In some of my previous conversations with a pair of my mates, I believed a more in-depth formula to aid out dividend investing for them is to let a fund manager operate their dividend map for them.

The shriek with that formula is that a particular buddy may well well also take into fable a fund manager is more healthy than any other or that the return performance of a fund manager is too unsure that he would no longer unquestionably feel assured about it.

Recordsdata flash: Must you invest in a portfolio of equities, your returns will be unsure whether or no longer you admire it or no longer. Even bond returns are unsure resulting from reinvestment threat.

For the time being, we can invest in a systematically stuffed with life ETF that expresses our funding philosophy by investing in excessive-dividend securities.

On this video, I deep-dived into one such ETF, the Forefront FTSE All-World Excessive Dividend UCITS ETF:

I made a gorgeous long video because I went in-depth right into a form of areas:

- The model you can dawdle a portfolio as a dividend investor

- Introduction to the fund

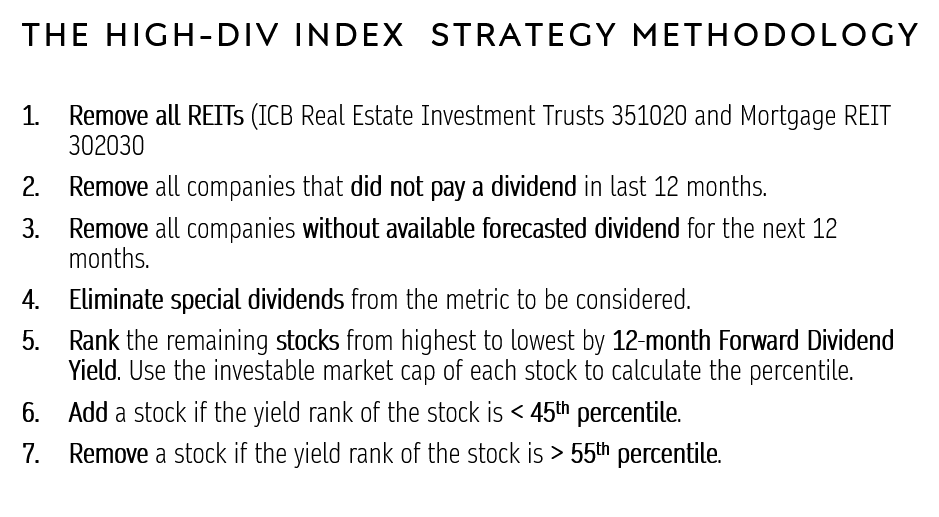

- How VHYL & VHYG systematically invest in excessive-dividend firms

- The Advantages of Enforcing Your Dividend Formulation with an ETF

- What’s going to we call this form of ETF?

- Going thru one of the crucial VHYL/VHYG fund characteristics reminiscent of returns, dividends

