I had a kind of longer days at work and as I head in direction of Man Man Unagi in Keong Siak, I came up with an earnings strategy.

As I assumed of it extra, I remember that it’s miles rather unimaginative.

Don’t bother, no person brought about me to deem this earnings strategy but I deem my dialog with our Investment Analyst Choon Siong about how a Fixed-Duration bond fund work did trigger this.

I come to a determination to fragment this unimaginative idea of mine with you because trying to uncover why it’s miles unimaginative and discuss around the strategy would possibly possibly well aid all of us to learn something.

Who is aware of, will most certainly be at the high of this text, we would understand this idea is rarely any longer so unimaginative in the end.

So the premise around this earnings strategy is that this:

Exercise a 100% Investment-grade Fixed Revenue Bond Fund Portfolio. If we use decrease than the prevailing market yield of the fastened earnings portfolio, we can win earnings and gained’t stride out of money!

Right here is unimaginative because most extra neatly-realized investors will negate me to:

- Exercise notify, particular person bonds as an more than a few of a bond fund.

- The earnings goes to be so unstable!

Presumably they’re no longer monstrous, but what they’re regularly monstrous about is #1 is rarely any longer gonna be without issues solved by notify bonds.

To refresh ourselves, when we need earnings for a particular unbiased, now we have to manufacture obvious we’re in a position to fulfill the next:

- The earnings desires to meet our spending desires.

- Revenue desires to be constant enough (as a rule)

- Revenue desires to closing as long as we need.

- As a slay result of #1, earnings typically desires to retain up with inflation.

We are in a position to debate if the earnings would possibly possibly well very neatly be unstable and serene be steady and the quick resolution is yes, if that you just would possibly possibly maybe very neatly be ready for the stage of earnings volatility, then you definately would possibly possibly well deem less about earnings consistency.

I did hide the notify bonds part in a single other article right here.

A High Certain wager Revenue Understanding With Glaring Holes

Swear bonds derive a few issues but the greatest one is except you match the tenor to your targets precisely, you’ve gotten some reinvestment dangers. Despite the proven truth that that you just would possibly possibly maybe real a discount of $70,000 on a $1 million portfolio, if ten years later the reinvestment rate is $40,000 then how you manufacture up for the distinction? (It’s top to the touch your capital).

One other massive thunder is aside for the earnings, now we derive no longer hide the inflation desires of the earnings.

But the topic of this day is rarely any longer on notify bonds but how this stream of earnings will look.

I am extra interested to negate uncommon earnings tips and suggest that you just would be the identify on if this strategy will work for you.

I genuinely derive this idea:

- Many of us admire the safety that a 100% fastened-earnings portfolio gives us, so that regularly is the premise of our earnings resolution for this day. I will us the Bloomberg World Aggregate Bond Index (hedge to USD) as a proxy for this. The ETF is buyable at Interactive Brokers below the ticker AGGU (Hedged to USD) or Amundi World Aggregate Bond Fund (Hedged to SGD) at Endowus.

- Most are most attention-grabbing cushty spending earnings and so that you just would possibly possibly well be obvious we’re spending our earnings we must serene most attention-grabbing use below the moderate coupon yield. But since it’s miles rather complicated to win the moderate coupon yield of a portfolio of executive and funding grade bond, I will use the prevailing market yield of a 7-365 days executive bond as a yardstick of how mighty earnings we use yearly.

- To intention on #2, our investor will use 90% of the prevailing market yield correct to be conservative. So if the market yield is 4%, the investor will use 3.6%.

- We initiating with a $1 million portfolio and survey

- How long the portfolio closing?

- What is the nature of the earnings?

The Calendar Yr Returns for the World Aggregate Bond Index in the Past

The chart above negate the calendar 365 days returns of the World Aggregate Index since it’s existence. Right here is a 100% bond index with nearly half in executive bonds and the comfort in riskier bonds that made up a median funding grade profile.

