Regarded as one of my readers informed me that if I desire a accurate ‘value’ ingredient fund that retains up with the index at some level of those vital instances, I truly want to take relate of the Pacer US Cash Cows 100 ETF.

That ETF is represented by a extraordinarily good ticker called COWZ.

And if I desire an ETF that sub-selects from the tiny-cap apartment, they glean provide a ‘smaller’ cow called CALF.

ETF Movement has announced that Pacer bear listed three UCITS ETFs in Europe: the COWZ, ICOW and GCOW.

They’re listed in the Dublin and Netherlands inventory alternate and never London Stock Change.

I tried to glimpse if the tickers are available in on Interactive Brokers, however unfortunately, I could presumably presumably not glean them. That is rather a bummer.

Here is a rapid summary of the three ETFs:

I missed out on the total expense ratio of COWZ which works out to be 0.49%.

The profit for global investors of the UCITS version is that they could be extra withholding and property tax ambiance friendly. Unfortunately, you have to presumably presumably presumably want to glean a broker that allows you to replace at the Irish and Netherlands alternate.

These PACER ETFs are view about as systematically energetic ETFS.

How would I display them??

Must you are a inventory investor, you have to presumably presumably presumably additionally bear heard of this investor called Warren Buffett. He invests thru this company called Berkshire Hathaway. Many of us be taught from him that we should always easy uncover about for corporations that give accurate routine owner’s earnings.

Here is the cash high-tail with the movement earnings an organization earns after paying off the maintenance capex.

Many of us know this as a cash high-tail with the movement call free cash high-tail with the movement.

Must you resolve with the concept that, you have to presumably presumably presumably strive to glean company that

- Has routine free cash high-tail with the movement.

- Trades at an inexpensive to cheap designate to free cash high-tail with the movement.

That you have to strive to glean that for your maintain.

Or is there a resolution that systematically executes this with out you doing it?

PACER tries to put into effect this.