- Amassing vs distributing funds designate performance

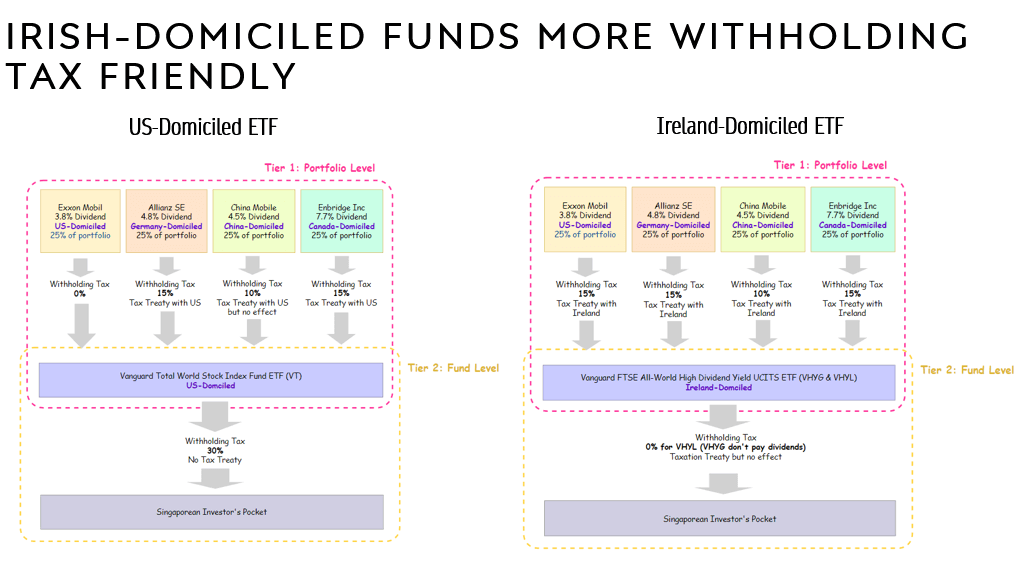

- Why Irish-domiciled ETFs are most in model. Illustrating the Withholding Tax distinction between a US-domiciled ETF and an Irish one.

- Crafting a spending notion spherical VHYL by just spending the dividends paid out

- So, will we possess the revenue more consistent and aid our procuring energy?

- Combining the gathering and distributing funds into one notion.

I made the video no longer so that you just can total in a single sitting and whenever you are attracted to the form of topic. Must you are, enact use some time on it and don’t power yourself to aid out staring at in a single sitting.

Right here are some strategies further strategies about what I offered.

We can relish an option of carrying the portfolio manager hat and being straight enthusiastic with the securities resolution and option-making, but to simplify issues and are living a much less difficult existence, we may well well also desire to delegate the responsibility away right into a Neat Beta Excessive Dividend map embedded inner an stuffed with life index.

Other divided ETF may well well also dawdle a assorted map from this but when we review its methodology, you can even realize you are doing a form of identical issues to this mechanical map.

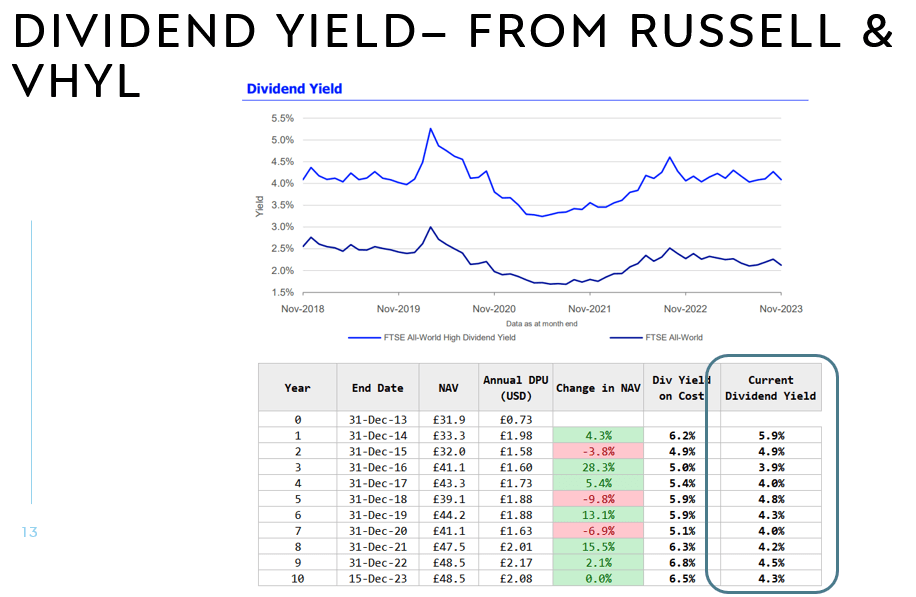

Right here is the doubtless dividend yield, whenever you address to aquire it at varied years from 2013 to 2023. The dividend yield may well well even be excessive enough for you but it varies.

I tried my simplest to display hide withholding tax to the audience any other time. Took a bit of of time, but you can even relish fleshing this out since this modified into once requested moderately time and any other time.

