Now now not every stock rose closing year. Deem about these four — Nike (NYSE: NKE), MarketAxess (NASDAQ: MKTX), Paycom Tool (NYSE: PAYC), and The Hershey Firm (NYSE: HSY) — which fell between 10% and 42% in 2023. That stands in stark contrast to the S&P 500 index’s 23% upward push.

Despite these being concerned drops, nothing changed dramatically for the worse regarding any of the four dividend growers’ operations. This disconnect between declining fragment costs and every company’s management assign in its niche can also invent alternatives for investors fascinated regarding the lengthy haul.

These corporations are dwelling to smartly-funded dividends that offer the doable to develop far into the lengthy lunge. Because of this these S&P 500 shares are four of my high choices to appreciate in 2024 and defend forever.

1. Nike

With an whole return north of 92,000% since its preliminary public providing (IPO) in 1980, Nike has a good track document of closing potentially the most dominant tag in footwear and apparel.

To attend quantify right how powerful the Nike title is, defend in mind that Kantar Brandz listed it as the 13th-most-treasured tag in 2022, earlier than corporations adore Coca-Cola, Tesla, and Netflix. This high-tier tag energy is noteworthy for investors. The corporations in Kantar Brandz’s high 100 each year have faith posted stock returns stronger than the S&P 500 by a bag of 357% to 245% since 2006.

Handiest yet for investors, Piper Sandler’s 2023 glimpse on U.S. formative years’ spending confirmed that Nike remained the far-and-away chief in footwear and apparel, with 61% and 35% of respondents calling the company their current for every section. This sturdy mindshare amongst Gen Z potentialities signals that Nike’s fresh struggles are fast and can also still now now not be an ongoing dispute as these younger potentialities age and initiate making more monetary decisions on their very have faith.

On the monetary facet, Nike will pay a 1.4% dividend yield that only uses 40% of its rating profits, leaving a promising progress runway for investors hunting for passive profits. Or now now not it is grown this dividend by 11% each year over the closing 5 years. Nike guarantees to reward affected person investors who are animated to attend out the currently cross client spending atmosphere that helped its stock scoot 20% in the closing year.

Thanks to its only-in-class tag, friendly money returns to shareholders, and a rightsizing stock that has dropped 17% from its 2022 highs, Nike appears adore a top price commercial trading at the beautiful ticket of 25 cases free money waft (FCF).

2. MarketAxess

With its specialize in bringing bond trading into the digital age, MarketAxess has delivered whole returns above 1,700% since its IPO in 2004. Then another time, even following this astonishing lunge, the company’s progress memoir can also still be removed from over.

Despite this generation of supercomputers and synthetic intelligence, CEO Christopher Gerosa estimates that now now not up to 40% of U.S. high-grade and high-yield bonds is traded electronically, adore they are on MarketAxess’s all-to-all platform. These figures descend even decrease, to 5% or 7%, for rising markets. With Gerosa and MarketAxess waiting for electronic bond trading to extinct and anecdote for over 80% of trades for every bond neighborhood, the company’s progress memoir would possibly perchance perchance perchance still be in its early chapters.

Whereas this progress runway gives quite loads of intrigue for investors over the very lengthy time frame, the subdued ranges of volatility in this day’s markets continue to weigh on MarketAxess’s monetary results, sending its stock down 16% in the previous year. Although I’m a enormous fan of these calmer markets, right here is now now not a good element for MarketAxess particularly, because it prospers from the elevated bond trading that on the total occurs alongside elevated ranges of volatility.

With a 1% dividend yield that has grown by 12% each year over the final decade — and that only uses 44% of the company’s rating profits — MarketAxess is gay to pay investors to attend for the inevitable turnaround in the electronic bond trading market. The corporate experiences earnings on Jan. 31, so MarketAxess will rapidly provide us with some insights into the persona of this turnaround.

3. Paycom

Paycom gives cloud-basically based human capital management (HCM) tools reminiscent of expertise acquisition and management, time and labor management, payroll, and human resources. It has become a 12-bagger in now now not up to a decade since its IPO. After launching its computerized and employee-guided payroll solution, Beti, in 2021, the company saw a dramatic decrease in payroll errors and omissions from its potentialities.

It is a enormous stamp, exact? Of route — a minimal of, in the very lengthy time frame. This original providing is a immense attend to its potentialities and their happiness. But in the fast time frame, this streamlining of its potentialities’ payrolls has weighed on Paycom’s progress charges, because it previously made money fixing these errors and omissions.