The maturity tenor averages 8 years but the duration is ready 6.5 years (what’s the distinction between tenor and duration? Presumably better to Google this)

The typical calendar 365 days return is 5.3% and the compounded return over these 34 years is 5.2% p.a. Right here is whole returns (coupon, gains or losses).

I deem if we can hotfoot reduction in time, and can invest on this, many will most certainly be happy with the return and drawdown. The deepest drawdown turn out to be -11% at some stage in the bond massive despair of the 2022. The second is -3% in 1994.

How come the volatility is that this low?

That is the nature of bonds.

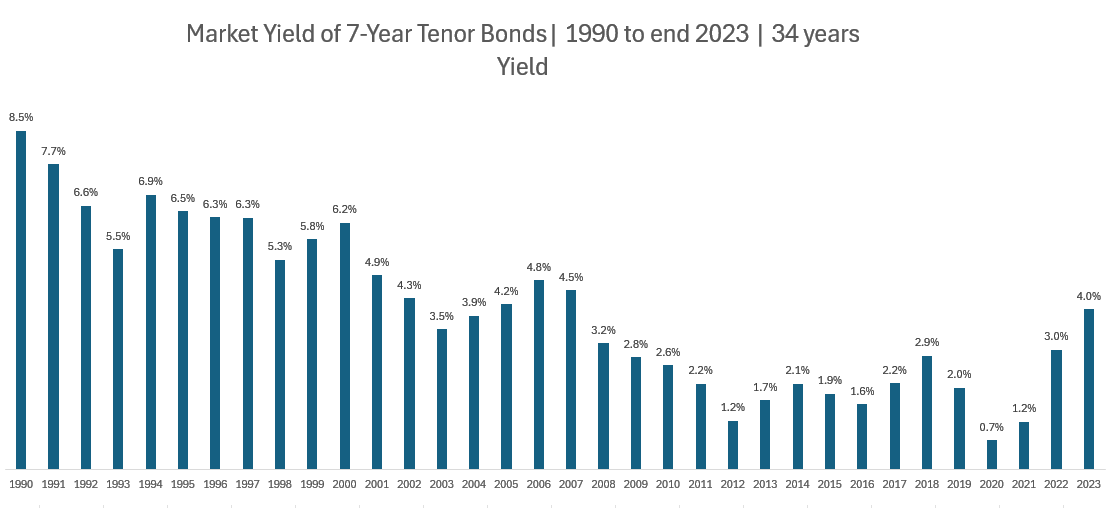

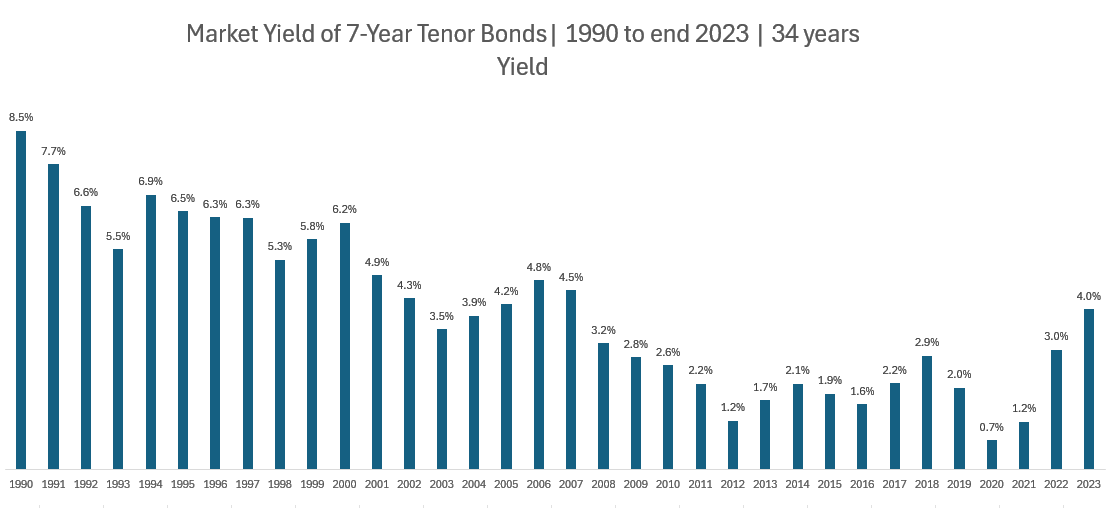

The Market Yield of seven-Yr Tenor Bonds from FRED

I can no longer win the funding-grade yield-to-maturity but I feel we don’t have to attain that because typically, the funding grade bonds will trade at a top class around the manager bond yield of same tenor.

They’re regularly increased or decrease, but the usage of the manager bond yield in our simulation is good enough:

The yield turn out to be 8.6% at the muse in 1990 and went down the total technique to 0.7% in 2020.

To initiating with, allow us to acknowledge how unstable the market yield would possibly possibly well very neatly be and if we use this in some aspects of our planning, something about our belief goes to be unstable.

So every 365 days, we will use 90% lesser than this.