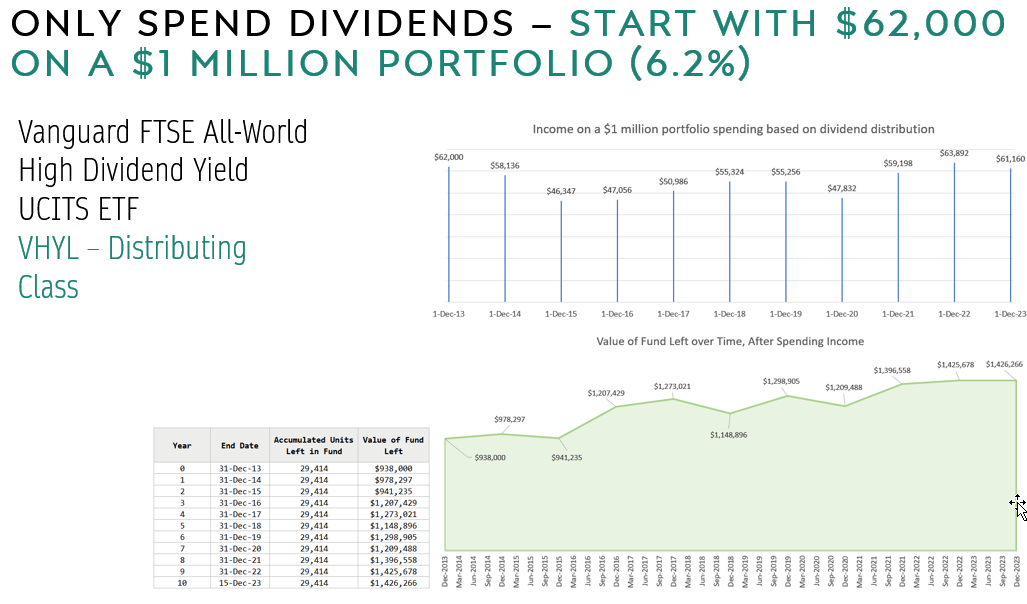

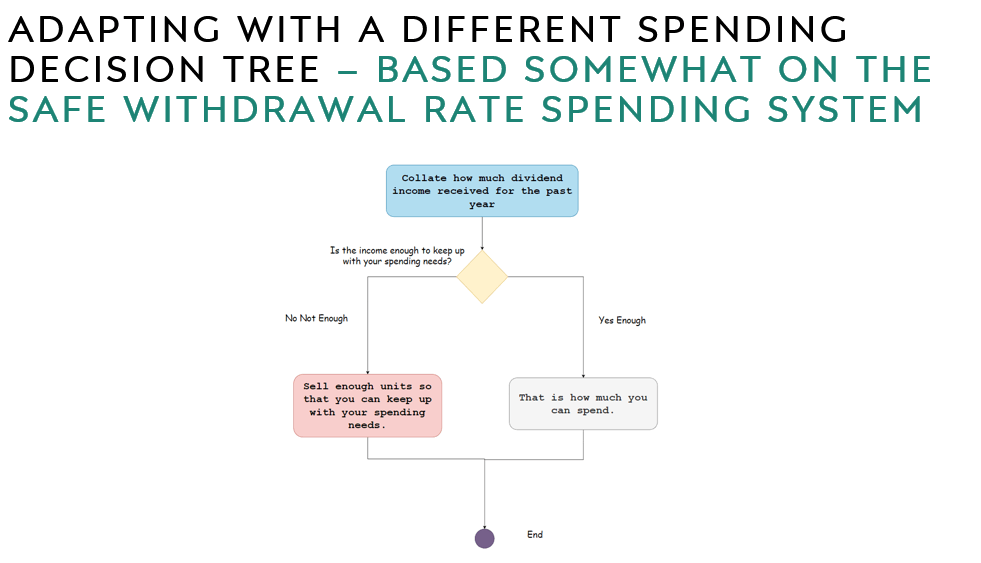

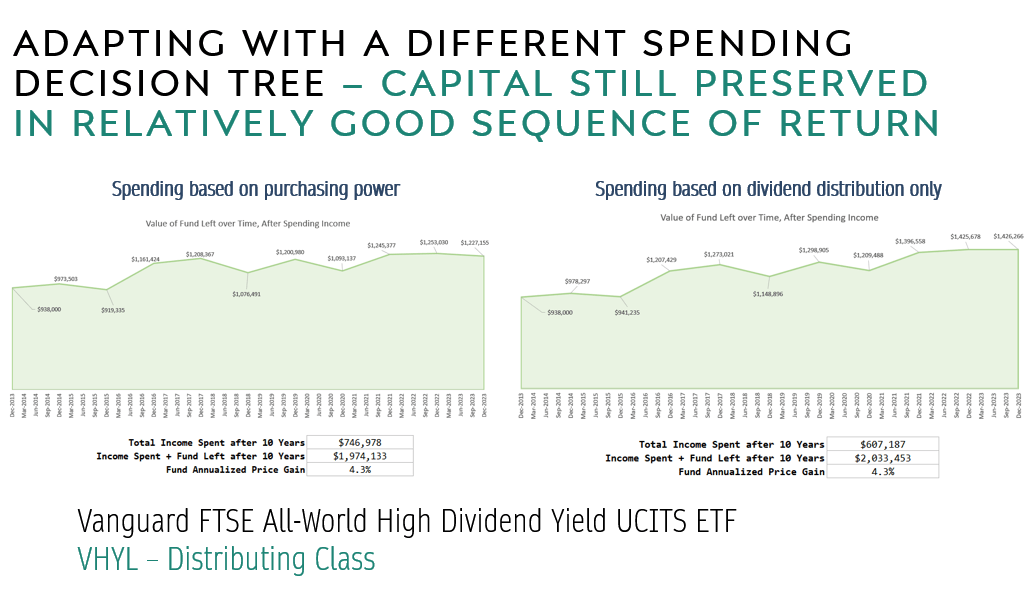

How does the portfolio look if we address to use most productive the revenue of the portfolio?

The length is moderately quick, but we can peep how issues are if we use at a gorgeous excessive SWR.

The revenue from spending dividends most productive is much less consistent, but will we originate spherical more revenue consistency but unruffled possess use of a distributing ETF?

It turns out it’s miles workable within the quick time length that we relish. Under no circumstances does this imply adopting this map will work with all historical 20 or 30-300 and sixty five days classes you can even are living thru, but I show that you just can even win consistent, inflation-adjusted revenue and unruffled aid your capital when compared to a use-dividend-most productive map.

In characterize so that you just can alternate these stocks I mentioned, you can even begin an fable with Interactive Brokers. Interactive Brokers is the leading low-designate and environment pleasant dealer I use and have confidence to invest & alternate my holdings in Singapore, the usa, London Stock Trade and Hong Kong Stock Trade. They imply you can even alternate stocks, ETFs, alternatives, futures, foreign exchange, bonds and funds worldwide from a single constructed-in fable.

That it’s doubtless you’ll also read more about my strategies about Interactive Brokers in this Interactive Brokers Deep Dive Sequence, initiating with how to originate & fund your Interactive Brokers fable without distress.

Kyith is the Proprietor and Sole Author within the back of Investment Moats. Readers tune in to Investment Moats to be taught and originate stronger, firmer wealth foundations, how to relish a Passive funding map, know more about investing in REITs and the nuts and bolts of Inviting Investing.

Readers also voice Kyith to be taught the formula to devise effectively for Monetary Security and Monetary Independence.

Kyith labored as an IT operations engineer from 2004 to 2019. For the time being, he works as a Senior Solutions Specialist in Insurance coverage Delivery-up Havend. All opinions on Investment Moats are his occupy and does no longer characterize the views of Providend.

That it’s doubtless you’ll also peek Kyith’s present portfolio here, which makes use of his Free Google Stock Portfolio Tracker.

His funding dealer of replacement is Interactive Brokers, which permits him to invest in securities from assorted exchanges at some stage within the arena, at very low charge rates, without custodian expenses, conclude to space currency rates.

That it’s doubtless you’ll also read more about Kyith here.

Most novel posts by Kyith (peep all)