A Singapore Treasury Invoice subject (BS24118Z) shall be auctioned on Thursday, 12th September 2024.

Whereas you happen to love to subscribe efficiently, probabilities are you’ll perhaps presumably like to set your listing through Web banking (Money, SRS, CPF-OA, CPF-SA) or in particular person (CPF) by 11th September. Singaporeans, PR, and non-Singaporeans can all aquire these Singapore Treasury Bills.

That you just would perchance understand the particulars at MAS right here.

Within the previous, I even own shared with you the virtues of the Singapore T-payments, their finest uses, and strategies to subscribe to them right here: How to Aquire Singapore 6-Month Treasury Bills (T-Bills) or 1-Year SGS Bonds.

The Tbill decrease-off yield within the final public sale is 3.13%.

Whereas you happen to choose on a non-competitive advise, probabilities are you’ll perhaps be legitimate-rated the quantity you advise and would yield 3.13%. Whereas you happen to would possibly perchance presumably very effectively be looking out to be definite you secured all that you just advise, it’ll be better to make a different a competitive advise, nonetheless probabilities are you’ll perhaps presumably like to get your advise real.

Some previous non-competitive auctions had been legitimate-rated. Here are some previous examples:

In competitive bidding, if your advise is decrease than the eventual decrease-off yield (within the instance beneath), probabilities are you’ll perhaps presumably presumably get 100% of what you advise for on the decrease-off yield (no longer the decrease yield that you just advise for).

Gaining Insights About the Upcoming Singapore T-invoice Yield from the Day-to-day Closing Yield of Present Singapore T-payments.

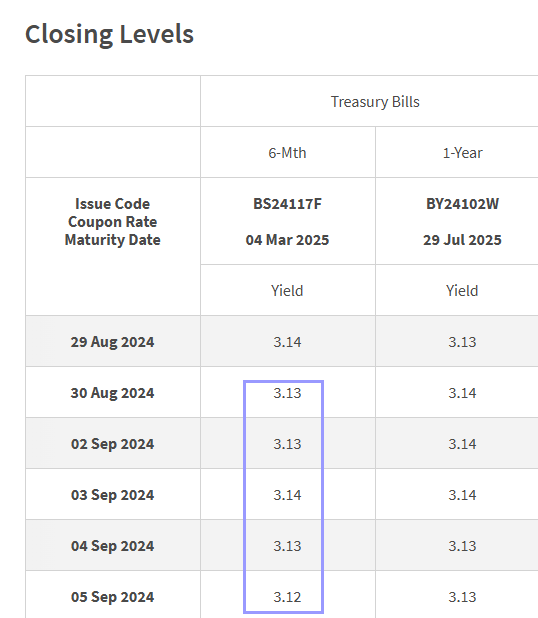

The desk beneath reveals the scorching curiosity yield the six-month Singapore T-payments is shopping and selling at:

The day-to-day yield at closing provides us a tough indication of how necessary the 6-month Singapore T-invoice will alternate on the end of the month. From the day-to-day yield at closing, we must all the time nonetheless inquire of the upcoming T-invoice yield to alternate shut to the yield of the final subject.

Currently, the 6-month Singapore T-payments are shopping and selling shut to a yield of 3.12%, necessary decrease than two weeks ago.

Gaining Insights About the Upcoming Singapore T-invoice Yield from the Day-to-day Closing Yield of Present MAS Bills.

Most regularly, the Monetary Authority of Singapore (MAS) will subject a 4-week and a 12-week MAS Invoice to institutional traders.

The credit quality or threat of the MAS Invoice must be very identical to that of Singapore T-payments since the Singapore govt disorders both. The 12-week MAS Invoice (3 months) must be the closest period of time to the six-month Singapore T-payments.

Thus, we can create insights into the yield of the upcoming T-invoice from the day-to-day closing yield of the 12-week MAS Invoice.

The decrease-off yield for essentially the most stylish MAS invoice auctioned on 3rd Sep (two days ago) is 3.4%. The MAS invoice is simply just like the final subject two weeks ago.

Currently, the MAS Invoice trades shut to 3.41%.

Equipped that the MAS 12-week yield is at 3.41% and the final traded 6-month T-invoice yield is at 3.12%, what’s regularly the T-invoice yield this time round?

The six-month Singapore Treasury invoice yield have to nonetheless proceed to face rigidity no subject the weakening USD. I won’t be stunned if we gaze the yield for this upcoming subject be closer to 3.04%.

