A Singapore Treasury Bill field (BS24100F) will seemingly be auctioned on Thursday, 4 January 2024.

Within the occasion you take care of to subscribe successfully, derive your whisper through Web banking (Cash, SRS, CPF-OA, CPF-SA) or in individual (CPF) by third January.

That you just can investigate cross-check the predominant points at MAS here.

Within the past, I have shared with you the virtues of the Singapore T-bills, their finest uses, and straight forward programs to subscribe to them here: How to Buy Singapore 6-Month Treasury Bills (T-Bills) or 1-Year SGS Bonds.

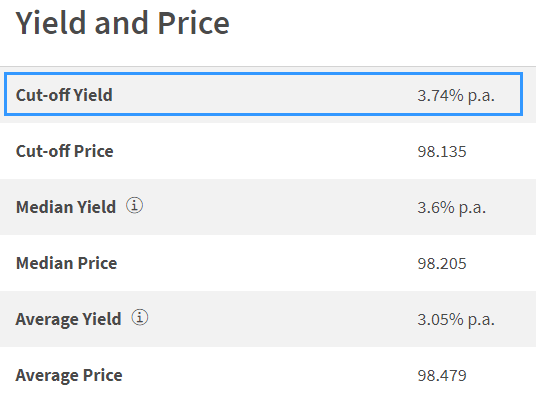

The minimize-off yield worthwhile Tbill bidders can form is 3.73%.

For the 2d time, while you opt out a non-aggressive express, you are going to be pro-rated the amount you express and would yield 3.73%. Within the occasion you wish to make certain you secured all that you simply express, that is also better to favor a aggressive express, nevertheless you wish to derive your express just.

Some of you who take care of to derive 100% of what you express for can favor aggressive bidding as a substitute. In aggressive bidding, in case your express is lower than the eventual minimize-off yield (in the instance below), you’re going to derive 100% of what you express for on the minimize-off yield (no longer the lower yield that you simply express for):

Aggressive bidding is better for people that take care of to procure thoroughly what they take care of to derive for certain financial planning reasons, such as doing CPF Special Tale (SA) shielding. But on story of we received’t know what is the minimize-off yield, a rule of thumb I’d exercise is half of the least minimize-off yield.

I have a pair of complaints that by placing this rule accessible, I will seemingly be section of the motive the minimize-off yield is lower. I in actual fact feel that if someone has a certain financial planning motive (reveal SA Shielding) to express lower, then I judge that is pure. The public sale system in save of residing factors in characters that prefer the bonds no topic the yield, and if there are a form of of us with such an bustle, then the final public sale reflects that mammoth request of on story of when request of is colossal, the worth (on this case, yield goes down) goes up.

Gaining Insights About the Upcoming Singapore T-invoice Yield from the Day after day Closing Yield of Original Singapore T-bills.

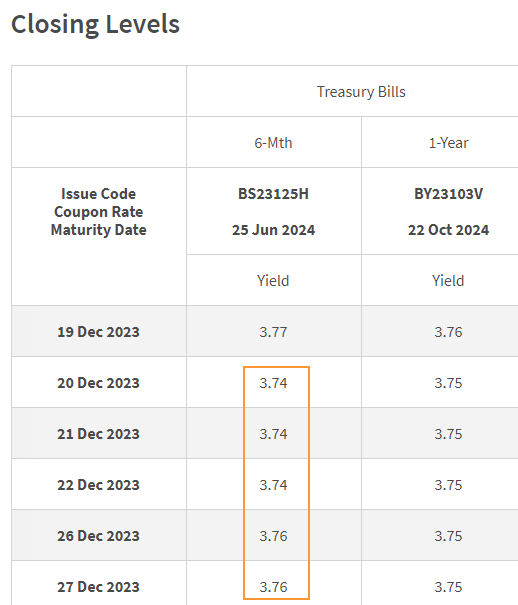

The table below shows the hot passion yield the six-month Singapore T-bills is shopping and selling at:

The day after day yield at closing affords us a rough indication of how noteworthy the 6-month Singapore T-invoice will trade on the pause of the month. From the day after day yield at closing, we must search recordsdata from the upcoming T-invoice yield to trade end to the yield of the final field.

Currently, the 6-month Singapore T-bills are shopping and selling end to a yield of 3.76%, rather an equivalent to three.77% yield we noticed two weeks previously.

Gaining Insights About the Upcoming Singapore T-invoice Yield from the Day after day Closing Yield of Original MAS Bills.

