One day of the mid-Nineties, the appearance of the bag opened fresh doors for corporate The United States and altered its boost trajectory eternally. But for more than a quarter of a century, educated and everyday traders were pondering which transformative innovation would possibly perchance well presumably be subsequent to rival what the bag did for agencies. Artificial intelligence (AI) appears to be the anointed resolution to this long-standing predict.

With AI, machine and programs oversee projects that would possibly perchance well previously were assigned to people. What gives AI such enormous-reaching attainable — PwC believes man made intelligence can add $15.7 trillion to the worldwide financial system by 2030 — is the potential for machine and programs to learn and evolve without human intervention.

Even if AI shares were in terms of unstoppable over the final 18 months, a shift in AI euphoria can also very successfully be brewing, with Nvidia (NASDAQ: NVDA) being the perpetrator within the back of it.

Nvidia’s working ramp has been in terms of flawless

Earlier than I dig into the negatives, let’s give credit where credit is due. Semiconductor titan Nvidia modified into in a role to harness its first-mover advantage to alter into the main provider of graphics processing objects (GPUs) in AI-accelerated files services and products.

Consistent with an evaluation from the researchers at TechInsights, Nvidia accounted for 3.76 million of the three.85 million GPUs that were shipped to project files services and products final year. For these of you questioning, this represents a cool 98% market part.

On high of its first-mover advantage, Nvidia holds optimistic-decrease compute advantages over its competition. Whereas Intel (NASDAQ: INTC) and Developed Micro Units (NASDAQ: AMD) are trying and play gain-as much as Nvidia’s in-query H100 GPU, Nvidia is readying to roll out its subsequent-technology GPU architecture, diagnosed as Blackwell. In June, CEO Jensen Huang also teased the successor to Blackwell, diagnosed as Rubin, which is anticipated to hit the market in 2026.

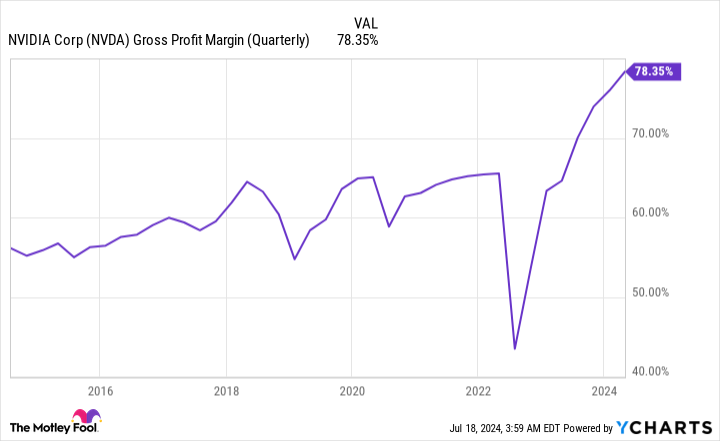

The query for Nvidia’s chips has also overwhelmed their supply. When an in-query correct is in tight supply, it be not irregular for the gross sales trace of stated correct to meaningfully magnify. Nvidia has been in a role to lift its H100 to (at one point) north of $40,000 per chip. The end result’s a distinguished growth within the firm’s adjusted irascible margin to 78.35% at some stage within the fiscal first quarter (ended April 28).

The AI revolution has lifted Nvidia’s shares by 706% since the birth up of 2023, which has boosted its market cap by more than $2.7 trillion. It be this historical scaling from no doubt one of Wall Toll road’s most influential agencies that compelled the firm’s board to total a 10-for-1 stock split in June.

Alternatively, Nvidia’s glory days can also show to be short-lived.

Nvidia’s receive forecast is an ominous warning of challenges to reach back

No topic how high the bar has been reveal, Nvidia has hurdled Wall Toll road’s revenue and revenue forecasts in every of the old 5 quarters. However the firm’s adjusted irascible margin forecast for the fiscal second quarter gives an ominous warning for Wall Toll road and traders that must not be not eminent.

Nvidia’s second-quarter steering requires its adjusted irascible margin to reach back in at 75.5%, plus or minus 50 basis positive aspects. This would possibly occasionally seemingly ticket a 235 to 335 basis-point decline from the 78.35% adjusted irascible margin reported within the fiscal first quarter.

In one appreciate, a 75.5% adjusted irascible margin is set 10 percentage positive aspects elevated than where issues stood in early 2022. A 75% to 76% adjusted irascible margin is soundless phenomenal for a alternate the size of Nvidia.

On the varied hand, this represents the first expected decline in adjusted irascible margin since the summer season of 2022. More importantly, it appears to be like to be a transparent warning that the otherworldly pricing energy Nvidia has enjoyed is foundation to dissipate.