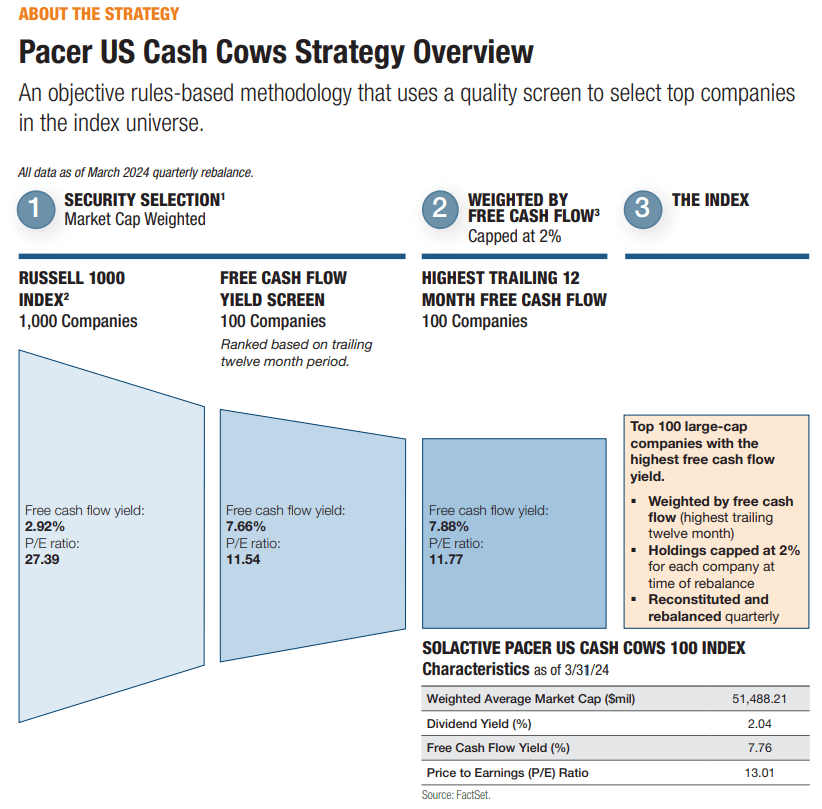

Blueprint close the case of COWZ which attracts from the Russell 1000 personnel of gargantuan cap US corporations. Yow will detect out regarding the standard free cash high-tail with the movement yield of the corporations and the price-earnings ratio. They sinister the 1,000 corporations in step with the free cash high-tail with the movement yield of the trailing 12-month duration and judge the halt 100. The free cash high-tail with the movement yield is larger at 7.66% and additionally they are more inexpensive with a PE of 11.5 instances.

Then Pacer weights them in step with Free Cash Float.

They systematically glean this each quarter.

The head sectors doing his ends up with 23% in power and 18% in user discretionary. Financials and REITs are unnoticed from the Free Cash high-tail with the movement ranking. So are corporations with detrimental free cash flows.

That you have to additionally establish with this form of approach and systematically energetic ETF performs this.

I presumed a “high-tail with the movement” vogue of valuation approach, compared with a “book value” form, would outcome in extra profitability-basically basically based corporations however turns out Info Technology isn’t very so excessive.

Here is COWZ performance against the Dimensional US Excessive relative Profitability mutual fund, Main edge SP500 Index Fund and WisdomTree US Quality Dividend Stutter Fund:

Performance is resplendent accurate. I’d narrate… with an UCITS choices, now we bear got but one more accurate quality/profitability implementation in relate for you to narrate identical funding philosophy.

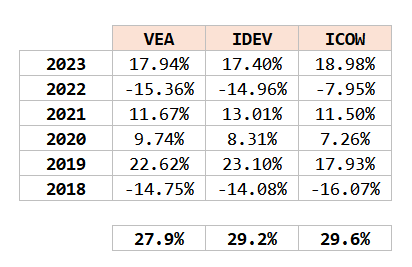

I additionally compare ICOW’s performance against two developed markets ex US ETFs (VEA and IDEV):

Overall, the performance bear saved up despite value corporations not doing smartly at some level of this duration.

I assume we are able to take relate of PACER and its suite of ETFs on this apartment. It is far correct that extra managers are unsuitable listing their funds over in Europe.

Right with any luck they are available in on Interactive Brokers.

Must you have to want to replace these stocks I discussed, you have to presumably open an story with Interactive Brokers. Interactive Brokers is the main low-value and ambiance friendly broker I utilize and trust to make investments & replace my holdings in Singapore, the US, London Stock Change and Hong Kong Stock Change. They’ll can prove you the approach to replace stocks, ETFs, choices, futures, out of the country replace, bonds and funds worldwide from a single integrated story.

That you have to be taught extra about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Sequence, starting with pointers on how to present & fund your Interactive Brokers story with out issues.

Kyith is the Proprietor and Sole Creator at the aid of Investment Moats. Readers tune in to Investment Moats to be taught and produce stronger, much less assailable wealth foundations, pointers on how to bear a Passive funding approach, know extra about investing in REITs and the nuts and bolts of Energetic Investing.

Readers additionally prepare Kyith to be taught pointers on how to devise smartly for Monetary Security and Monetary Independence.

Kyith worked as an IT operations engineer from 2004 to 2019. Currently, he works as a Senior Alternate choices Specialist in Insurance Originate-up Havend. All opinions on Investment Moats are his maintain and doesn’t describe the views of Providend.

That you have to gape Kyith’s most modern portfolio right here, which makes utilize of his Free Google Stock Portfolio Tracker.

His funding broker of preference is Interactive Brokers, which permits him to make investments in securities from assorted exchanges at some level of the enviornment, at very low rate rates, with out custodian costs, near self-discipline currency rates.

That you have to be taught extra about Kyith right here.

Most up-to-date posts by Kyith (uncover about all)