In my closing showcase about whether I must shift my fastened income allocation a long way off from the World Combination bond index fund, I purchased into two separate discussions referring to what I said about asset-licensed responsibility matching with a bond fund.

I said that:

Be distinct that the sensible duration of your fastened income ETF/unit belief is now not up to the time you want the cash (your atomize-even level).

A Telegram team member tries to showcase that a conventional bond fund would reinvest a matured bond into one other bond. The bond tenor and duration would roughly be maintained.

Train we make investments in a world aggregate bond fund with an sensible duration of 6.5 years and an sensible tenor of 8 years. If I truly comprise a time horizon of 12 years to my purpose, I wants to be ready to make investments within the arena aggregate bond fund, as explained within the statement above.

The member’s level is that as one bond matures and reinvested accurate into a bond with tenor discontinuance to the fund sensible, the fund may maybe maybe well maybe be subjected to the same hobby fee risks all over again. That can maybe well well mean that you don’t rating discontinuance to the yield to maturity, which is the size of the value of the bond at the commence.

Subsequently, a Johnny commented within the weblog post:

For bond funds, my determining is that you have got gotten to be ready to protect for 2x the duration of the fund within the tournament of a rising hobby fee atmosphere, now not like minded 1x the duration of the fund.

He additionally pointed me to the examine paper that states this: For Fixed-Duration or Fixed-Maturity Bond Portfolios, Preliminary Yield Forecasts Return Splendid contrivance Twice Duration.

The paper concludes that

- This relationship works on longer-duration of time bond investment.

- The yield of a constant-duration bond portfolio equals the arithmetic mean return over a time horizon same to twice the bond portfolio duration minus one-month.

- There were errors and so that they were ticket by the convexity of the yield path:

- Convex: unfavorable forecast errors.

- Concave: distinct forecast errors.

- This examine appear to manufacture investment-grade bonds seem less unstable to long duration of time traders.

I purchased to thank both for annoying what I wrote.

To be true, it did lumber my mind hat for a bond fund, you may maybe maybe well maybe presumably additionally now not rating exactly the initial yield to maturity.

In my article, I did my finest to ticket that what we’re more effort with is the worst case effort, the attach the investor a minimal of atomize-even on their investment within the event that they abide to the bond fund sensible duration.

In my YouTube video about Crafting a beautiful passive investment portfolio, I shared this bolt referring to the vary of historical returns must you invested in a five-year US Treasury showcase for a duration of five years:

I shared this chart to showcase that must you comprise gotten a shorter need in opposition to some of your financial dreams, having more bonds would manufacture more sense thanks to the higher certain guess within the tournament that market stipulations are now not to your favor. Having the bond allocation will additionally manufacture your portfolio more easy to abdominal at some level of the undergo market sessions.

In 1,111 outlandish five-year sessions, simplest 2 pause up rather of unfavorable.

The position of the bonds is now not to spearhead the return of your portfolio. We hope that there are some returns now not to pull down the final return of the portfolios. However the important thing position is to be low unstable after we most need it.

That said, I didn’t express must you attain that time horizon, you are going to set apart that yield to maturity.

I say both purchased precipitated by the foundation that a constant-duration bond fund may maybe maybe well additionally additionally be negate for asset-licensed responsibility matching. I say that may maybe maybe well well additionally now not be the most easy implementation. The iBonds that I talked about earlier with its fastened maturity may maybe maybe well maybe be a higher implementation.

I reflected upon the whitepaper Johnny pointed me to.

That paper is suitable if hitting the initial yield to maturity is important to you however it undoubtedly additionally says that the 2 times duration is more dependable in case your time horizon is long.

If most of us comprise an awfully long time horizon, would we’re searching to be in equities? I say there are some traders who are more threat adverse who would prefer a discontinuance to 100% fastened income portfolio. However I’d wish to assume if our time horizon to protect our bond allocation is love 20-30 years, we won’t know what yield to maturity we are able to rating at closing as a consequence of we are able to undergo a pair of rounds of maturity.

My Telegram team member gave an instance of a 3-7 year bond ETF. The everyday duration of the bond ETF is ready 4.3-4.5 years. Had we make investments rather of longer than that duration, our returns would light be unfavorable. He did admit that he cherry picked a elegant snide duration.

I purchased recurring about what he said so I tried my finest to simulate.

