Even when Apple (NASDAQ: AAPL) stock dipped proper thru last week’s promote-off to almost 12% off its 2024 excessive (at Tuesday’s cease), that wasn’t enough to function me must comprise it.

So why am I sour on a stock that so many others are bullish on? All of it has to form with valuation.

Apple’s boost has been wretched

If you happen to dwell within the U.S., likelihood is you both hang an iPhone or other Apple product, or know any individual who does. Apple is terribly less dominant worldwide, nonetheless is aloof a highly recognizable and customary label.

Because Apple’s alternate is customarily centered on excessive-pause electronics, or no longer it’s more inclined to ask cycles than firms selling more cost effective electronics. As inflation has taken its toll, Apple’s gross sales comprise struggled.

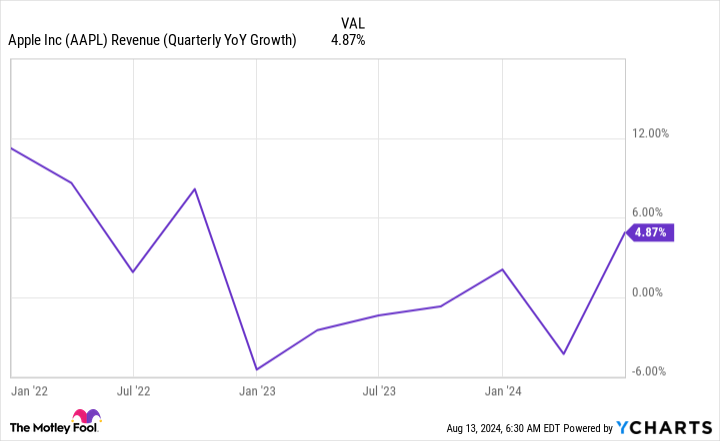

For the reason that delivery of 2022, Apple has struggled to post double-digit earnings boost and even had a pair of quarters the attach gross sales dipped compared with the yr-ago duration. Its newest quarter saw earnings lengthen yr over yr, nonetheless gross sales of its flagship product, the iPhone, diminished a little bit yr over yr.

The last two and a half of years would were grand worse for Apple if it weren’t for its products and services division. This encompasses earnings from promoting, the App Store, cloud products and services, and digital bellow like Apple TV and Apple Song. Unlike its hardware earnings, which fluctuates, products and services has more of a subscription-model really feel to it, which is colossal to stability out the more cyclical side of the alternate.

But is that enough to justify buying the stock?

The numbers don’t add up for the stock

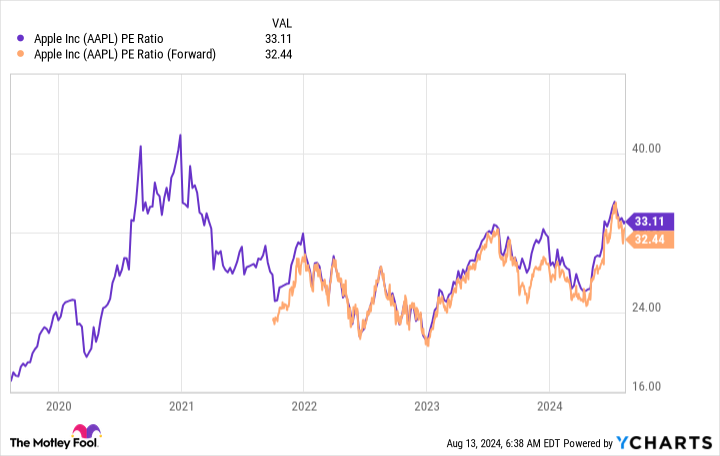

Top rate firms alternate for top rate valuations. Some firms correct comprise such excessive execution that traders are willing to pay up for them. Apple has been on this self-discipline for a whereas, nonetheless I deserve to pronounce that idea.

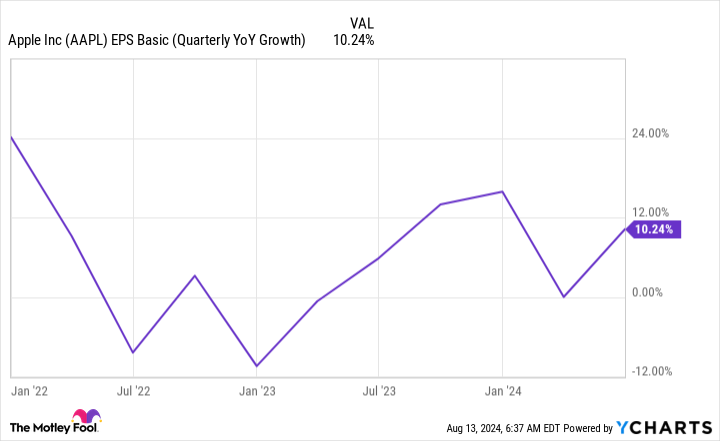

Its earnings boost has been wretched, and whereas its earnings boost has considerably saved up with the total market, it aloof struggles to post double-digit increases.

With Apple impending three years of uninspiring outcomes, I’m assured it doesn’t deserve its top rate.

At 32 cases forward earnings estimates and 33 cases trailing earnings, the stock is as pricey as it was in early 2021. At that time, earnings was increasing by 50%, with earnings doubling yr over yr. Apple was price the highest rate traders paid then, nonetheless the recent Apple is no longer.

Its traders are maintaining on to the postulate that Apple Intelligence, the company’s generative AI product, will likely be mandatory and situation off customers to upgrade to the latest iPhone. Because this selection can easiest be whisk on the latest skills of phones, it would possibly maybe maybe maybe situation off an upgrade wave. But that’s no longer guaranteed and would no longer form grand for the stock apart from a one-time wave of ask.

There are grand better tech investments. Microsoft trades at nearly the same valuation but has repeatedly posted double-digit earnings and earnings boost. Otherwise that probabilities are you’ll stare at Meta Platforms, which is more affordable and rising extremely hasty (increasing earnings by 22% within the 2d quarter and earnings by 75%).

Apple is correct too pricey and no longer performing as effectively as it needs to to justify its valuation. At these prices, there are some distance too many better firms to put money into, and I deem traders will comprise to construct their money there as an different.

Ought to you invest $1,000 in Apple staunch now?

Before you comprise stock in Apple, comprise in thoughts this:

The Motley Fool Stock Manual analyst crew correct known what they ponder are the 10 handiest shares for traders to derive now… and Apple wasn’t even handed one of them. The ten shares that made the slash would possibly maybe derive monster returns within the coming years.

Personal in thoughts when Nvidia made this checklist on April 15, 2005… when you invested $1,000 at the time of our recommendation, you’d comprise $763,374!*

Stock Manual provides traders with an straightforward-to-apply blueprint for success, along with steering on constructing a portfolio, customary updates from analysts, and two novel stock picks every month. The Stock Manual provider has bigger than quadrupled the return of S&P 500 since 2002*.

*Stock Manual returns as of August 12, 2024

Randi Zuckerberg, a used director of market style and spokeswoman for Facebook and sister to Meta Platforms CEO Designate Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Meta Platforms. The Motley Fool has positions in and recommends Apple, Meta Platforms, and Microsoft. The Motley Fool recommends the next choices: long January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure protection.

1 Stock I Would no longer Contact With a 10-Foot Pole, Even After the Market Sell-Off Dropped Its Label was in the starting up published by The Motley Fool