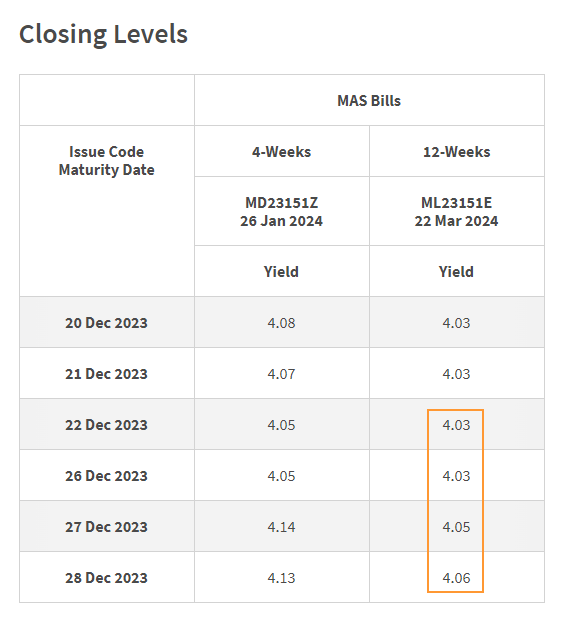

On the total, the Financial Authority of Singapore (MAS) will field a 4-week and a 12-week MAS Bill to institutional patrons.

The credit quality or the credit threat of the MAS Bill wants to be very an equivalent to Singapore T-bills for the reason that Singapore govt issues each. The 12-week MAS Bill (3 months) wants to be the closest term to the six-month Singapore T-bills.

Thus, we are able to originate insights into the yield of the upcoming T-invoice from the day after day closing yield of the 12-week MAS Bill.

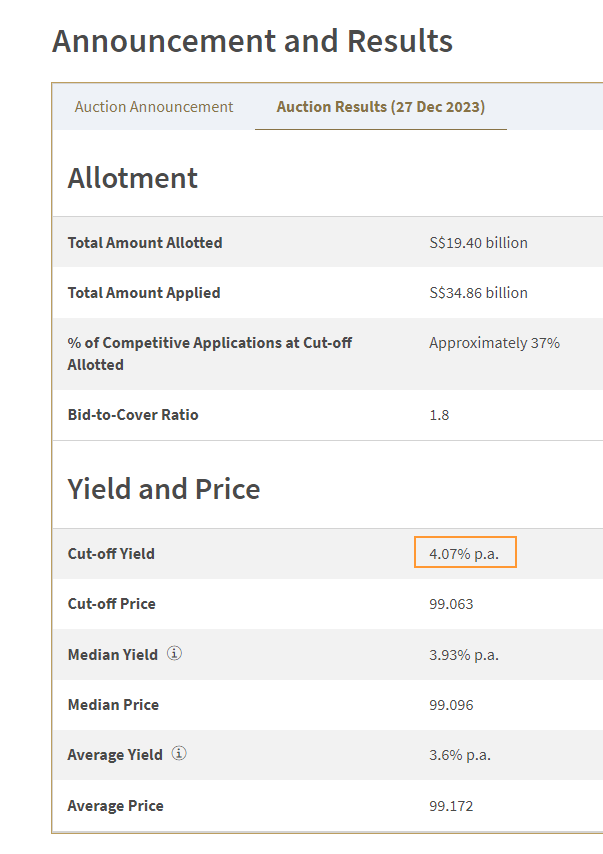

The minimize-off yield for the most modern MAS invoice auctioned on twenty seventh Dec (a day previously) is 4.07%. The MAS invoice is somewhat lower than the final field two weeks previously.

Currently, the MAS Bill trades end to 4.06%.

Provided that the MAS 12-week yield is at 4.06% and the final traded 6-month T-invoice yield is at 3.76%, what’s going to seemingly be the T-invoice yield this time round?

We proceed to leer that the 1-month and 3-month trade with a difference to the 6-month and one-year Treasury invoice yields currently traded with a difference, and this seemingly manner that the yield on the 12-week MAS Bill couldn’t be indicative of the save the 6-month treasury invoice sooner or later trades at.

Inflation has advance down nevertheless for the final quarter the rapid pause of the passion yield curve have close namely the an identical. If the Federal Reserve favor to hike or reduce rates, this would possibly perhaps well trade.

I assassinate peek that the rapid-term rates to hover across the fluctuate nevertheless given the strength of shopping and selling, we would perhaps well perhaps pause up nearer to 3.80% on this field.

