I in actual fact have confidence a friend who asked me about the performance of First Sentier FSSA Dividend Earnings towards the Emerging Market index.

FSSA Dividend Earnings is doubtless one of the main popular funds since I started investing in 2003.

Evaluating the performance of Dividend Earnings to an Emerging Market index is an apples-to-orange comparison.

That apart, right here is the annualized total returns:

| Fund/Index | 1M | 3M | 1Y | 3Y | 5Y |

| iShares MSCI Emerging Market IMI Index ETF (EIMI) | 8.4% | 8.7% | 17.7% | -0.7% | 4.2% |

| FSSA Dividend Earnings | 8.0% | 8.4% | -0.4% | -4.3% | 2.9% |

I adjust the EIMI, which is a USD denominated index, to have faith SGD appreciation over the assorted time classes.

EIMI is doing better than the FSSA Dividend Earnings.

But there will be no longer much surprises because of the we’re comparison a portfolio of Asia stocks towards Emerging market stocks.

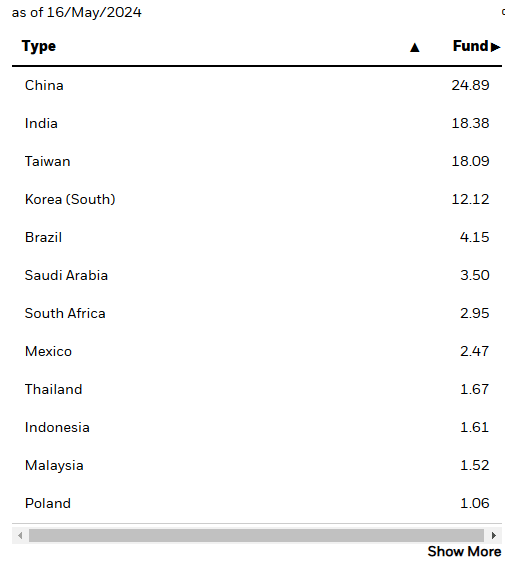

Here is the residing allocation for First Sentier Dividend Earnings:

And right here’s EIMI:

The wonderful distinction is how much of South Korea, Brazil, Saudi Arabia and South Africa over Dividend Earnings’s allocation.

The funds are residing and die by their holdings.

We ought to silent snatch a seek recordsdata from at some longer timeframe performance, and a greater knowledge residing if we’re irregular about whether it is a accurate idea to swap to an rising market fund.