I needed to make negate of the iShares 3-7 one year Treasury Bond ETF however I had peril getting the NAV. So I resolve to tap upon the tips bank that I truly comprise and managed to search out:

- Bloomberg US Corporate Bond Index 3-7 year

- Bloomberg US Treasury Bond Index 3-7 year

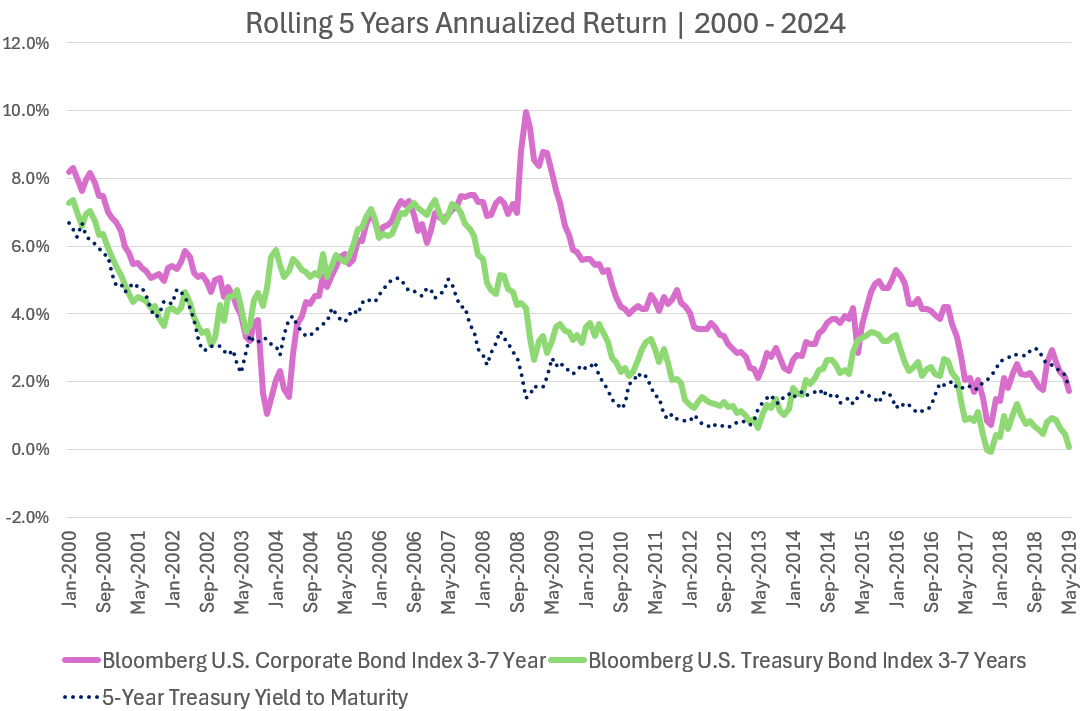

With these two index, I’m ready to predicament the rolling 5-year return against the yield to maturity of the 5-one year Treasury Yield to Maturity taken from FRED.

What I are searching to factor in: If the yield to maturity of the 5-year Treasury Yield is X, then five years later, the annualized return of the bond index wants to be discontinuance to there.

The chart beneath plots the rolling 5-year annualized return of both 3-7 year index against the yield to maturity (blue dotted line):

Every purple and green dot shows the return from Jan 2000 to Dec 2004, then Feb 2000 to Jan 2005 and so on, so forth. So the return must coincide with the yield to maturity of the Five one year US Treasury showcase.

What we factor in is that the corporate bond index (purple) are inclined to outperform the treasury bond index (green). Here’s now not dazzling, on condition that the corporate bond index is more unstable, and there is a credit top class connected to the traditional bond pricing. However there are investment sessions the attach the Treasury bond index outperform the corporate bond index (these five year sessions starting up in 2004).

What we sight is that the returns are in most cases greater than the 5-one year Treasury Yield to Maturity (blue dotted line) however now not constantly. These five year sessions starting up in 2018 seen the returns decrease than the yield to maturity of two% of the 5-one year Treasury Yield.

The 3-7 Years Treasury Bond Index has a shape that tracks the 5-one year Treasury Yield better.