Listed below are your other Elevated Return, Safe and Rapid-Term Financial savings & Funding Alternate choices for Singaporeans in 2023

You are going to be questioning whether or no longer other savings & funding alternatives give you greater returns nevertheless are aloof moderately safe and liquid ample.

Listed below are different other categories of securities to succor in thoughts:

| Security Form | Vary of Returns | Lock-in | Minimal | Remarks |

|---|---|---|---|---|

| Mounted & Time Deposits on Promotional Charges | 4% | 12M -24M | ||

| Singapore Financial savings Bonds (SSB) | 2.9% – 3.4% | 1M | An true SSB Instance.” recordsdata-whisper=”Max $200k per individual. When in request of, it would perhaps well perhaps additionally additionally be spicy to derive an allocation. An true SSB Instance.”>Max $200k per individual. When in request of, it would perhaps well perhaps additionally additionally be spicy to derive an allocation. An true SSB Instance. | |

| SGS 6-month Treasury Bills | 2.5% – 4.19% | 6M | How to buy T-bills e-book.” recordsdata-whisper=”Fair correct while you have a form of cash to deploy. How to buy T-bills e-book.”>Fair correct while you have a form of cash to deploy. How to buy T-bills e-book. | |

| SGS 1-Year Bond | 3.72% | 12M | How to buy T-bills e-book.” recordsdata-whisper=”Fair correct while you have a form of cash to deploy. How to buy T-bills e-book.”>Fair correct while you have a form of cash to deploy. How to buy T-bills e-book. | |

| Brief Insurance coverage Endowment | 1.8-4.3% | 2Y – 3Y | An true instance Gro Capital Ease” recordsdata-whisper=”Guarantee they are capital assured. Continuously, there is a maximum quantity you would possibly well perhaps additionally buy. An true instance Gro Capital Ease“>Guarantee they are capital assured. Continuously, there is a maximum quantity you would possibly well perhaps additionally buy. An true instance Gro Capital Ease | |

| Money-Market Funds | 4.2% | 1W | Fair correct while you have a form of cash to deploy. A fund that invests in fixed deposits will actively enable you capture the highest prevailing passion rates. Originate read up the factsheet or prospectus to guarantee the fund only invests in fixed deposits & equivalents. |

This table is updated as of 17th November 2022.

There are other securities or merchandise that would perhaps well perhaps fail to meet the factors to present encourage your essential, excessive liquidity and correct returns. Structured deposits luxuriate in derivatives that create bigger the stage of threat. Many cash management portfolios of Robo-advisers and banks luxuriate in rapid-length bond funds. Their values would perhaps well perhaps fluctuate in the rapid term and couldn’t be finest while you require a 100% return of your essential quantity.

The returns offered are no longer solid in stone and would perhaps well perhaps fluctuate in step with the hot rapid-term passion rates. It’s most realistic to undertake extra aim-primarily based planning and exercise the most finest devices/securities to enable you procure or employ down your wealth as a substitute of having all of your money in transient-term savings & funding alternatives.

Within the occasion you wish to trade these shares I talked about, you would possibly well perhaps additionally open an story with Interactive Brokers. Interactive Brokers is the leading low-worth and atmosphere pleasant broker I exercise and belief to speculate & trade my holdings in Singapore, the United States, London Stock Commerce and Hong Kong Stock Commerce. They permit you to trade shares, ETFs, alternatives, futures, forex, bonds and funds worldwide from a single integrated story.

That you just can read extra about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Sequence, starting up with straightforward programs to assassinate & fund your Interactive Brokers story without anguish.

Kyith is the Proprietor and Sole Creator in the encourage of Funding Moats. Readers tune in to Funding Moats to be taught and produce stronger, firmer wealth foundations, straightforward programs to have a Passive funding approach, know extra about investing in REITs and the nuts and bolts of Packed with life Investing.

Readers additionally follow Kyith to search out out straightforward programs to conception effectively for Financial Security and Financial Independence.

Kyith worked as an IT operations engineer from 2004 to 2019. Currently, he works as a Senior Alternate choices Specialist in Insurance coverage Start-up Havend. All opinions on Funding Moats are his hold and does no longer list the views of Providend.

That you just can investigate cross-check Kyith’s contemporary portfolio here, which uses his Free Google Stock Portfolio Tracker.

His funding broker of selection is Interactive Brokers, which enables him to speculate in securities from different exchanges all around the area, at very low commission rates, without custodian charges, end to save of residing forex rates.

That you just can read extra about Kyith here.

Newest posts by Kyith (peek all)