Given how prolonged the bull market had been, and how prolonged we been ready for a recession, there is a case that we are finish to the tail-finish of an economic cycle.

Nonetheless the records from DataTrek salvage a case that we would per chance well be in a center of the industrial cycle than unhurried.

Right here’s what’s presented in DataTrek Research’s episode on The Compound repeat.

GDP

What you would be seeing is the Atlanta Fed model of the assign GDP goes. The blue house shows the assign the analyst expects the GDP to cruise spherical. The fairway line shows the Atlanta Fed’s estimate, which shows that the records bounced across the underside of the two% vary. If the number is saved all the draw in which throughout the two-3% vary, the economy is mainly wholesome. The greenline looks to be to repeat that we are having better records for that reason of higher retail gross sales numbers lately.

Nowhere finish to a pessimistic vary.

Gasoline Question

Datatrek helps its customers song the gasoline quiz a week.

The US makes articulate of roughly 9.5 million barrels of gasoline. Tracking this enables us to gaze the health of the economy because to salvage someplace, you purchased to power to someplace. The brown line shows the quiz closing year across the year and the blue line shows the unique year.

Contemporary quiz is comfortable nonetheless after July the blue line went above the brown line, indicating that the economy is not large nonetheless in actual fact doing better with gasoline prices down.

“It is extraordinarily subtle to own a recession when gas prices are declining. Historical past factual shows that.”

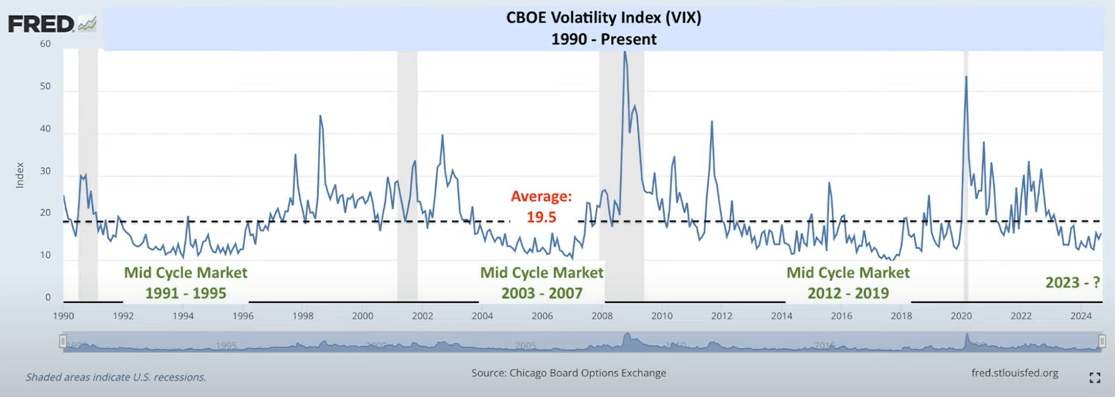

The VIX

This chart shows that the month-to-month VIX readings, which is the implied volatility of the S&P 500, going aid to the 1990s:

The standard VIX is nineteen.5. A mid-cycle market has a decrease-than-average VIX regime. There appear to own a cycle to this and we would well be within the center of one.

Consecutive Job Losses (Financial shock)

Recessions own two sources essentially: Geopolitical or economic shocks.

The chart above shows the month-to-month jobs progress going aid to the 1990s. The originate of the past three recession shows three month-to-month of consecutive job losses. Recession normally begins when companies began to aggressively shedding workers.

Recession normally requires a catalyst:

- 1990: Gulf Battle

- 2000: Dot-com bubble burst

- 2008: GFC

Vulgar Oil Prices (Geopolitical shock)

Sooner than or all through a recession, there usually is a spike in oil prices:

The dusky dotted line helps you repeat when oil prices drop 20%.

Decrease oil prices are most likely to expand economy cycles, excessive prices are most likely to total them. There were 8 intervals the assign oil prices dip below 20% and in 5 of these, no recession adopted within the following year. In 2 of them, the economy became already contracting. The closing one became all through covid interval.

Oil prices would routinely spike finish to 80% sooner than or all through recession.

