Sizable- and megacap shares accept as true with performed well in 2024. Retail massive Costco (NASDAQ: COST) hasn’t overlooked the bag alongside with the replenish 32% 365 days up to now. Its chain of membership warehouse clubs is gaining market portion in the United States and striking up solid boost precise by method of its in-particular person and e-commerce operations, impressing investors.

At $863 per portion as of this writing, it would perhaps well also very well be a future stock-split candidate. Will the stock reach $1,000 by 365 days-finish, and is it a aquire at these prices? Let’s investigate.

Strong boost and an incoming fee hike?

The COVID-19 pandemic changed into as soon as a boon for retailers equivalent to Costco. Income boost accelerated, pushing annual sales from $150 billion to $200 billion over appropriate about a years. But unlike diversified retailers, Costco did no longer face a pandemic boost hangover. In actuality, the firm has persevered to post solid boost and these days surpassed $250 billion in annualized sales.

The backside line has adopted suit with earnings per portion (EPS) up discontinuance to 100% in the previous five years. This solid boost has investors speculating a cost hike is incoming for Costco’s membership program. A membership for the time being costs $60 or $120, searching on the tier. There are well over 100 million individuals, and the firm hasn’t raised its membership fee since 2017. Costco customarily raises membership prices every five years or so, which arrangement the firm is previous due for a cost hike.

With excessive profit margins on the memberships themselves, a cost hike would perhaps reduction Costco continue to develop its EPS over the subsequent five years to boot.

Neglect $1,000 per portion — give consideration to valuation as an change

This can even require a 16% obtain for Costco’s portion fee to breach four-decide territory. For the explanation that stock has already climbed by twice this amount in the critical half of 2024, I develop no longer doubt or no longer it’s doable for Costco to surpass $1,000 sooner than the finish of the 365 days.

This form of excessive stock fee moreover makes Costco a stock-split candidate. Investors accept as true with these days viewed Nvidia and Chipotle fight by method of the route of, and Costco’s closing stock split changed into as soon as in 2000.

But investors shouldn’t give consideration to either of this stuff. Stock splits finish no longer matter over the lengthy length of time. A stock split appropriate arrangement there are more portion of the identical firm on the market available in the market. The precise stock fee does no longer matter; what issues is valuation.

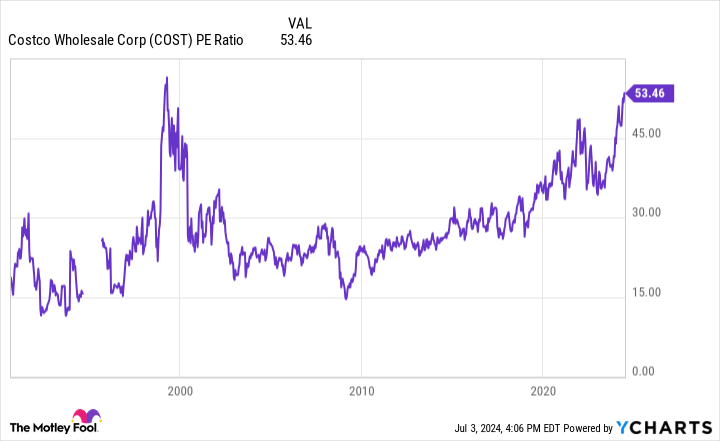

And Costco’s valuation has been mountaineering for years. It for the time being has a cost-to-earnings ratio (P/E) of 53, discontinuance to an all-time excessive and well above its lengthy-length of time reasonable of 27.

At these ranges, investors accept as true with very excessive expectations for Costco’s future boost.

Defend some distance off from Costco stock (for now)

Costco is a big enterprise. Even with $250 billion of trailing-12-month sales, the firm changed into as soon as in a station to develop comparable sales 6.5% in its fiscal 2024 third quarter (ended May 12). E-commerce sales were up 20.7% 365 days over 365 days. Earnings need to continue to upward thrust too, resulting from its track document of slack-and-regular boost.

But that is the remark: slack and regular. Costco is no longer a hypergrowth stock, nonetheless it absolutely’s valued like one with a P/E ratio of larger than 53.

Neglect the stock split. Neglect the aptitude for shares to reach $1,000 in the advance length of time. It is not connected how massive a enterprise is in uncover so that you can pay too steep a top rate to aquire it: Value issues.

Can accept as true with to mute you invest $1,000 in Costco Wholesale supreme now?

Old to you aquire stock in Costco Wholesale, remember this:

The Motley Fool Stock Consultant analyst team appropriate identified what they imagine are the 10 simplest shares for investors to aquire now… and Costco Wholesale wasn’t one of them. The 10 shares that made the lower would perhaps bag monster returns in the approaching years.

Way discontinuance into consideration when Nvidia made this checklist on April 15, 2005… for oldsters that invested $1,000 on the time of our recommendation, you’d accept as true with $771,034!*

Stock Consultant offers investors with a easy-to-discover blueprint for success, including steerage on constructing a portfolio, regular updates from analysts, and two fresh stock picks every month. The Stock Consultant service has larger than quadrupled the return of S&P 500 since 2002*.

*Stock Consultant returns as of July 2, 2024

Brett Schafer has no station in any of the shares mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill, Costco Wholesale, and Nvidia. The Motley Fool has a disclosure coverage.

Costco Is Up 32% in 2024: May the Stock-Split Candidate Hit $1,000 per Half by the End of the Year? changed into as soon as on the muse published by The Motley Fool