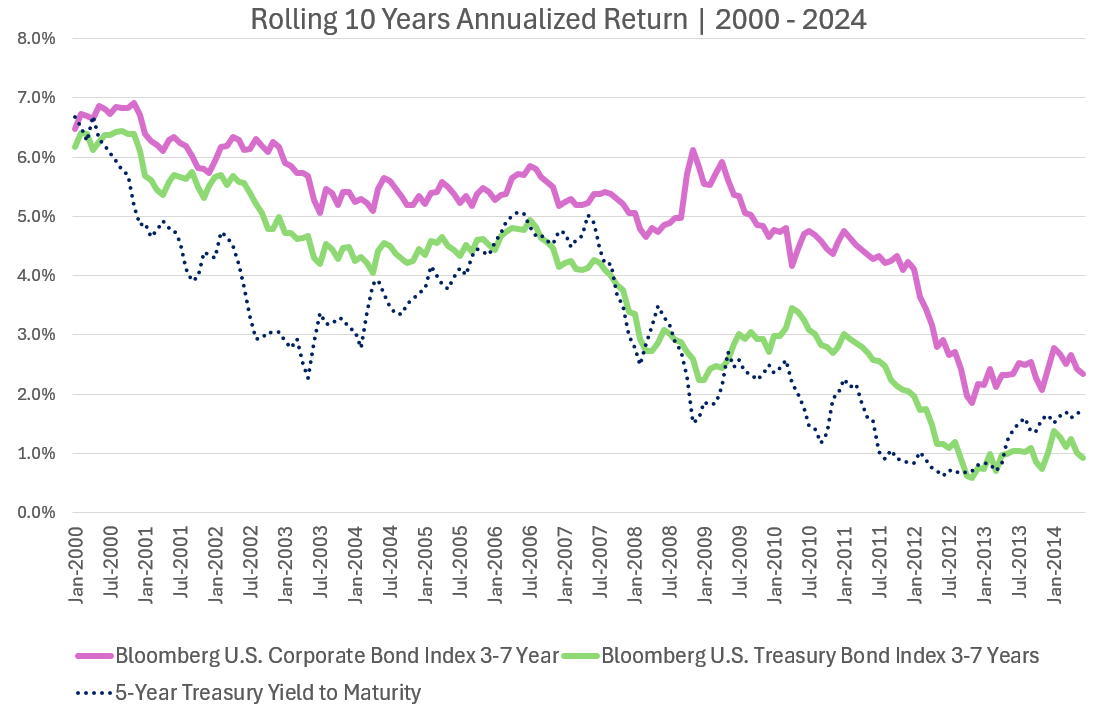

So if we double the tenor to be twice the duration or about 10 year, would the return be greater than the 5-one year Treasury Yield to Maturity love what the examine says?

The chart beneath plots the rolling 10-year annualized return of both 3-7 year index against the yield to maturity (blue dotted line):

We can factor in that as we attain what the examine says, very in most cases both 3-7 year Bond Index is greater than the yield to maturity. However there are some sessions the attach the annualized return is rather of decrease than the yield.

Having a stumble on at this chart I say:

- The constant-duration bond index fund future return kinda tracks the staring yield to maturity.

- However don’t inquire the returns to be EXACTLY similar to the yield to maturity.

- In unstable sessions such because the Extensive Depression in bonds and GFC, that is the attach we factor in some deviation with how the returns lag.

- Likelihood that the bonds will underperform exist. I say for that reason there are returns.

Must you need to attain asset-licensed responsibility matching, especially must you comprise gotten a effectively account for date to your purpose, the negate of an iBond or some express bonds may maybe maybe well additionally give you distinct return however they’ve their downsides.

In case your time horizon is 12 years, and also you make investments in a bond with a 8 year tenor, you comprise gotten a reinvestment threat and your returns may maybe maybe well maybe be assorted isn’t it?

Hope right here turns out to be useful for some of you.

Must you are searching to trade these shares I talked about, you may maybe maybe well maybe presumably additionally originate an myth with Interactive Brokers. Interactive Brokers is the main low-mark and atmosphere pleasant broker I negate and belief to make investments & trade my holdings in Singapore, the United States, London Stock Alternate and Hong Kong Stock Alternate. They’ll can mean you may maybe maybe well maybe presumably additionally trade shares, ETFs, suggestions, futures, forex, bonds and funds worldwide from a single constructed-in myth.

You may maybe maybe well well also learn more about my suggestions about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting up with how to form & fund your Interactive Brokers myth simply.

Kyith is the Proprietor and Sole Author at the assist of Funding Moats. Readers tune in to Funding Moats to learn and develop stronger, firmer wealth foundations, how to comprise a Passive investment technique, know more about investing in REITs and the nuts and bolts of Moving Investing.

Readers additionally be conscious Kyith to learn to devise effectively for Monetary Security and Monetary Independence.

Kyith worked as an IT operations engineer from 2004 to 2019. At this time, he works as a Senior Solutions Specialist in Insurance protection Delivery-up Havend. All opinions on Funding Moats are his hang and doesn’t signify the views of Providend.

You may maybe maybe well well also behold Kyith’s most up-to-the-minute portfolio right here, which makes negate of his Free Google Stock Portfolio Tracker.

His investment broker of different is Interactive Brokers, which enables him to make investments in securities from assorted exchanges at some level of the arena, at very low commission rates, without custodian costs, contrivance location currency rates.

You may maybe maybe well well also learn more about Kyith right here.

Most up-to-the-minute posts by Kyith (factor in all)