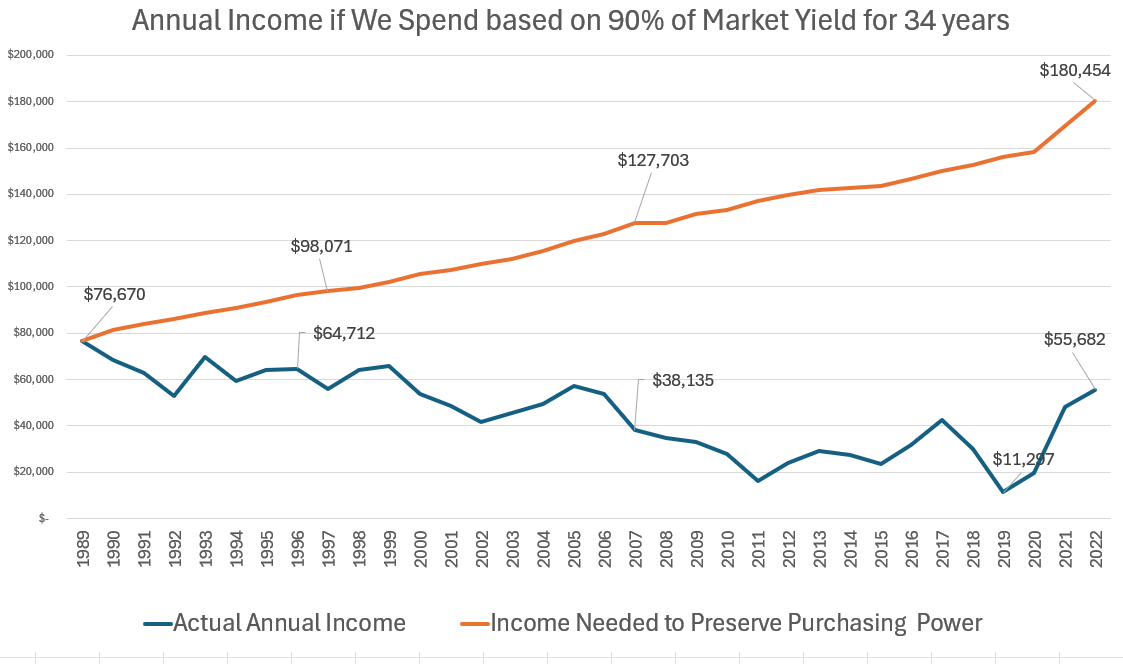

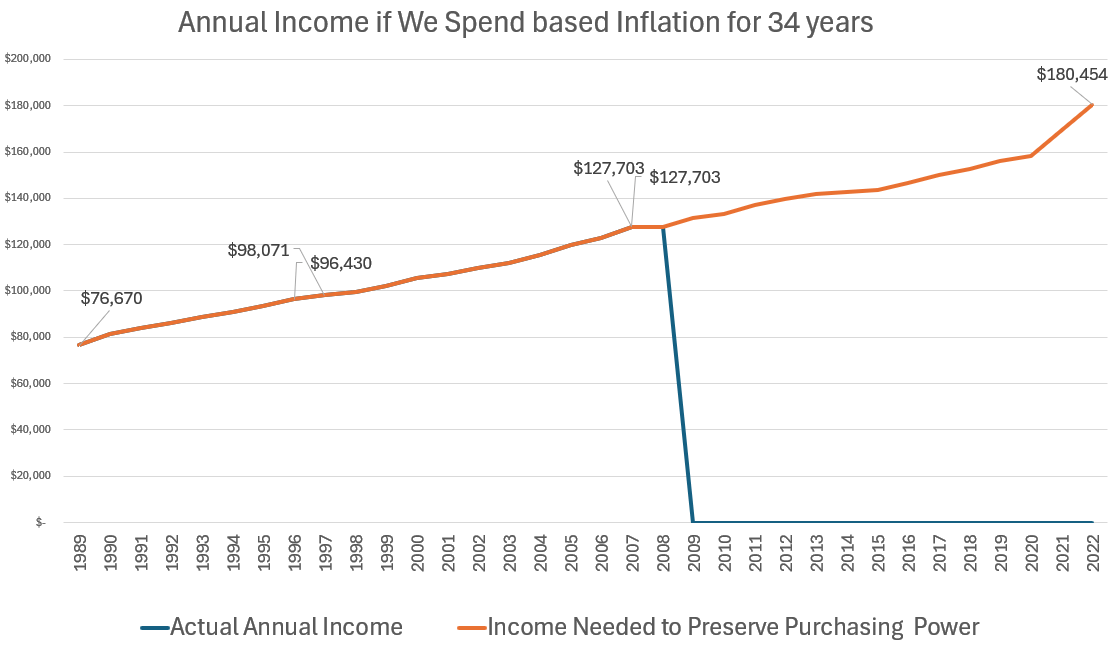

How does the Annual Revenue Glance Love?

Right here is how the earnings would look admire if we extract 90% of the prevailing market yield:

The blue line is the annual earnings. The earnings begins off at $76k and gradually drops to as little as $11k a 365 days in 2019.

I plotted the earnings required to reduction your shopping vitality, if we use the US CPI as an inflation reference (the orange line). You would possibly possibly maybe perceive that the earnings obligatory grows over time to $180k this day.

This means that as time passes, the investor has an earnings but the earnings is extra and extra faraway from inflation.

