A Singapore Treasury Bill area (BS24119S) will likely be auctioned on Thursday, twenty sixth September 2024.

If you are trying to subscribe efficiently, it could perhaps well maybe perhaps be wanted to dispute your portray through Net banking (Money, SRS, CPF-OA, CPF-SA) or in particular person (CPF) by twenty fifth September. Singaporeans, PR, and non-Singaporeans can all aquire these Singapore Treasury Bills.

You would possibly well maybe perhaps ogle the info at MAS right here.

In the previous, I grasp shared with you the virtues of the Singapore T-bills, their splendid makes utilize of, and tricks on how to subscribe to them right here: Purchase Singapore 6-Month Treasury Bills (T-Bills) or 1-365 days SGS Bonds.

The Tbill slit-off yield within the last auction is 3.10%.

If you pick out a non-aggressive show, you need to to well maybe perhaps perhaps also very successfully be pro-rated the quantity you show and would yield 3.10%. If you prefer to fetch definite you secured all that you just show, this could occasionally be better to make a need a aggressive show, however it could perhaps well maybe perhaps be wanted to receive your show stunning.

Some previous non-aggressive auctions were pro-rated. Listed below are some previous examples:

In aggressive bidding, if your show is decrease than the eventual slit-off yield (within the instance underneath), you are going to receive 100% of what you show for at the slit-off yield (now no longer the decrease yield that you just show for).

Gaining Insights Relating to the Upcoming Singapore T-invoice Yield from the Day-to-day Closing Yield of Present Singapore T-bills.

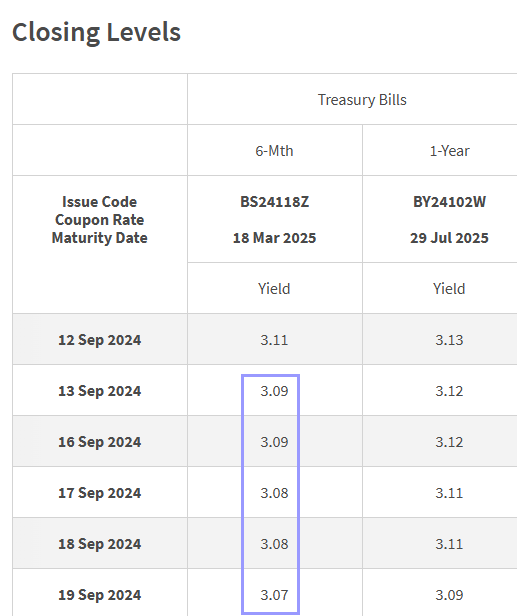

The table underneath shows the contemporary hobby yield the six-month Singapore T-bills is trading at:

The each day yield at closing presents us a rough indication of how valuable the 6-month Singapore T-invoice will commerce at the stop of the month. From the each day yield at closing, we ought to nonetheless save an dispute to the upcoming T-invoice yield to commerce shut to the yield of the last area.

Currently, the 6-month Singapore T-bills are trading shut to a yield of 3.07%, valuable decrease than two weeks within the past.

Gaining Insights Relating to the Upcoming Singapore T-invoice Yield from the Day-to-day Closing Yield of Present MAS Bills.

Most regularly, the Monetary Authority of Singapore (MAS) will area a 4-week and a 12-week MAS Bill to institutional investors.

The credit rating quality or risk of the MAS Bill wants to be very connected to that of Singapore T-bills for the reason that Singapore authorities points both. The 12-week MAS Bill (3 months) wants to be the closest duration of time to the six-month Singapore T-bills.

Thus, we can reach insights into the yield of the upcoming T-invoice from the each day closing yield of the 12-week MAS Bill.

The slit-off yield for the most contemporary MAS invoice auctioned on 17th Sep (two days within the past) is 3.23%. The MAS invoice is connected to the last area two weeks within the past.

Currently, the MAS Bill trades shut to 3.24%.

Given that the MAS 12-week yield is at 3.24% and the last traded 6-month T-invoice yield is at 3.07%, what is in total the T-invoice yield this time round?

The Federal Reserve of the US grasp announced that they are going to be reducing the rates by 50 basis facets. This ought to nonetheless save tension on the shorter-duration of time rates. Except there are some dramatic components affecting the markets, we ought to nonetheless watch the yield on the six-month Treasury to be dramatically decrease at closer to 2.90%.

Listed below are your other Better Return, Safe and Short-Interval of time Savings & Funding Strategies for Singaporeans in 2023

You would possibly well maybe perhaps also very successfully be wondering whether or now no longer other savings & investment ideas provide you better returns however are nonetheless pretty protected and liquid ample.