Here are your other Increased Return, Safe and Short-Term Financial savings & Funding Strategies for Singaporeans in 2023

You shall be wondering whether other savings & investment alternatives present you with better returns nonetheless are nonetheless rather safe and liquid enough.

Here are completely different other categories of securities to rob into consideration:

| Safety Form | Differ of Returns | Lock-in | Minimal | Remarks |

|---|---|---|---|---|

| Fixed & Time Deposits on Promotional Charges | 4% | 12M -24M | ||

| Singapore Financial savings Bonds (SSB) | 2.9% – 3.4% | 1M | A appropriate SSB Instance.” records-listing=”Max $200k per particular person. When in set a matter to, it would possibly perchance presumably additionally be no longer easy to get an allocation. A appropriate SSB Instance.”>Max $200k per particular person. When in set a matter to, it would possibly perchance presumably additionally be no longer easy to get an allocation. A appropriate SSB Instance. | |

| SGS 6-month Treasury Bills | 2.5% – 4.19% | 6M | How to aquire T-payments e-book.” records-listing=”Factual if you happen to own moderately a couple of money to deploy. How to aquire T-payments e-book.”>Factual if you happen to own moderately a couple of money to deploy. How to aquire T-payments e-book. | |

| SGS 1-Year Bond | 3.72% | 12M | How to aquire T-payments e-book.” records-listing=”Factual if you happen to own moderately a couple of money to deploy. How to aquire T-payments e-book.”>Factual if you happen to own moderately a couple of money to deploy. How to aquire T-payments e-book. | |

| Short-period of time Insurance coverage Endowment | 1.8-4.3% | 2Y – 3Y | A appropriate instance Gro Capital Ease” records-listing=”Be definite they’re capital guaranteed. In most cases, there is a maximum quantity probabilities are you’ll perhaps presumably aquire. A appropriate instance Gro Capital Ease“>Be definite they’re capital guaranteed. In most cases, there is a maximum quantity probabilities are you’ll perhaps presumably aquire. A appropriate instance Gro Capital Ease | |

| Money-Market Funds | 4.2% | 1W | Factual if you happen to own moderately a couple of money to deploy. A fund that invests in fastened deposits will actively succor you capture the highest prevailing curiosity rates. Attain read up the factsheet or prospectus to be definite the fund most efficient invests in fastened deposits & equivalents. |

This desk is updated as of 17th November 2022.

There are other securities or merchandise that would possibly perchance presumably honest fail to meet the criteria to present abet your essential, high liquidity and appropriate returns. Structured deposits own derivatives that lift the stage of threat. Many money management portfolios of Robo-advisers and banks own short-period bond funds. Their values would possibly perchance presumably honest fluctuate within the short period of time and have to nonetheless no longer be finest if you happen to require a 100% return of your essential quantity.

The returns equipped are usually no longer solid in stone and have to nonetheless fluctuate in line with the scorching brief curiosity rates. You would possibly want to always nonetheless undertake more intention-based planning and utilize essentially the most lawful devices/securities to succor you ranking or spend down your wealth as a alternative of getting your complete money in brief savings & investment alternatives.

Whereas you happen to would truly like to alternate these shares I mentioned, probabilities are you’ll perhaps presumably commence an story with Interactive Brokers. Interactive Brokers is the leading low-rate and efficient dealer I utilize and believe to make investments & alternate my holdings in Singapore, the US, London Inventory Alternate and Hong Kong Inventory Alternate. They allow you to alternate shares, ETFs, alternatives, futures, forex, bonds and funds worldwide from a single integrated story.

That you just would perchance read more about my pointers on Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with methods to build & fund your Interactive Brokers story without issues.

Kyith is the Proprietor and Sole Writer on the abet of Funding Moats. Readers tune in to Funding Moats to learn and create stronger, firmer wealth foundations, methods to own a Passive investment approach, know more about investing in REITs and the nuts and bolts of Energetic Investing.

Readers additionally observe Kyith to learn the model to idea effectively for Monetary Safety and Monetary Independence.

Kyith labored as an IT operations engineer from 2004 to 2019. Currently, he works as a Senior Strategies Specialist in Insurance coverage Initiate up-up Havend. All opinions on Funding Moats are his own and would no longer signify the views of Providend.

That you just would perchance understand Kyith’s recent portfolio right here, which uses his Free Google Inventory Portfolio Tracker.

His investment dealer of assorted is Interactive Brokers, which lets in him to make investments in securities from completely different exchanges all around the realm, at very low commission rates, without custodian prices, shut to standing forex rates.

That you just would perchance read more about Kyith right here.

Most stylish posts by Kyith (gaze all)