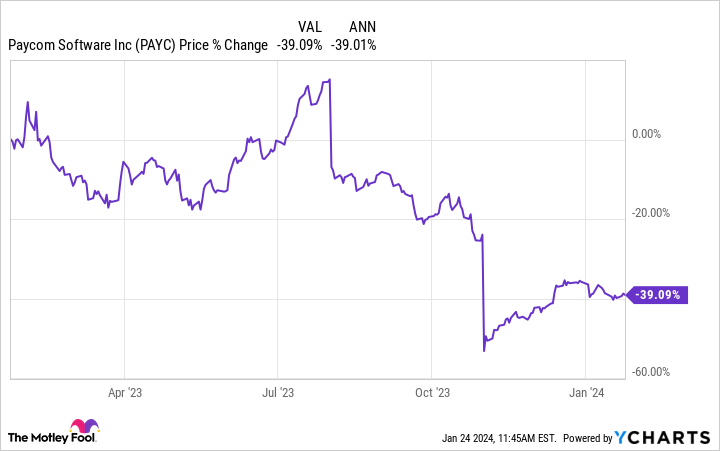

This substitute-off between non permanent anguish and lengthy-time frame substitute is what makes Paycom so attention-grabbing this day, especially with its stock down spherical 40% in the previous year.

Within the wreck, this will also still clarify to be a good “dispute” for Paycom. Beti’s early success highlights why the company’s choices remain potentially the most loved amongst its potentialities in its HCM niche. With a original 0.8% dividend yield that management expects to continue raising each year — and that only uses 26% of the company’s rating profits — Paycom is on the total a budding dividend progress memoir.

With its sales growing by 22% irrespective of these good-to-have faith headwinds, Paycom would possibly perchance perchance perchance rapidly outgrow its ticket-to-earnings (P/E) ratio of 34.

4. Hershey

As potentially the most winning chocolatier and confectioner amongst its publicly traded peers — on a return on invested capital (ROIC) foundation — The Hershey Firm has recorded market-beating annualized returns of 13% since its 1978 IPO. Powered by its namesake Hershey tag and its ownership of the Reese’s and Equipment Kat manufacturers, the company is dwelling to some of of the high 5 most-recognizable chocolate labels in the U.S.

Thanks to this frequent recognition and over 100 loved manufacturers, Hershey maintains spherical a 45% fragment of the U.S. chocolate market and a 30% fragment of the candy, mint, and gum (CMG) niche.

This mixture of high-notch profitability, tag energy, and commercial management leaves Hershey uniquely smartly-positioned to outlive threats adore Mr. Beast’s Feastables choices and the upward push of GLP-1 weight-loss medication. Or now now not it is dwelling to a smartly-funded 2.3% dividend yield that’s its absolute best for the reason that 2020 break and a P/E ratio of 21 that’s at its lowest since 2019, following a 10% descend over the closing year. I am going to fortunately buy more of this loved American tag at a discount for my daughter.

Whenever you invest $1,000 in Nike exact now?

Earlier than you buy stock in Nike, defend in mind this:

The Motley Fool Stock Marketing consultant analyst team right identified what they assume are the 10 only shares for investors to appreciate now… and Nike wasn’t one in all them. The 10 shares that made the cut would possibly perchance perchance perchance originate monster returns in the arrival years.

Stock Marketing consultant gives investors with a straightforward-to-prepare blueprint for fulfillment, including guidance on building a portfolio, customary updates from analysts, and two original stock picks every month. The Stock Marketing consultant carrier has bigger than tripled the return of the S&P 500 since 2002*.

*Stock Marketing consultant returns as of January 22, 2024

Josh Kohn-Lindquist has positions in Coca-Cola, Hershey, MarketAxess, Netflix, Nike, Paycom Tool, and Tesla. The Motley Fool has positions in and recommends MarketAxess, Netflix, Nike, Paycom Tool, and Tesla. The Motley Fool recommends Hershey and recommends the following alternate choices: lengthy January 2025 $47.50 calls on Nike. The Motley Fool has a disclosure policy.

4 Top S&P 500 Dividend Enhance Shares Down Between 10% and 42% to Aquire in 2024 and Retain Forever changed into at the beginning assign printed by The Motley Fool