Intel and AMD have not been nervous about their want to chip away at Nvidia’s hardware monopoly in project files services and products. Intel unveiled its Gaudi 3 AI accelerator chip in April, with plans of a ramped up industrial birth at some stage within the third quarter. In the period in-between, AMD has been beefing up production of its MI300X AI-GPU, which is seriously more cost-effective than the H100 GPU.

Even if some positive aspects of the Gaudi 3 and MI300X offer aggressive edges over Nvidia’s H100, the latter holds a transparent-decrease compute advantage. The distress for Nvidia is that it be nowhere shut to assembly the query of its possibilities. In consequence, Intel and AMD don’t occupy any trouble finding a solid market for their AI-GPUs within the arriving months.

Furthermore, Nvidia’s high four possibilities by bag gross sales — Microsoft, Meta Platforms, Amazon, and Alphabet — are internally constructing AI-GPUs for their respective files services and products.

A lot like Intel and AMD, these in-home chips aren’t going to rival the compute potential of Nvidia’s H100 or Blackwell architecture. But they are going to rob up precious exact property in AI-accelerated files services and products. The sort of these AI-GPUs also gives a pretty optimistic message that The United States’s most influential agencies purpose to diminish their reliance on Nvidia’s hardware going forward.

The huge majority of Nvidia’s boost over the final 5 quarters can also very successfully be traced to its pricing energy. With Intel and AMD reveal to flood the market with additional chips, and four “Very finest Seven” companies constructing AI chips for interior spend, the AI-GPU scarcity that is fueled Nvidia’s adjusted margin ramp goes to recede. Nvidia’s forecast decline in adjusted irascible margin seemingly speaks to these pricing pressures, which I judge will simplest grow stronger in subsequent quarters.

But wait — there would possibly be more

To boot to Nvidia’s receive forecast reputedly portending trouble, history hasn’t been all that kind to subsequent-giant-thing innovations, applied sciences, and traits.

When examined over long periods, some hyped traits occupy made traders seriously richer (e.g., the bag), whereas others ended up face-planting (e.g., 3D printing and hashish shares). But one thing every single subsequent-giant-thing innovation or sort has had in usual since the mid-Nineties is that all of them endured a bubble-bursting match early in their existence.

To be optimistic, there would possibly be not any device to precisely forecast when the music will stop or the euphoria will recede by device of a game-changing technology or buzzy sort. But when taking a look within the rearview contemplate, there hasn’t been a single occasion for three a long time where traders didn’t overestimate the adoption and/or utility of a fresh technology or sort.

Whereas some traders would be of the thought that man made intelligence has the flexibility to buck this unwritten rule, in actual fact that most agencies lack a successfully-defined blueprint for the device AI goes to magnify gross sales and profits. This, by definition, demonstrates an overestimation of adoption and/or utility of this game-changing technology.

I strongly judge there would possibly be a course for man made intelligence to meaningfully pork up global productivity and provide consumption-facet advantages when taking a look 10 or twenty years into the long gallop. But over the subsequent year or two, I check it to alter into painfully obvious to Wall Toll road and everyday traders that most agencies have not any exact blueprint to generate a return on their AI investments.

With history as my files, and Nvidia’s steering as my confirmation, I fully check the AI bubble to burst sooner as every other of later.

Would possibly well soundless you invest $1,000 in Nvidia wonderful now?

Earlier than you aquire stock in Nvidia, put in mind this:

The Motley Fool Stock Manual analyst team correct diagnosed what they judge are the 10 simplest shares for traders to aquire now… and Nvidia wasn’t no doubt one of them. The ten shares that made the decrease would possibly perchance well presumably sort monster returns within the arriving years.

Take into memoir when Nvidia made this checklist on April 15, 2005… whereas you invested $1,000 on the time of our recommendation, you’d occupy $741,989!*

Stock Manual gives traders with an effortless-to-discover blueprint for success, including steering on building a portfolio, current updates from analysts, and two fresh stock picks every month. The Stock Manual service has more than quadrupled the return of S&P 500 since 2002*.

Secure out about the 10 shares »

*Stock Manual returns as of July 15, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Fool’s board of administrators. Randi Zuckerberg, a broken-down director of market sort and spokeswoman for Facebook and sister to Meta Platforms CEO Note Zuckerberg, is a member of The Motley Fool’s board of administrators. John Mackey, broken-down CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Fool’s board of administrators. Sean Williams has positions in Alphabet, Amazon, Intel, and Meta Platforms. The Motley Fool has positions in and recommends Developed Micro Units, Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the next alternate strategies: long January 2025 $forty five calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Figuring out: This Nvidia Forecast All however Confirms That the Artificial Intelligence (AI) Bubble Will Burst Sooner Quite Than Later modified into within the muse revealed by The Motley Fool