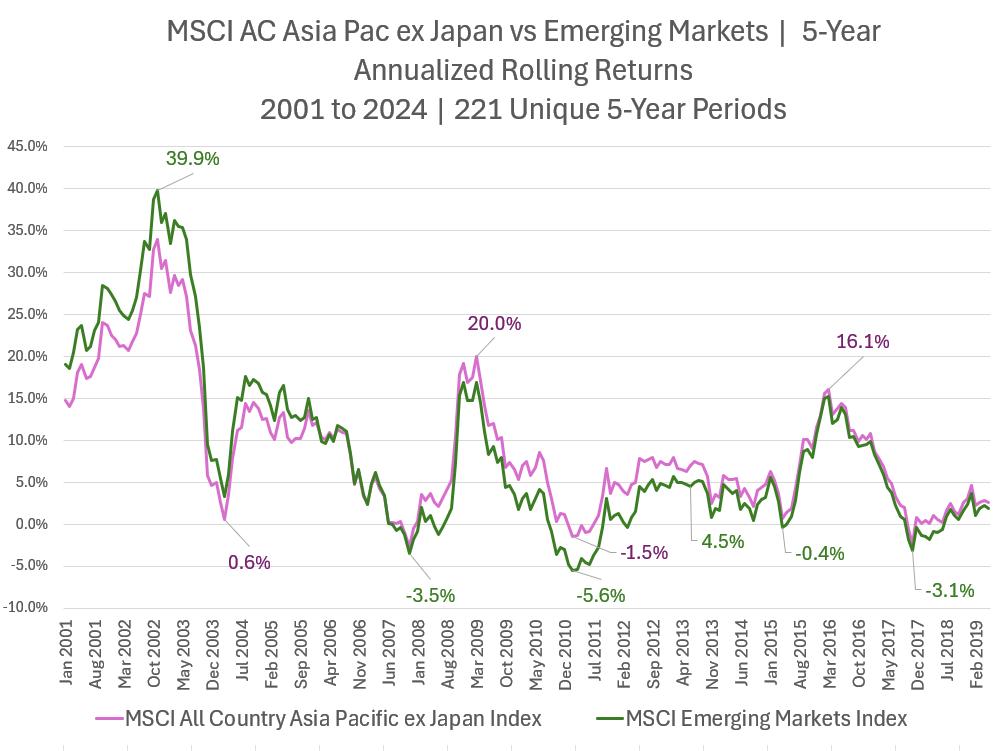

In the chart beneath, I collated the rolling 5-12 months annualized returns of the MSCI All Country Asia Pacific ex Japan index towards the MSCI Emerging Market index:

We have returns knowledge from 2001 to April 2024, which allowd us to mediate upon 221 irregular 5-12 months returns.

Any point on this chart is an annualized return so 39.9% is the annualized return while you delivery investing in Oct 2002 to Sep 2006.

You would perchance presumably perhaps also leer that the inexperienced line (Emerging markets) is continually above the crimson line (AC Asia Pacific ex Japan) while you invest earlier than 2008 and since then, the AC Asia Pacific ex Japan have confidence done better.

But no longer by much.

There are clear 5-12 months classes where the variation is main ample. The 5 12 months classes starting in Jan 2010 is one. If you are in MSCI Emerging markets, your annualized return will be -5.6% p.a. but while you are in AC Asia Pacific ex Japan, this might presumably be better at -1.5% p.a.

What can we learn from this? There are about a main international locations that create up a enormous composition of each Asia Pacific ex Japan and Emerging markets and so what will separate the performance is the performance of those international locations that is point to in a single and no longer in one more.

Brazil and South Africa will be about a of the main international locations.

I leave it to my friend to create his investment decision.

I invested in a a range of portfolio of alternate-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My most well-most popular broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers enable you to trade in the US, UK, Europe, Singapore, Hong Kong and loads diverse markets. Alternatives as effectively. There are no longer any minimal monthly charges, very low international replace costs for forex alternate, very low commissions for diverse markets.

To to find out extra talk over with Interactive Brokers these days.

Be part of the Funding Moats Telegram channel right here. I could section the materials, research, investment knowledge, deals that I method upon that enable me to hump Funding Moats.

Save Luxuriate in Me on Fb. I section some tidbits that are no longer on the weblog put up there continuously. You would perchance presumably perhaps presumably additionally resolve to subscribe to my voice material through the electronic mail beneath.

I crash down my sources according to these topics:

- Constructing Your Wealth Foundation – If and discover these easy monetary ideas, your very prolonged timeframe wealth ought to silent be handsome much managed. Uncover what they are

- Filled with life Investing – For energetic stock investors. My deeper tips from my stock investing journey

- Discovering out about REITs – My Free “Direction” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Note all of the frequent 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many treasure

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much or no longer it is crucial to enact these, and the assorted ways you will also additionally be financially free

- Providend – The build apart I primitive to work doing research. Rate-Easiest Advisory. No Commissions. Financial Independence Advisers and Retirement Experts. No price for the first meeting to know the procedure in which it in actual fact works

- Havend – The build apart I for the time being work. We would like to deliver commission-based entirely insurance recommendation in a much bigger procedure.

Kyith is the Owner and Sole Writer in the back of Funding Moats. Readers tune in to Funding Moats to learn and plot stronger, extra impregnable wealth foundations, the technique to have confidence a Passive investment method, know extra about investing in REITs and the nuts and bolts of Filled with life Investing.

Readers additionally insist Kyith to learn the technique to position effectively for Financial Security and Financial Independence.

Kyith labored as an IT operations engineer from 2004 to 2019. Currently, he works as a Senior Solutions Specialist in Insurance Delivery up-up Havend. All opinions on Funding Moats are his hang and does no longer represent the views of Providend.

You would perchance presumably perhaps presumably glance Kyith’s most up-to-date portfolio right here, which uses his Free Google Stock Portfolio Tracker.

His investment broker of preference is Interactive Brokers, which permits him to invest in securities from assorted exchanges in all places the field, at very low commission rates, with out custodian costs, terminate to residing forex rates.

You would perchance presumably perhaps presumably read extra about Kyith right here.

Most popular posts by Kyith (glimpse all)