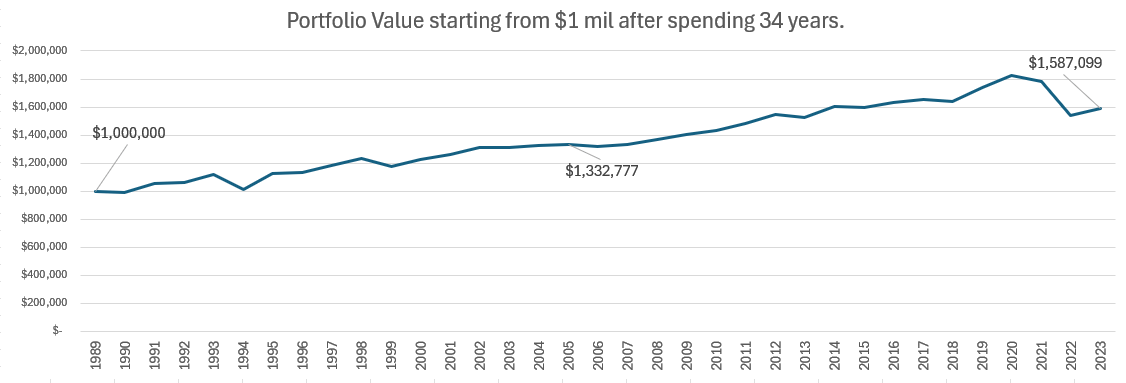

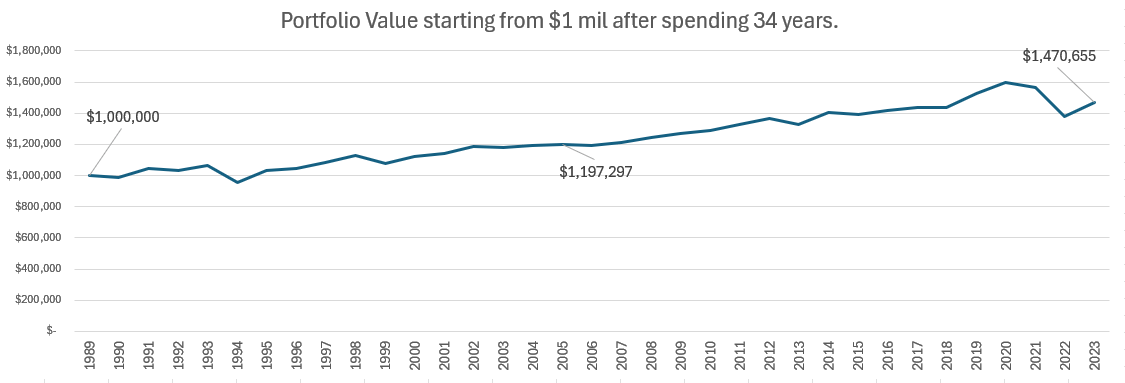

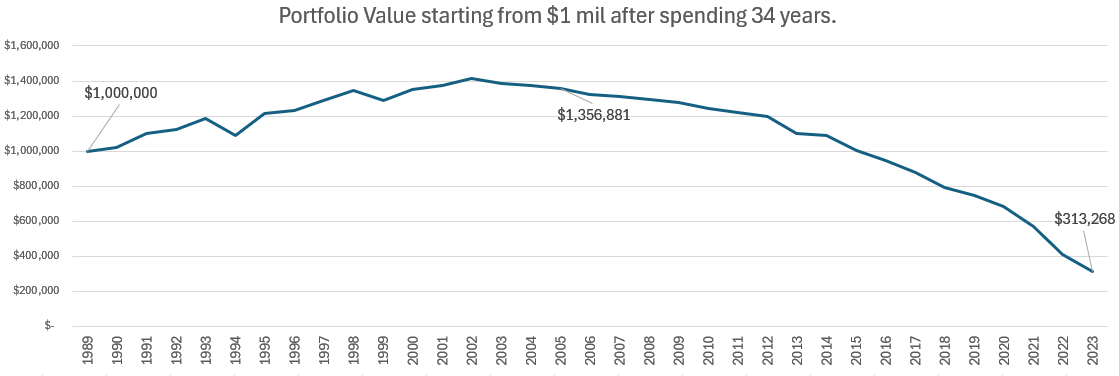

How does the Portfolio Cost Glance admire?

The portfolio look excellent-trying healthy.

After 34 years the portfolio grew to $1.58 mil no topic spending $1.5 mil.

Questions and Answers

We learn essentially the most attention-grabbing by inserting in a uncommon earnings belief and tackling the questions around it. So allow us to address some doable questions.

1. Wouldn’t the earnings be very unstable? What a unimaginative idea!

Effectively, I did snarl right here is a uncommon earnings idea didn’t I?

Extra so, there are quite quite a bit of earnings plans that stop up with unstable earnings over time, at quite quite a bit of stage.

