Synthetic Intelligence (AI) shares had been battered over the summer season. The VanEck Semiconductor ETF, which is chock-elephantine of semiconductor shares that are tied to the AI sector, fell as great as 25% from the all-time excessive it method in July.

Nevertheless, I live bullish on AI. Merchants own most productive considered the starting phases of how this abilities will reshape the enviornment, and extra enhancements will snatch years and even decades to emerge.

That’s a mighty case for owning AI shares lengthy timeframe — right here are two I uncover particularly compelling.

The chopping-edge chief in records analytics

Topping my list is Palantir Technologies (NYSE: PLTR).

The corporate, which gives AI-powered big records alternate strategies, is riding excessive. Earlier this month, it used to be introduced that Palantir would join the S&P 500 index. That news spurred a rally in the inventory, which has already climbed by 113% year to this level.

Gradual that perfect efficiency is the corporate’s sterling fundamentals. Soundless a young company, Palantir is basically inquisitive about rising its buyer coarse and earnings. As of the 2d quarter, its quarterly earnings increased to $678 million, up 27% from a year earlier.

In an analogous vogue, Palantir’s U.S. buyer depend is rising very with out warning. The corporate reported 295 American commercial prospects final quarter, up 83% year over year. Moreover, Palantir is attracting better prospects as it closed 27 deals price more than $10 million every at some level of the interval.

Unnecessary to stammer, Palantir is riding the wave of AI momentum. As CEO Alex Karp illustrious in his most most up-to-date shareholder letter, “Our disclose across the commercial and executive markets has been pushed by an unrelenting wave of quiz from prospects for synthetic intelligence systems that transcend the merely performative and tutorial.”

Briefly, the corporate has caught the wave and is riding it smartly. Merchants in the hunt for an AI inventory to aquire and withhold for the lengthy timeframe ought to quiet strongly possess in thoughts Palantir.

The root of AI innovation

Next on my list of AI shares is Nvidia (NASDAQ: NVDA).

That said, Nvidia is a inventory I prefer to aquire and withhold for the next decade or longer. That’s crucial because I’ve made no secret of my conception that the inventory has change into very pricey.

Nonetheless, I quiet learn it as a mighty aquire because AI is a lengthy-timeframe constructing that will play out over decades. Within the identical manner the rep continues to conform, AI has a lengthy side road ahead of it.

That’s big news for Nvidia, particularly, because its product is the traipse-to solution when it involves constructing the “brains” of various AI models. It makes the graphic processing models (GPUs) most appreciated by AI builders

The red-hot quiz for AI-capable GPUs manner Nvidia can mark high dollar for its products, alongside side the H100 and its quickly-to-debut Blackwell chip.

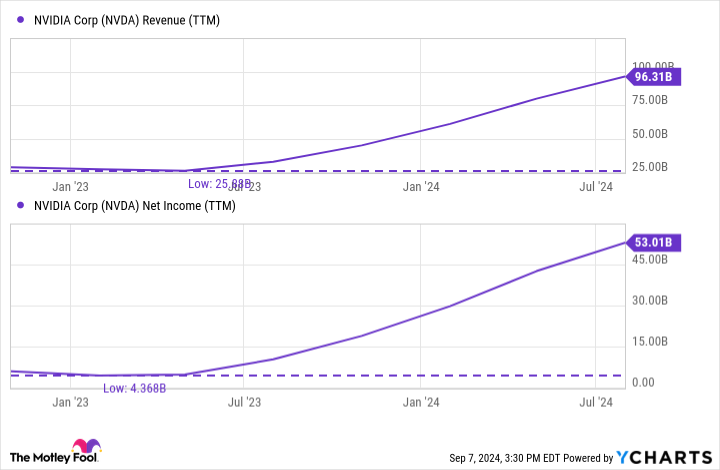

Or no longer it is crucial to possess in thoughts why Nvidia’s inventory has surged more than 600% over the final two years: The corporate’s earnings and profits are exploding.

In its most most up-to-date quarter (ended July 28), earnings used to be $30.0 billion, up 122% from a year earlier. Over the final one year, the corporate has generated $96.3 billion in gross sales, up from $25.7 billion decrease than two years in the past. Profits own in an analogous map surged.

The corporate’s dominant situation in AI has pushed its allotment mark to original heights, but even following its amazing two years of beneficial properties, Nvidia remains an AI inventory I prefer to own for the next decade and beyond.

Could well honest quiet you invest $1,000 in Palantir Technologies lawful now?

Earlier than you aquire inventory in Palantir Technologies, possess in thoughts this:

The Motley Idiot Stock Manual analyst workforce correct identified what they imagine are the 10 most productive shares for traders to aquire now… and Palantir Technologies wasn’t one amongst them. The 10 shares that made the decrease would possibly well form monster returns in the coming years.

Abet in thoughts when Nvidia made this list on April 15, 2005… while you occur to invested $1,000 at the time of our advice, you’d own $710,860!*

Stock Manual gives traders with a in point of fact easy-to-apply blueprint for success, alongside side steering on constructing a portfolio, in sort updates from analysts, and two original inventory picks every month. The Stock Manual service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Manual returns as of September 16, 2024

Jake Lerch has positions in Nvidia. The Motley Idiot has positions in and recommends Nvidia and Palantir Technologies. The Motley Idiot has a disclosure protection.

2 Synthetic Intelligence (AI) Shares You Can Purchase and Preserve for the Next Decade used to be at the start printed by The Motley Idiot