Listed below are diverse other categories of securities to preserve up in mind:

| Security Sort | Fluctuate of Returns | Lock-in | Minimum | Remarks |

|---|---|---|---|---|

| Fastened & Time Deposits on Promotional Charges | 4% | 12M -24M | ||

| Singapore Savings Bonds (SSB) | 2.9% – 3.4% | 1M | An real SSB Instance.” recordsdata-portray=”Max $200k per particular person. When in save an dispute to, it could perhaps well maybe perhaps also even be intelligent to receive an allocation. An real SSB Instance.”>Max $200k per particular person. When in save an dispute to, it could perhaps well maybe perhaps also even be intelligent to receive an allocation. An real SSB Instance. | |

| SGS 6-month Treasury Bills | 2.5% – 4.19% | 6M | buy T-bills handbook.” recordsdata-portray=”Acceptable within the occasion you grasp lots of money to deploy. buy T-bills handbook.”>Acceptable within the occasion you grasp lots of money to deploy. buy T-bills handbook. | |

| SGS 1-365 days Bond | 3.72% | 12M | buy T-bills handbook.” recordsdata-portray=”Acceptable within the occasion you grasp lots of money to deploy. buy T-bills handbook.”>Acceptable within the occasion you grasp lots of money to deploy. buy T-bills handbook. | |

| Transient Insurance Endowment | 1.8-4.3% | 2Y – 3Y | An real example Gro Capital Ease” recordsdata-portray=”Be obvious that they are capital assured. Most regularly, there could be a most quantity you are going to be capable to aquire. An real example Gro Capital Ease“>Be obvious that they are capital assured. Most regularly, there could be a most quantity you are going to be capable to aquire. An real example Gro Capital Ease | |

| Money-Market Funds | 4.2% | 1W | Acceptable within the occasion you grasp lots of money to deploy. A fund that invests in mounted deposits will actively can abet you capture the top doubtless prevailing hobby rates. Attain read up the factsheet or prospectus to fetch obvious the fund most efficient invests in mounted deposits & equivalents. |

This table is as a lot as the moment as of 17th November 2022.

There are other securities or merchandise that will fail to fulfill the standards to give inspire your valuable, excessive liquidity and appropriate returns. Structured deposits fetch derivatives that amplify the extent of risk. Many money administration portfolios of Robo-advisers and banks fetch short-duration bond funds. Their values could well maybe perhaps also fluctuate within the short duration of time and could well maybe perhaps now no longer be splendid within the occasion you require a 100% return of your valuable quantity.

The returns supplied are now no longer solid in stone and will fluctuate according to the contemporary temporary hobby rates. You ought to nonetheless adopt extra unbiased-basically based totally planning and utilize the most appropriate instruments/securities to can abet you rep or spend down your wealth in preference to getting your entire money in temporary savings & investment ideas.

If you are trying to must commerce these stocks I mentioned, you are going to be capable to originate an story with Interactive Brokers. Interactive Brokers is the leading low-cost and atmosphere friendly broker I utilize and trust to invest & commerce my holdings in Singapore, the US, London Stock Alternate and Hong Kong Stock Alternate. They enable you to commerce stocks, ETFs, ideas, futures, international substitute, bonds and funds worldwide from a single integrated story.

You would possibly well maybe perhaps read extra about my solutions about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting up with tricks on how to carry out & fund your Interactive Brokers story simply.

Kyith is the Owner and Sole Author within the inspire of Funding Moats. Readers tune in to Funding Moats to be taught and create stronger, firmer wealth foundations, tricks on how to grasp a Passive investment technique, know extra about investing in REITs and the nuts and bolts of Energetic Investing.

Readers also practice Kyith to be taught to situation successfully for Financial Security and Financial Independence.

Kyith worked as an IT operations engineer from 2004 to 2019. Currently, he works as a Senior Strategies Specialist in Insurance Originate-up Havend. All opinions on Funding Moats are his grasp and doesn’t signify the views of Providend.

You would possibly well maybe perhaps ogle Kyith’s contemporary portfolio right here, which makes utilize of his Free Google Stock Portfolio Tracker.

His investment broker of need is Interactive Brokers, which permits him to invest in securities from diverse exchanges all the plan during the sphere, at very low commission rates, with out custodian expenses, shut to situation forex rates.

You would possibly well maybe perhaps read extra about Kyith right here.

Most contemporary posts by Kyith (watch all)