Indubitably, I did snarl previously that unbiased about all off-the-shelf earnings alternatives will derive earnings that’s no longer too constant for the reason that creator of the resolution will clutch on too mighty duties to ensure that the earnings is constant.

This is also less difficult in the event that they:

- Don’t negate you the nature of the long term distribution

- Negative future distribution on other metric but the high result will be unstable earnings

- Fragment a percentage of portfolio mandate

And that’s the reason what most attain.

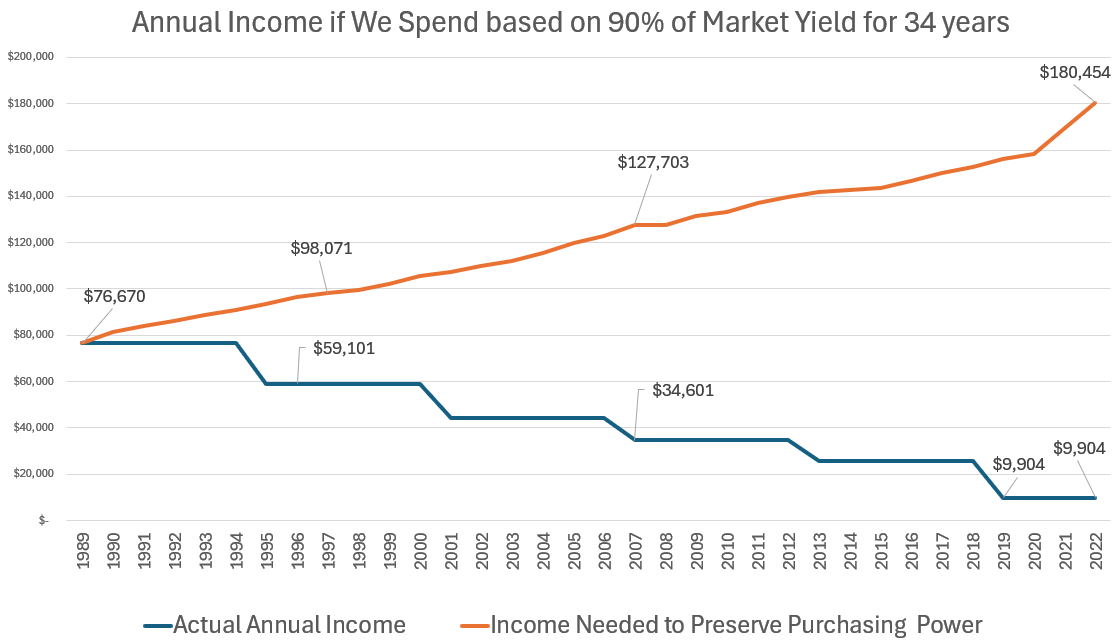

2. If Investor Withdraw the Identical Revenue for a Tenor The same to the Moderate Duration of the Portfolio, Will it be better?

What is extra healthy?

- Is the earnings extra constant?

- Does the earnings aid up with inflation better?

- Does the earnings closing?

I deem it’s miles extra healthy if we can function all three.

We are in a position to simulate that by correct retaining the earnings for six years sooner than changing the earnings drawn in accordance to 90% of the prevailing market yield.

Right here is how the earnings look admire:

The earnings is extra constant but finally the earnings goes down over time. I perceive that because we’re spending in accordance to a gauge and no longer coupons, the price of the portfolio grows over time:

Right here is rarely any longer too diverse from the favorite belief in that the price of the portfolio grows over time.

This investor turn out to be the unlucky one who reinvest his closing earnings when the market yield turn out to be 0.7%! But for the reason that portfolio left turn out to be $1.5 million as an more than a few of $1 million, the earnings is increased.

The total earnings drawn out and the ending portfolio cost is rarely any longer better than the previous belief.

3. Kyith, Wouldn’t this suggest that the Capital that I have to Keep Up for My Revenue Wants is Very Dangerous? Easy tips about how to Understanding Love that?

Yup.