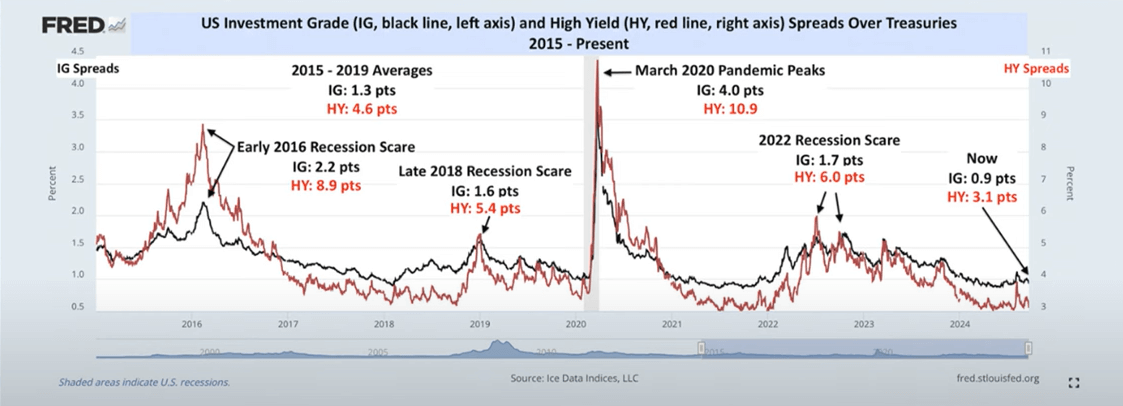

High Yield and Company Bond Unfold Over Treasury

This chart shows the spread of company bonds, and the excessive yield junk bonds over likelihood-free treasury:

The spread changes over time. When the market is insecure about recession, the market calls for a elevated spread over likelihood-free sooner than they will salvage invested in it. Thus, we encounter all through these recession, or recession scares, the excessive yield and investment grade spread normally fan out.

We are not seeing it at demonstrate.

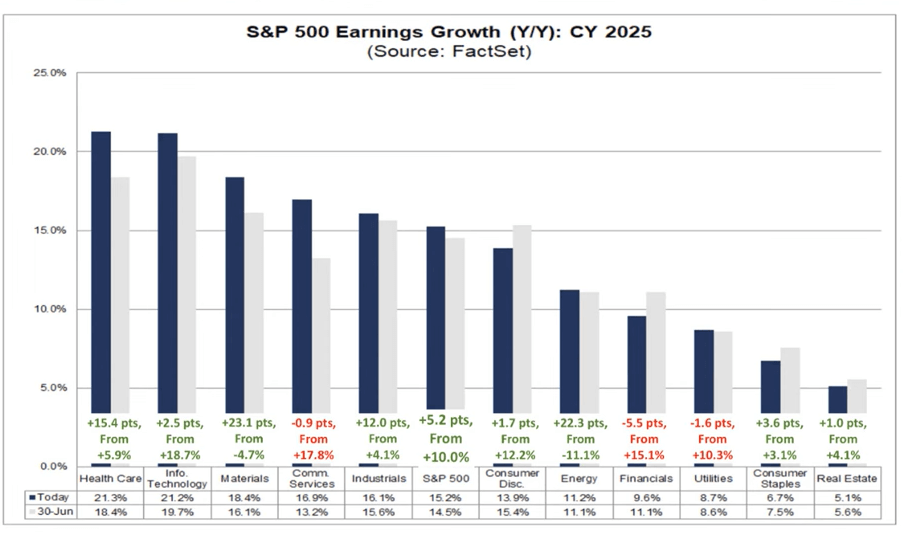

Nature of Earnings Hiss

The chart below shows analyst earnings projection for 2025, aggregated by FactSet:

The numbers below repeat the swing of earnings projection. As an illustration, Industrials repeat 4.1% this year to 12% projected subsequent year.

These are projections nonetheless we are seeing that the numbers are broadening out.

The numbers aloof wish to occur even though.

Explore the Video if You per chance would be

The hyperlink to the video.

Even as you occur to would per chance well be seeking to alternate these stocks I talked about, you would possibly be in a position to originate an account with Interactive Brokers. Interactive Brokers is the main low-fee and atmosphere friendly dealer I articulate and belief to make investments & alternate my holdings in Singapore, the United States, London Stock Change and Hong Kong Stock Change. They mean you would possibly be in a position to alternate stocks, ETFs, alternatives, futures, forex, bonds and funds worldwide from a single integrated account.

You are going to be in a position to read extra about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Sequence, starting with easy easy solutions to construct & fund your Interactive Brokers account with out anguish.

Kyith is the Proprietor and Sole Author at the aid of Funding Moats. Readers tune in to Funding Moats to be taught and beget stronger, firmer wealth foundations, easy easy solutions to own a Passive investment strategy, know extra about investing in REITs and the nuts and bolts of Titillating Investing.

Readers also prepare Kyith to be taught the capacity to concept well for Financial Safety and Financial Independence.

Kyith labored as an IT operations engineer from 2004 to 2019. Presently, he works as a Senior Solutions Specialist in Insurance Originate-up Havend. All opinions on Funding Moats are his dangle and would not impart the views of Providend.

You are going to be in a position to gape Kyith’s unique portfolio here, which makes articulate of his Free Google Stock Portfolio Tracker.

His investment dealer of preference is Interactive Brokers, which permits him to make investments in securities from a bunch of exchanges all the draw in which throughout the sphere, at very low fee rates, with out custodian expenses, finish to space currency rates.

You are going to be in a position to read extra about Kyith here.

Latest posts by Kyith (encounter all)