creator within the inspire of Investment Moats. Readers tune in to Investment Moats to learn and gain stronger, firmer wealth foundations, the fashion to enjoy a Passive funding approach, know extra about investing in REITs and the nuts and bolts of Active Investing.

Readers additionally practice Kyith to search out out the fashion to characteristic properly for Monetary Security and Monetary Independence.

Kyith worked as an IT operations engineer from 2004 to 2019. Currently, he works as a Senior Choices Specialist in Insurance coverage Start-up Havend. All opinions on Investment Moats are his dangle and does now not symbolize the views of Providend.

You would possibly perchance perchance perchance ogle Kyith’s novel portfolio here, which makes command of his Free Google Stock Portfolio Tracker.

His funding broker of different is Interactive Brokers, which enables him to make investments in securities from various exchanges all around the place the sphere, at very low fee rates, without custodian costs, end to place currency rates.

You would possibly perchance perchance perchance learn extra about Kyith here.

Most modern posts by Kyith (look all)