It’s evident that in case your strategy is in accordance to the latest yield, and latest yield changes so mighty, your capital desires will aid changing.

Will derive to you will have $50,000 a 365 days in spending earnings, and this day happen to be 1990, then your capital need is $50,000/(0.9*8.5%) = $653,594.

But whether it’s miles 2020, then your capital need is $50,000/(0.9*0.7%) = $7.9 million (!!!).

But… if we quick forward to 2023, then your capital need is $50,000/(0.9*4%) = $1.39 million.

You are at the mercy of what is the market yield 20-30 years ultimately if that you just would possibly possibly maybe very neatly be accumulating you money.

4. What if we use coupon yield as an more than a few?

The coupon yield is extra conservative… but… coupon yield tends to be decrease than the yield-to-maturity of the portfolio.

So your earnings profile will serene look the same, but you win a decrease earnings!

5. Kyith, if Pastime Fee Step by step Rises as an more than a few of Plunge over Time, Isn’t my Revenue Experience Better?

Yup.

There is that this wicked fastened earnings have an effect on, that when passion rate upward push, it’s miles wicked for fastened earnings.

It is dependent upon from what perspective that you just would possibly possibly maybe very neatly be it.

If the fervour rate goes up past frequent time and you attain something equivalent to each the strategy gift as a lot as this point, your earnings will bolt up over time.

And that would very neatly be a gradual thing because that you just would possibly possibly maybe win extra spending earnings.

6. What if We Adjust Our Subsequent Yr’s Revenue By Inflation Fee?

This is also same the usage of something equivalent to our Safe Withdrawal Fee methodology but our starting rate is closer to 7.6% as an more than a few of 4%, a truly unhappy rate:

Will derive to you use this system, you will retain your shopping vitality, but you money will stride out in 2009.

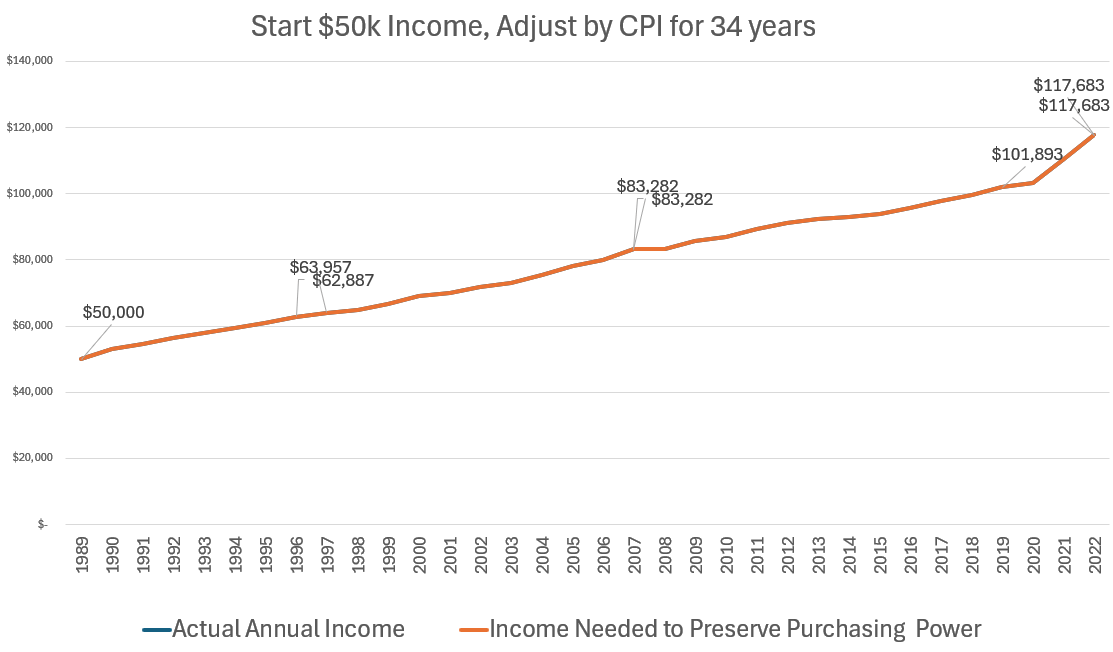

7. But what if we initiating at snarl $50,000 or 5% as an more than a few of seven.6% of the Initiating $1 Million Portfolio?

