Or no longer it’s no longer easy to beat the growth potential of cryptocurrencies. Ark Make investments founder Cathie Wood, as an illustration, believes that Bitcoin has extra than 2,000% in long-time length upside. However some stocks secure staunch as worthy room for boost. If you happen to are hunting for most upside, these two stocks are for you.

This AI inventory has been a rocket

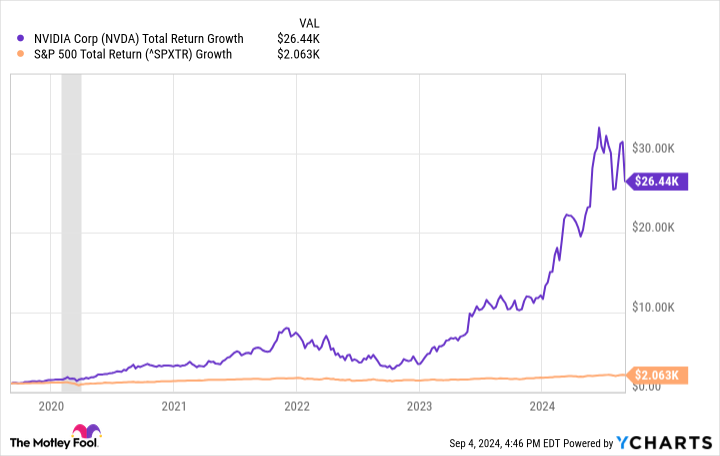

No list of stocks with big upside would be whole without a mention of Nvidia (NASDAQ: NVDA). Few investments secure ever risen as lickety-split because the chipmaker. A $1,000 investment made five years ago would already be worth extra than $26,000. But Wall Avenue analysts quiet deem there is extra than 30% in beneficial properties to attain within the following three hundred and sixty five days. On condition that Nvidia’s market cap is now around $2.6 trillion, it will also be no longer easy to narrate how it would carry additional gigantic beneficial properties within the near time length. However there are several causes for optimism.

The the same catalyst that has sent Nvidia inventory soaring is no longer going to only be in station for the following several a protracted time, but may presumably additionally quiet enhance very much over time. In a lot of techniques, the story of Nvidia is quiet very worthy in its early innings. That is on tale of the firm’s finest source of boost is the quick upward thrust of AI technologies that rely on its high-live graphics processing units (GPUs) to feature.

Long gone are the days when Nvidia’s monetary topic became once dictated by gaming and little bid cases. This day, there is an hands bustle for the substances that enable AI be taught and innovation — and Nvidia’s got the goods everyone desires.

In line with estimates from BIS Compare, the AI industry’s spending on semiconductors totaled around $15 billion final three hundred and sixty five days. However spending has already picked up dramatically in 2024, providing a tailwind that has extra than doubled Nvidia’s revenues over the final three hundred and sixty five days.

BIS Compare expects that spending to amplify by in relation to 32% over the following several years, with heaps extra boost expected past that. Nvidia has an estimated 90% market fragment in AI GPUs, positioning it to capture the lion’s fragment of this long-time length boost pattern. Nvidia may presumably additionally quiet also at once secure the revenue of the upward thrust of crypto, as it namely designs a range of its GPUs for cryptocurrency mining.

What’s the one category that can presumably additionally outpace the general cost of the crypto industry? AI. And in that arena, Nvidia is the inventory to bet on.

Diversify your portfolio with this fintech

Nvidia’s market cap will seemingly prevent it from rising by yet another 1,000% anytime shortly. However there is one fintech inventory that has the potential to develop so: Nu Holdings (NYSE: NU).

Most investors secure never heard of Nu, though it has a market cap of in relation to $70 billion. That is on tale of the bank operates exclusively in Latin America, and the one potential to derive entry to its providers and products is by smartphones. Its technique upended Latin America’s banking industry a decade ago. As a replace of constructing and working costly bodily branches, Nu offered its providers and products on to buyers online. This lowered charges, allowing it to compete aggressively on designate and choices.

Moreover, it enables Nu to innovate quicker than the rivals. When the firm launched its Nu Cripto platform — a service that allows of us to aquire, promote, and transact in diversified cryptocurrencies — it attained 1 million customers in a topic of months. Innovations esteem this lend a hand point to how Nu has gone from in actual fact zero prospects a decade ago to extra than 100 million this day.

However Nu is much from accomplished rising. There are extra than 650 million of us in Latin America, and Nu has proven its potential to penetrate markets lickety-split. Bigger than half of of all Brazilian adults are in actual fact Nu prospects, and Nu has been replicating its playbook in fresh markets esteem Mexico and Colombia.

Analysts question gross sales boost to be around 44% this three hundred and sixty five days, followed by yet another 30% in 2025, and there is a resplendent likelihood that Nu will retain double-digit share boost rates through the following decade and past. It is a protracted-time length tale, but Nu has the potential to match or exceed the efficiency of most major cryptocurrencies.

Could presumably well additionally quiet you invest $1,000 in Nvidia factual now?

Earlier than you aquire inventory in Nvidia, appreciate in mind this:

The Motley Fool Inventory Consultant analyst group staunch identified what they deem are the 10 most sensible most likely stocks for investors to aquire now… and Nvidia wasn’t one among them. The 10 stocks that made the lower may presumably additionally compose monster returns within the approaching years.

Carry into consideration when Nvidia made this list on April 15, 2005… even as you invested $1,000 on the time of our advice, you’d secure $630,099!*

Inventory Consultant provides investors with a very easy-to-observe blueprint for fulfillment, including guidance on constructing a portfolio, regular updates from analysts, and two fresh inventory picks every month. The Inventory Consultant service has extra than quadrupled the return of S&P 500 since 2002*.

*Inventory Consultant returns as of September 3, 2024

Ryan Vanzo has no position in any of the stocks talked about. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Nu Holdings. The Motley Fool has a disclosure policy.

2 Tech Shares With Extra Doable Than Any Cryptocurrency became once originally printed by The Motley Fool