Following an improbable beginning to the yr, Sizable Micro Computer‘s (NASDAQ: SMCI) stock chart has passed by a stark reversal over the past six months. It has lost shut to 60% of its price from its height, and most up-to-date developments appear to have extra dented investor self belief within the corporate.

First, the fiscal 2024 fourth-quarter outcomes it released on Aug. 6 weren’t as much as Wall Avenue’s expectations, and management’s guidance used to be disappointing. 2d, fast-vendor Hindenburg Research released a represent alleging accounting irregularities at Supermicro. Then, Supermicro management equipped that it used to be delaying the submitting of its annual represent, which finest added to the detrimental press.

Those factors point to why Wall Avenue analysts were downgrading the stock no longer too lengthy ago. Nonetheless provided that shares of this server and storage programs manufacturer are now procuring and selling at a shapely 22 conditions trailing earnings and 13 conditions forward earnings, opportunistic investors can be tempted to purchase Supermicro. Ought to peaceful they be doing that in light of the most up-to-date developments?

Addressing the elephant within the room

Investors would perchance presumably peaceful disclose that Hindenburg is a fast-vendor, and it has a financial hobby in seeing Supermicro’s stock label drop. In that context, we can’t be obvious that the allegations that Hindenburg is making are unswerving, seriously pondering that the fast-vendor has been imperfect within the past. That acknowledged, Supermicro used to be charged by the Securities and Substitute Price (SEC) for accounting violations in August 2020, when it used to be chanced on to have in come known earnings and understated its costs over a 3-yr duration.

Nonetheless, the corporate has recovered remarkably since then, clocking prominent positive factors over the past couple of years attributable to the emergence of a unique catalyst within the accumulate of synthetic intelligence (AI). Its earnings in its fiscal 2024 extra than doubled to $14.9 billion from $7.1 billion within the old yr. Non-GAAP earnings shot as much as $22.09 per piece, from $11.81 per piece in fiscal 2023.

Addressing the delay in Supermicro’s annual submitting, management clarified that “we fabricate no longer are looking ahead to any enviornment cloth adjustments in our fourth quarter or fiscal yr 2024 financial outcomes.” It added that the corporate is having a stare forward to a “ancient” 2025 with “a file number of orders, a significant and growing backlog of develop wins and main market positions all over hundreds of areas.”

Supermicro says that the most up-to-date developments will no longer have an impress on its production capabilities, and it be on goal to fulfill the demand for its AI server choices. Or no longer it is payment noting that Supermicro is looking ahead to its fiscal 2025 earnings to land between $26 billion and $30 billion. That would perchance presumably be one other yr of significant enhance from its $14.9 billion in fiscal 2024.

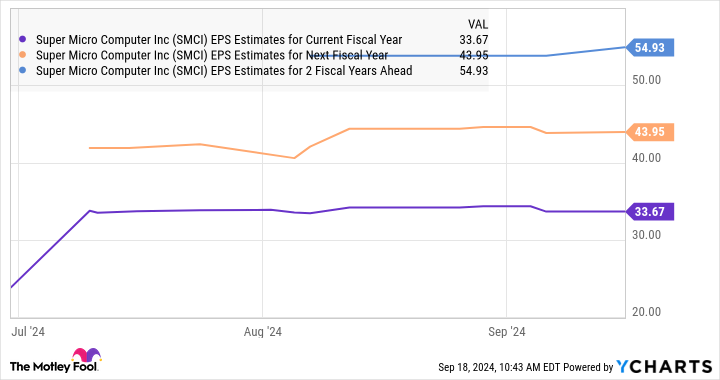

Although it is facing margin challenges attributable to the elevated investments it be making as it boosts capacity to fulfill the significant demand for its liquid-cooled server choices, management is assured that this can return to its normal margin vary sooner than the fiscal yr ends. Analysts’ consensus estimates additionally expose that Supermicro’s earnings are on goal to scheme bigger at an fabulous tempo within the original fiscal yr, adopted by healthy jumps within the next couple of years as successfully.

What would perchance presumably peaceful investors attain?

The delay in Supermicro’s annual submitting led JPMorgan to downgrade the stock from overweight to neutral and to reduce its label goal to $500 from $950. Even Barclays downgraded the stock to equal weight from overweight, citing the margin stress that Supermicro faces as successfully as the submitting delay. Nonetheless, JPMorgan’s downgrade wasn’t a outcomes of the Hindenburg represent nor a reflection of its capacity to alter into compliant, but attributable to the near-timeframe uncertainty that surrounds the corporate and the dearth of a compelling argument to purchase the stock.

So, threat-averse investors would attain successfully to succor for extra readability sooner than buying for this AI stock. Nonetheless, those with elevated threat appetites who’re having a stare so that you can add a fast-growing company to their portfolios can imagine buying for Supermicro now. It appears in a position to sustaining its spectacular enhance within the lengthy escape attributable to the sizable opportunities accessible to it within the AI server market.

Analysts demand Supermicro’s earnings to develop at an annualized payment of 62% over the next 5 years. If the corporate can accumulate past its original troubles, it would atomize as much as be a significant funding pondering the valuation at which it is procuring and selling good now.

Ought to peaceful you make investments $1,000 in Sizable Micro Computer good now?

Prior to you aquire stock in Sizable Micro Computer, imagine this:

The Motley Fool Stock Consultant analyst crew simply known what they mediate are the 10 finest stocks for investors to purchase now… and Sizable Micro Computer wasn’t one among them. The 10 stocks that made the lower would perchance presumably scheme monster returns within the coming years.

Clutch into chronicle when Nvidia made this checklist on April 15, 2005… while you invested $1,000 at the time of our advice, you’d have $710,860!*

Stock Consultant presents investors with an easy-to-observe blueprint for achievement, along with guidance on building a portfolio, normal updates from analysts, and two unique stock picks each month. The Stock Consultant service has extra than quadrupled the return of S&P 500 since 2002*.

*Stock Consultant returns as of September 16, 2024

JPMorgan Trail is an advertising companion of The Ascent, a Motley Fool company. Harsh Chauhan has no location in any of the stocks talked about. The Motley Fool has positions in and recommends JPMorgan Trail. The Motley Fool recommends Barclays Plc. The Motley Fool has a disclosure policy.

Is Sizable Micro Computer Stock a Aquire Now? used to be originally printed by The Motley Fool