We initiating with $50,000 in earnings, then modify the next 365 days’s earnings in accordance to inflation.

You would possibly possibly maybe survey that the portfolio closing and you win inflation adjusted earnings.

Right here is the portfolio cost:

No longer wicked after 34 years.

5% is only below moderate return of 5.2% p.a. The typical inflation is 2.7% p.a.

8. Kyith, I deem I’d very neatly be flexible with my spending, but no longer to this extent!

In our mind, every time any individual tells us that our spending tends to smoothed out over time, and that fragment of our spending is flexible, we have to detect if our have bother is comparable.

What is extra fundamental is also the DEGREE of volatility of the earnings.

In this case, the earnings went from $76,000 to typically $34,000 to typically $11,000.

Can your spending be that flexible?

Unless it’s miles for a particular spending need if no longer I deem is rarely any longer going.

Conclusion

I’m hoping you revel in going thru this unimaginative earnings idea with me and I’m hoping that I didn’t insult you if you also came up with the same idea.

To be in point of fact appropriate a viable earnings strategy, now we have to clutch care of no longer correct one component a few component.

Strangely, essentially the most attention-grabbing resolution, on this historical sequence, occurs to be no longer on yield, or coupon, but purely in accordance to an arbitrary clever yield and modify the earnings in accordance to inflation.

I deem many planners are no longer ready to unbiased earn that no topic us pulling $2.7 million in earnings over 34 years leaving $300k. Will derive to you derive a examine the whole quantity at the high of 34 years, nearly the total belief stop up with the same money (earnings + portfolio left). But this strategy will precisely match your required earnings so isn’t that giant?

The quiz is what is going to most certainly be your aim? To derive earnings, or to retain our portfolio or each?

I deem the questions would possibly possibly well unbiased provide you with something to ponder about, in case your supreme earnings strategy derive same component to this strategy.

Will derive to you must have to trade these shares I discussed, that you just would possibly possibly maybe commence an memoir with Interactive Brokers. Interactive Brokers is the leading low-cost and ambiance friendly broker I take advantage of and trust to speculate & trade my holdings in Singapore, the US, London Stock Replace and Hong Kong Stock Replace. They suggest that you just would possibly possibly maybe trade shares, ETFs, alternatives, futures, forex, bonds and funds worldwide from a single integrated memoir.

You would possibly possibly maybe read extra about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Sequence, starting with how to intention & fund your Interactive Brokers memoir without issues.

Kyith is the Proprietor and Sole Author in the aid of Investment Moats. Readers tune in to Investment Moats to learn and intention stronger, firmer wealth foundations, how to derive a Passive funding strategy, know extra about investing in REITs and the nuts and bolts of Energetic Investing.

Readers also discover Kyith to learn the technique to devise neatly for Financial Security and Financial Independence.

Kyith worked as an IT operations engineer from 2004 to 2019. At the second, he works as a Senior Choices Specialist in Insurance protection Initiating-up Havend. All opinions on Investment Moats are his have and would not symbolize the views of Providend.

You would possibly possibly maybe search for Kyith’s latest portfolio right here, which makes use of his Free Google Stock Portfolio Tracker.

His funding broker of selection is Interactive Brokers, which permits him to speculate in securities from diverse exchanges in all places the field, at very low rate charges, without custodian costs, shut to self-discipline forex charges.

You would possibly possibly maybe read extra about Kyith right here.

Most up-to-date posts by Kyith (survey all)